Curious about those little pixelated animal images you’re seeing all over the Internet, and wondering how on earth they are related to sophisticated technologies that help reduce counterfeiting in fashion, track license usage in music, and exchange digital items in games? The thing that links all this together is the ‘non-fungible token’, or ‘NFT’ for short. In this quick guide, we take you through what an NFT is and answer important questions related to buying, owning, and investing in NFTs.

A non-fungible token (NFT) is a unique and irreplaceable unit of data that is stored on a digital ledger (in most cases, the Ethereum blockchain).

In essence, NFTs are tokens that prove ownership of a particular asset, which can be a physical asset or a digital one. In this regard, they work similarly to a set of deeds on a house. The key difference, though, is that because the data is encrypted on a decentralized ledger, there is literally only one version of the asset in existence (unlike house deeds, which could easily be forged). NFTs provide a robust means of having and proving ownership, which is precisely why they are used so extensively by digital creators who, for years, have had to battle forgeries, theft, and otherwise unlawful uses of their products and other creations.

It’s not only in the digital creator realm that NFTs have their uses, though. There are several more use cases for NFTs, as the below examples show.

Digital artwork like Beeple’s is just one example of an NFT, but there are countless other applications for NFT technology. Some other examples include:

NFTs can also be used in much more traditional settings, like legal practice. Legal documents (for example, contracts) can be issued as NFTs. Similarly, you could also hold NFTs as a more secure way of proving your ownership of assets like houses, vehicles, jewellery, and weapons.

The possibilities for NFTs are endless, so expect to see numerous new applications of NFT technologies in the coming years.

Getting to grips with NFTs can be tough at first, but comparing them to regular digital files that we use every day (like an .mp3 copy of a song, for example) can illustrate their differences:

If you’re wondering why someone would pay millions for a .jpg file that someone else could still copy and use as they see fit, you’re not alone. Much of the pushback against NFTs has revolved around the question, ‘What’s the point?’

The answer to this question can get quite technical, but for now, let’s try to keep it as simple as possible.

One way to think about why there is value in holding NFTs is to think about a piece of famous artwork. Take da Vinci’s ‘Mona Lisa’ (the piece that has the highest ever insurance value for a painting) as an example. If someone came along and offered you the original ‘Mona Lisa’, you wouldn’t turn that down simply because someone else could own a print of it and hang it on their wall too. You’d want that thing for bragging rights as well as the fact that it is valued somewhere close to one billion USD.

As with any other asset, only you can decide whether a particular NFT makes a good investment given your financial circumstances, and you should do proper research using reliable data and tools before you put your resources on the line to acquire it.

In theory, NFTs make better investments than investments into most physical goods because of their inherent transparency and traceability. The NFT for ownership of a piece of artwork, for example, can only ever be created once. It is impossible to mint multiple NFTs for the same piece of data because by their very nature, the NFTs are ‘non-fungible’ (i.e. they cannot be exchanged in a like-for-like manner). This is not the case with non-NFT forms of ownership. If someone is trying to sell a designer watch, for example, they may even have the original certificate of authenticity, and nothing can really tell you whether that watch is rightfully the seller’s or whether it was stolen from someone else.

As for individual NFTs and how good of an investment they make, only the market can decide one way or another. Some of the most profitable NFT transactions so far have come off the back of huge publicity campaigns, often involving celebrities, and so in that regard their marketing is no different from a new celebrity-sponsored designer clothing line. If there’s hype around a certain creator, people are likely to buy from them (note that Beeple, as just one example, had an audience of millions of people already).

If you have decided that you want to buy an NFT, there are a number of ways that you can go about it.

You will need a couple of things before you can do so, though.

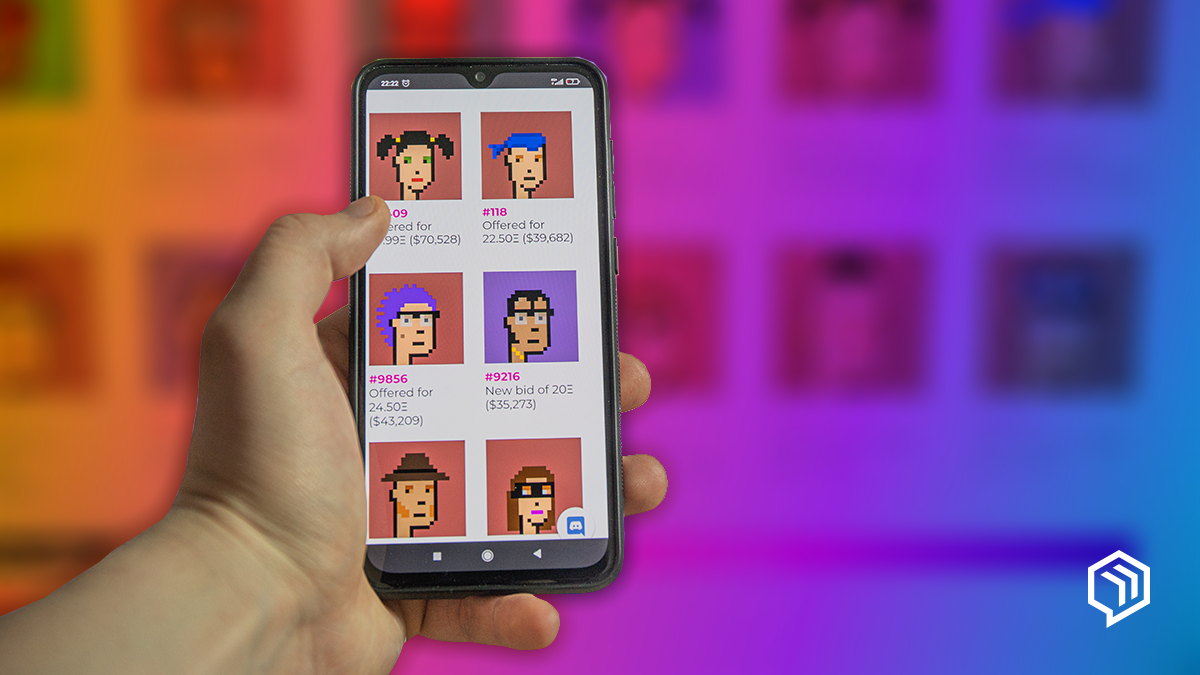

Firstly, you’ll need a crypto wallet, and secondly, you’ll need some way of funding your purchase, which in most cases will look like some form of cryptocurrency that is accepted on the NFT marketplace (this is likely to be Ether tokens for marketplaces based on the Ethereum blockchain). NFT marketplaces are just like other marketplaces (like Amazon or eBay) in that people can buy and sell a range of assets there.

Some popular marketplaces include:

Once you’ve selected a marketplace to trade on, you will need to link your crypto wallet to the marketplace to enable payment for the NFT you want to buy. Once you’ve bought your NFT, it will be stored in a collection in your crypto wallet, and you can either keep the asset, transfer it to someone else, or resell it.