WEEK OF AUGUST 14, 2023

Welcome to the Traderverse Weekly Newsletter!

Important Prices

What’s Moving The Markets?

Increasing AI Adoption

Despite Microsoft and Google’s concerns, numerous US workers are utilizing ChatGPT for tasks such as email drafting and document summarization, prompting fears of intellectual property breaches. A survey revealed that 28% of participants use ChatGPT regularly at work, even as just 22% reported employer approval.

Oil Prices On The Rise

The IEA predicts that OPEC+ supply cuts could lead to oil inventory depletion and price increases in the near term, while economic challenges might hinder global demand growth in 2024, differing from OPEC’s forecast.

US Credit Card Debt Passes $1 Trillion

Credit card debt in the US is at a record high, surging past $1 trillion. This trend contrasts with three years ago, when households were promptly using pandemic stimulus payments to pay off credit card debt.

Paypal Launches Stablecoin

PayPal launches its stablecoin PYUSD, tied to the US dollar and supported by cash equivalents, aiming to revolutionize payments with fast, affordable transfers and crypto accessibility, building on its prior cryptocurrency features.

High Hopes For Blackrock Bitcoin ETF

Galaxy CEO anticipates Bitcoin ETF approval in 4 to 6 months based on insider information from BlackRock and Invesco, leading to competitive marketing strategies among industry leaders. ARK Invest’s Cathie Wood stated that multiple Bitcoin ETFs gaining SEC approval simultaneously is possible.

Microsoft Exploring Digital Payments

Microsoft partners with Aptos Labs to boost their solutions using AI, concentrating on blockchain services like Aptos Assistant chatbot, while also investigating financial solutions encompassing asset tokenization, payments, and CBDCs, supported by Microsoft Azure for network security.

S&P Outlook

Bull Case: Since breaking below 4551.50 bears have continued to push price down. Bulls will want to hold price above 4490 and eventually get above 4551.50 . If price breaks below, not much demand until 4427.

Bear Case: Bears will want to continue to push price down and hold below 4490 with next demand near 4427. If demand breaks, not much support until a Daily demand at 4348.75.

EARNINGS RELEASE CALENDAR

FOR WEEK OF AUGUST 14THst

Expert Insights & Predictions

Despite recent struggles and a 17% decline in its stock value compared to the S&P 500’s 16% increase, there are a few compelling reasons to consider Chewy ($CHWY) as a promising swing trade for the rest of the year.

Despite concerns about sales growth and a shrinking customer base, deeper analysis reveals reasons for optimism. Chewy’s gross profit margin has improved due to price increases and higher customer spending, with average sales per customer rising from $446 million to $512 in the first quarter.

Furthermore, 75% of sales come from its auto-ship service, indicating growing subscription commitment. Operating cash flow surged by 80%, reaching $148 million, showing a positive trend in the company’s financials.

Despite the current stock price decline, Chewy’s price-to-sales ratio has dropped significantly from its pandemic peak, suggesting potential undervaluation. The possibility of a return to steady customer growth by late 2023 adds to the potential upside, although there might be volatility along the way.

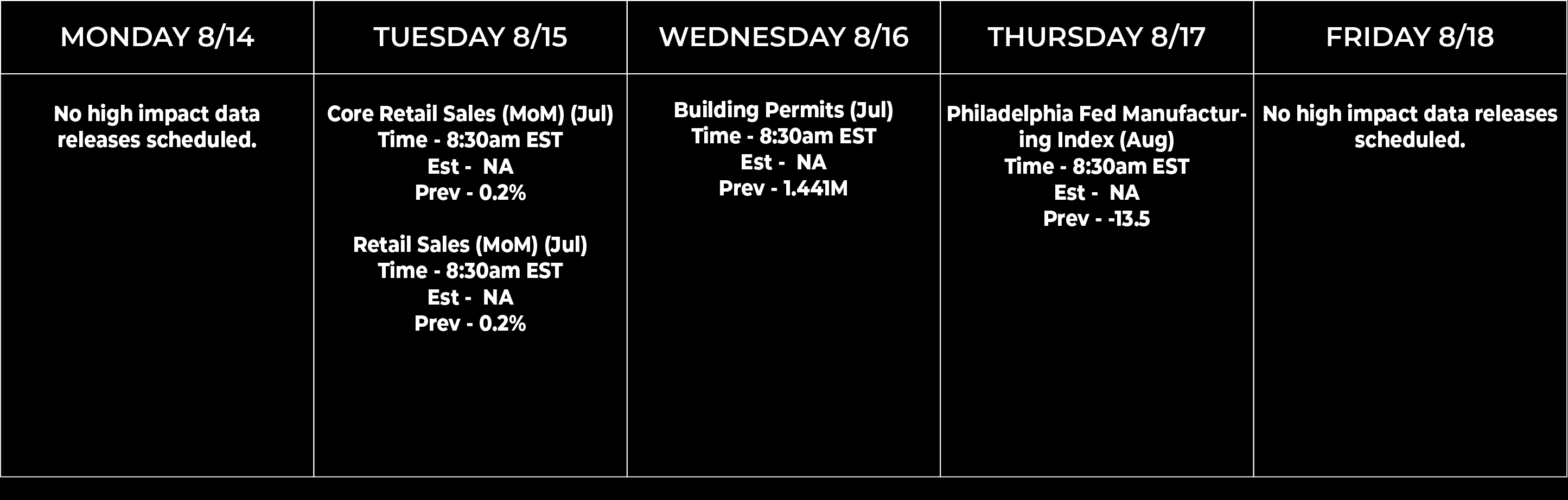

Economic Data Calendar