WEEK OF SEPTEMBER 18, 2023

Welcome to the Traderverse Weekly Newsletter!

Important Prices

What’s Moving The Markets?

Arm’s IPO Debut

Arm Holdings, under the ticker “ARM” saw a remarkable 25% surge in its first day of trading after its IPO, with an initial valuation of nearly $60 billion, despite a hefty price-to-earnings multiple compared to its peers like Nvidia.

Qualcomm’s Deal With Apple

Qualcomm said Monday that it will continue to supply Apple with 5G modem chips through 2026, raising concerns about the progress of Apple’s in-house developed 5G chip.

SEC Using AI Technology

The SEC is actively employing AI for market surveillance and enforcement actions to detect financial misconduct, with Chairman Gary Gensler citing the increasing importance of AI as a factor in the agency’s request for additional funding from Congress.

Deutsche Bank Offering Crypto Services

Deutsche Bank has partnered with Taurus to offer crypto custody and tokenization services, expanding its presence in the digital asset industry after participating in Taurus’s Series B funding round.

FTX Uncovers Assets

A court filing revealed that the FTX estate possesses nearly $7 billion in assets, including substantial holdings in Solana and Bitcoin, while also disclosing substantial payments to co-founder Sam Bankman-Fried before the exchange’s bankruptcy filing.

Binance US CEO Resigns

Brian Shroder, the former CEO of Binance.US, has left the exchange, marking another departure of a high-ranking executive, with Norman Reed stepping in as his replacement while the company also undergoes another round of layoffs.

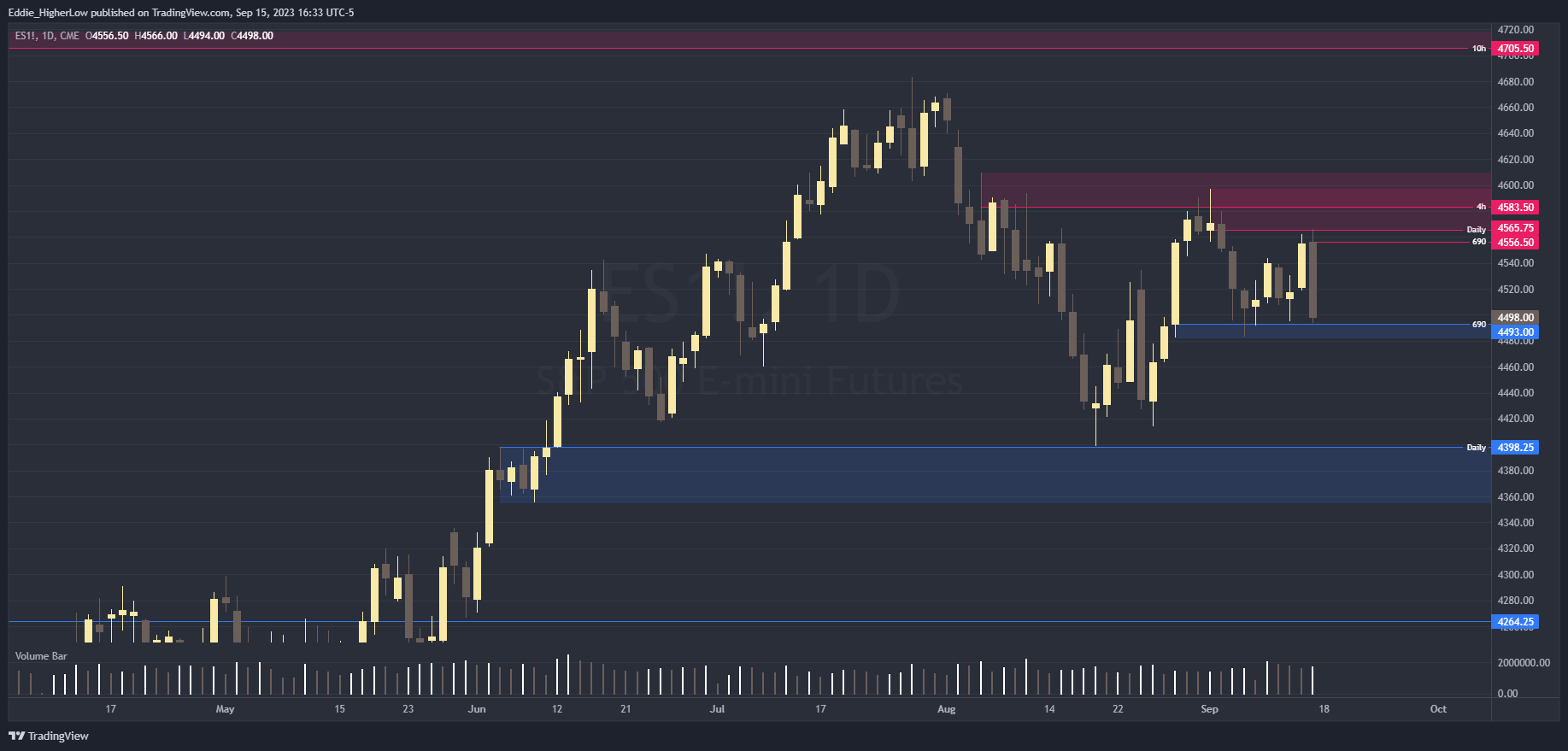

S&P Outlook

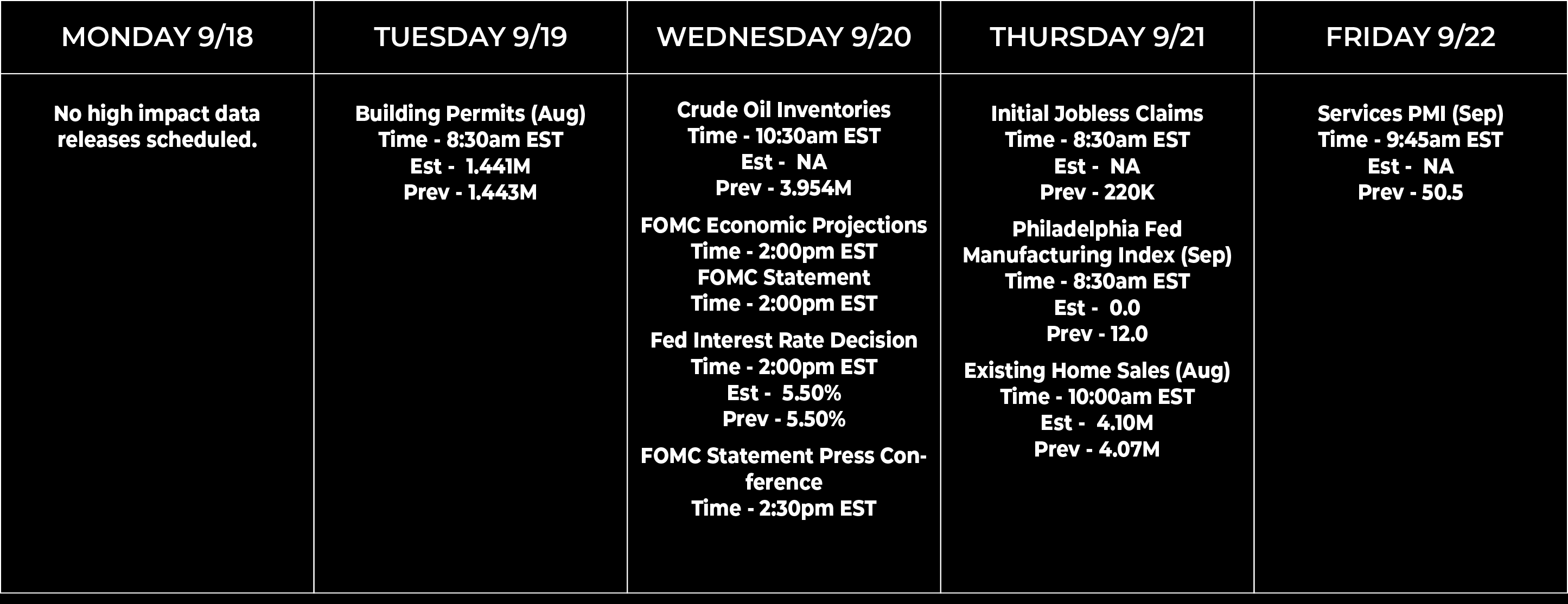

Bull Case: Bulls want to continue defending current demand at 4493. If price breaks below, not much support until 4398.25. To upside, bulls will need to crack new supply created at 4556.50.

Bear Case: Bears defending daily supply at 4565.75 and created new supply at 4556.50. Price closed at prior demand which has already been tested at 4493. If 4480 cracks, not much demand structure until 4398.

EARNINGS RELEASE CALENDAR

FOR WEEK OF SEPTEMBER 18th

Expert Insights & Predictions

Renewable energy stocks have gotten decimated since peaking back in January 2021 largely due to renewable projects getting delayed or canceled. As a result, the Global Clean Energy ETF (ICLN) is down -55% since peaking in 2021. There are multiple secular drivers in place for the resurgence of this space globally.

- Global coordination from major developed countries to scale back global warming.

- Corporate sustainability goals announced by major companies around the world to reduce carbon emissions by a specified date.

- Major policy support globally, including the recent Inflation Reduction Act (signed into law last year by President Biden), offering major tax benefits and funding for renewable projects.

- Public and societal pressure for all public and private entities to adopt carbon policies.

- Technological advances in clean energy which are also helping to drive overall costs down.

The bottom line is there has never been more pervasive global coordination and policy support to promote renewable energy development projects. Yet, ICLN is still down over -55% over the last 2 years.

Why do we think now is the time to consider a long term position?

We rely on DeMark analytics to decide when to enter and time our investments. We use “count methodology”, which includes 13’s (for exhaustion) and 9’s (for setups) to signal potential trend changes. We track two main counts: Combo (magenta) and Sequential (red). Currently, there are multiple 13’s from August that are still relevant. These levels are our “stop” indicators (pink dotted line). If these levels aren’t confirmed, we believe the 13’s can still influence the market. Additionally, recent lows show positive slow stochastic divergence compared to the price.

We also like when daily signals are aligned with other time frames. Currently the daily is now aligned with new weekly DeMark signals: The weekly has a pair of 13’s (combo and aggressive), and will likely post a 9 buy for this upcoming week. The last time we had similar alignment was in Sept/Oct of last year where this ETF managed to climb +24% over the next month.

Couple these signals with the proximity to a fairly significant level, the pre-covid high ($14.27), and we think the risk/reward is compelling.

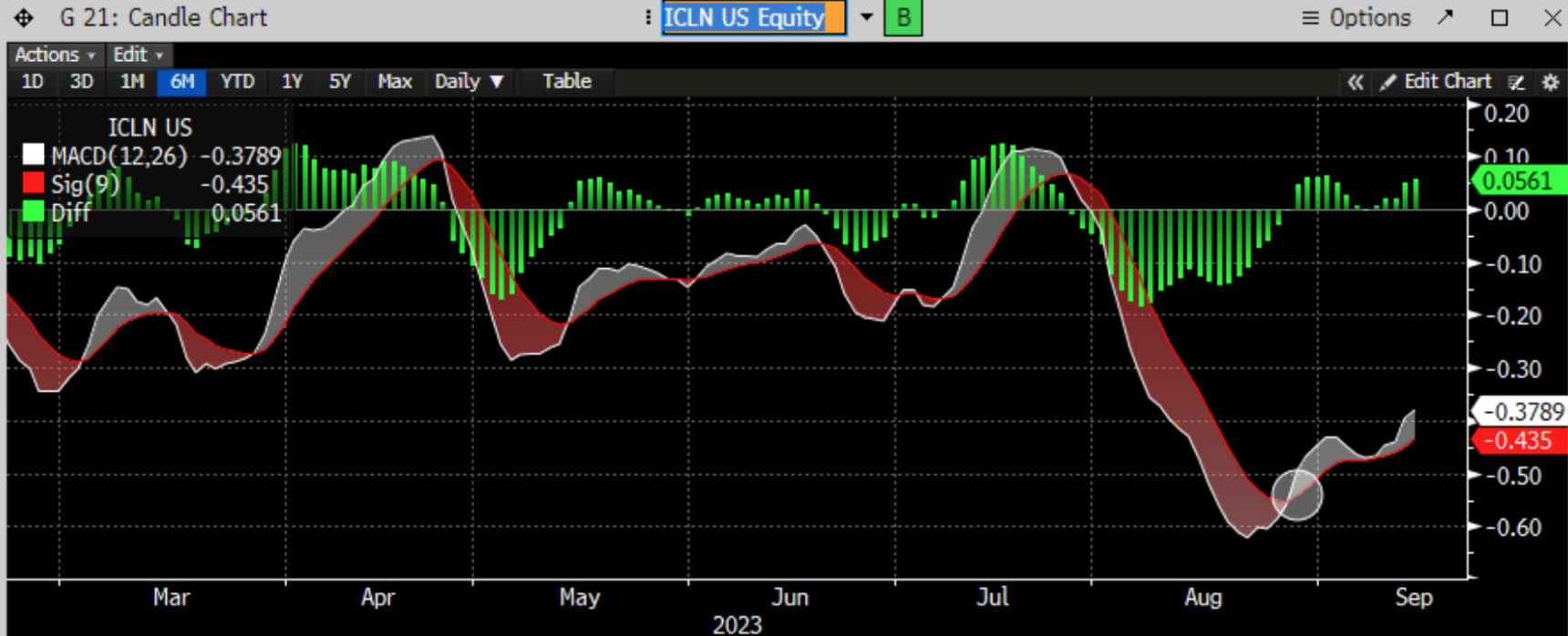

To add, the daily MACD is finally curling back up from a fairly depressed level.

The biggest difference between today’s timeframe when compared to last year’s similar DeMark signal alignment, is where we are in the interest cycle. We believe the FOMC is closer to the end of their rate hike campaign, which implies possible rate cuts next year. This means the clean energy space should see a resurgence in activity, as rates begin to back off from their peak. —@coiledspringcap

Economic Data Calendar