WEEK OF SEPTEMBER 25, 2023

Welcome to the Traderverse Weekly Newsletter!

Important Prices

What’s Moving The Markets?

Fed Pauses Rate Hikes

The Federal Reserve has decided to keep interest rates unchanged for the second consecutive meeting, indicating that future hikes will depend on future economic projections, while keeping rates between 5.25%-5.50%.

Stock Trading Through Apple iPhones

Apple had considered integrating built-in stock trading on iPhones in collaboration with Goldman Sachs, but decided to delay the feature due to timing concerns because of Covid-19.

Fed’s Outlook On A US Recession

Fed policymakers have revised their economic outlook, anticipating a 2.1% growth rate this year, which is more than double their June projection, and forecasting a stable 3.8% unemployment rate with no recession until at least 2027.

95% Of NFT Market Now worthless

The NFT craze that saw millions invested in digital assets has lost steam during the bear market, with NFT sales dropping by 10% to 45% on major blockchains over the past month, and a recent study revealing that approximately 95% of NFT collections have a market cap of 0 Ether, indicating widespread value depreciation in the market.

SEC Audits Binance.US

The SEC has expressed concerns about Binance US’s ability to ensure full collateralization in its latest filing and has requested court approval to inspect the exchange, to which Binance US has objected, stating that the requests are aimed at documents and information beyond the SEC’s jurisdiction.

Citi’s Blockchain System

Citigroup is introducing “Citi Token Services”, a new digital token and blockchain system for real-time payments, allowing customers to convert their deposits into digital tokens and send them globally instantly, operating on a private blockchain owned by Citigroup and accessible through existing Citibank systems.

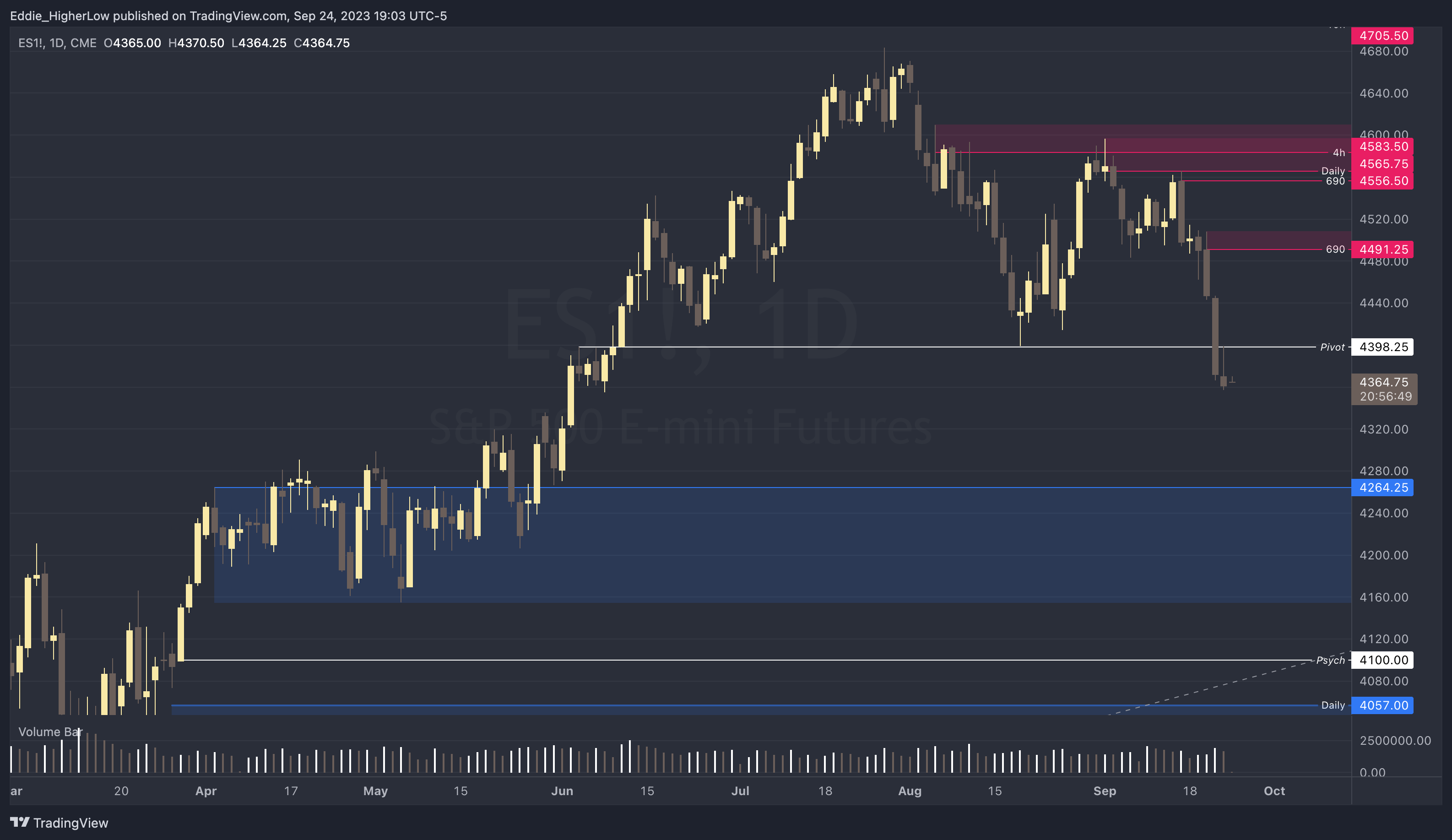

S&P Outlook

Bull Case: Bulls: Price closed below important pivot at 4398.25. To regain any momentum, bulls will need to break above and hold with next supply sitting at 4491.25. Not much demand structure until 4264.25.

Bear Case: Bears will want to continue to hold price below 4398.25 with next goal at 4264.25. If price breaks above, 4491.25 might be an area where bears may look to defend.

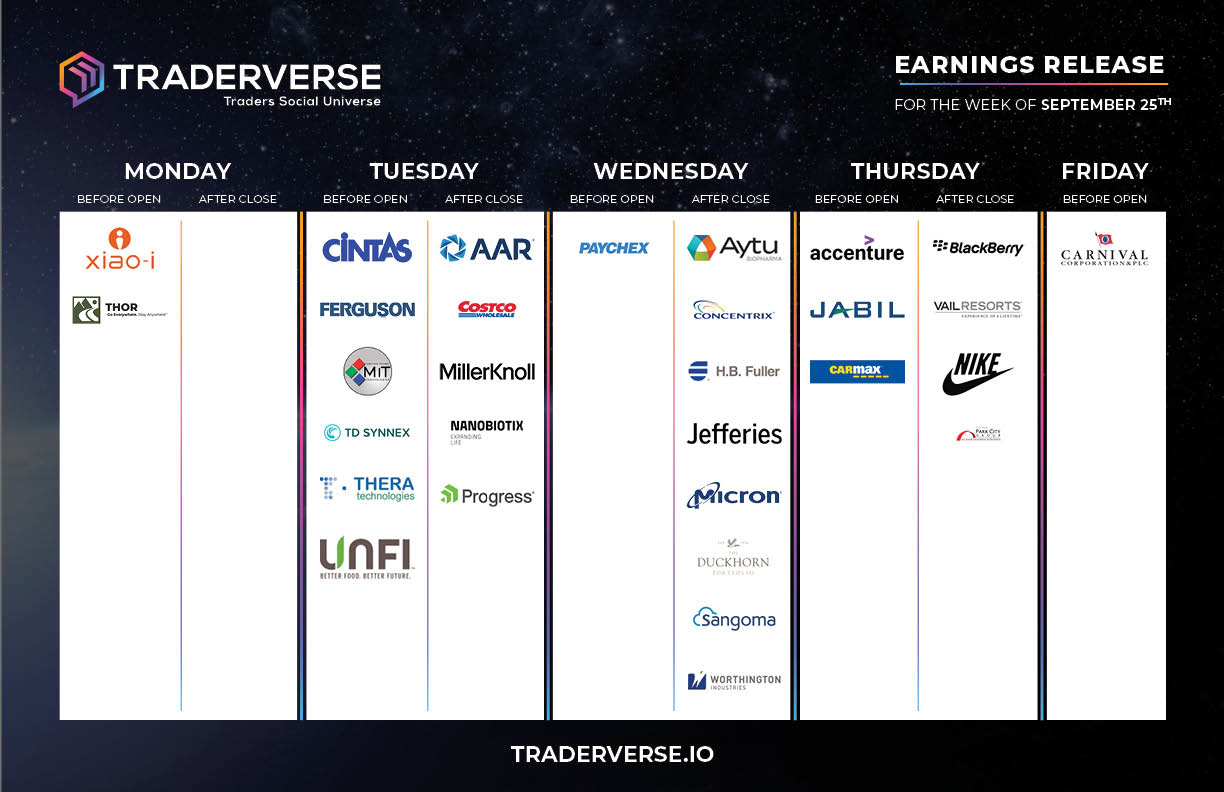

EARNINGS RELEASE CALENDAR

FOR WEEK OF SEPTEMBER 25th

Expert Insights & Predictions

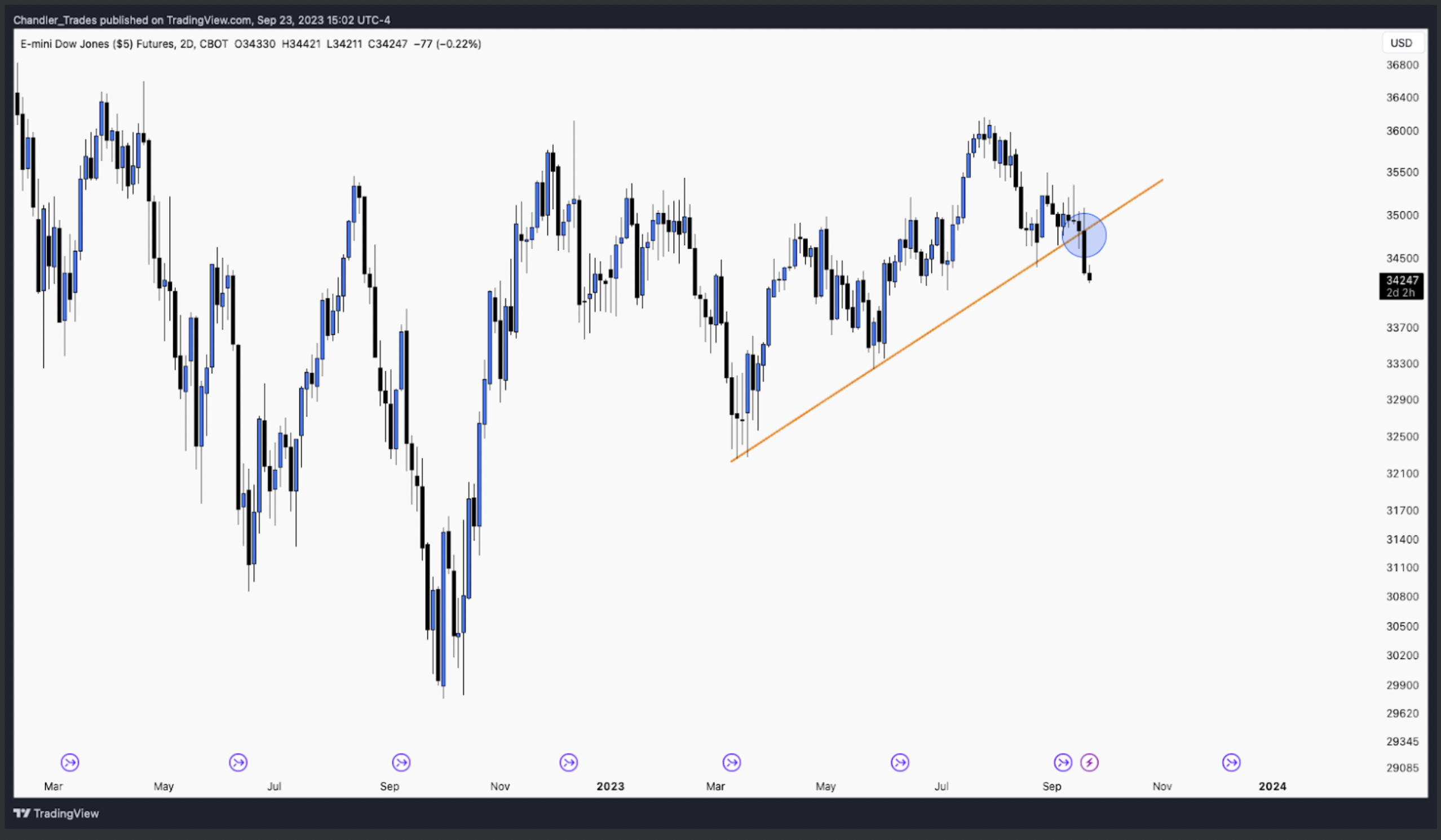

Bearish Momentum on the Rise

The bearish wave counts have been tracking well over the past month or so, emphasized by last week’s downside acceleration. The low/mid term trend has shifted in favor of the bears, with sellers even starting to make dents in the broader uptrend as well. This, combined with the weakness in small caps, suggests that bears are in the driver’s seat at the moment. While of course nothing is guaranteed in this business, the path of least resistance is to the downside. I am personally looking for continuation lower, unless/until the bulls prove otherwise. — @ChandlerTrading

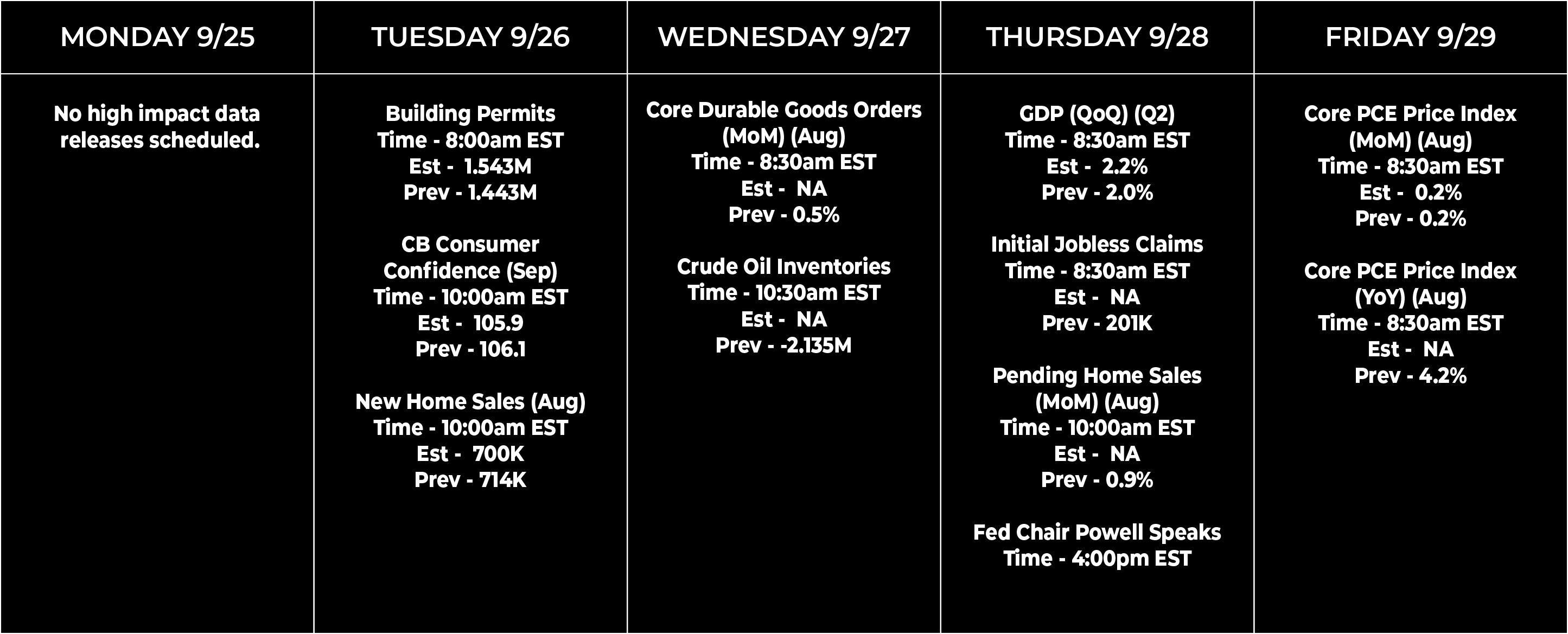

Economic Data Calendar