WEEK OF JULY 3, 2023

Welcome to the Traderverse Weekly Newsletter!

Important Prices

What’s Moving The Markets?

US considering new restrictions on AI chip exports to China

The US is considering new restrictions on exports of artificial intelligence chips to China. The Commerce Department will stop the shipments of chips made by Nvidia and other chip companies to customers in China as early as July

Interest Rates

US central bankers are likely to resume their rate hike campaign after a break earlier this month, Federal Reserve Chair Jerome Powell signaled last Thursday, as new, stronger than expected economic data underscored why more monetary tightening is likely needed.

SEC Says Spot Bitcoin ETF Filings are Inadequate

Amid several high profile submissions, the SEC says recent spot Bitcoin ETF filings are inadequate. The statements arrive after asset management giants BlackRock and Fidelity recently filed to launch their own spot Bitcoin ETFs.

Biden To Eliminate Loopholes for Crypto Traders

Biden claims that he will work on making the current tax system “fair” by eliminating loopholes for crypto traders, stating that the loopholes currently in place are costing the government $18 billion in lost tax revenue.

FTX Seeking to Relaunch

The controversial cryptocurrency exchange, FTX, is reportedly set to explore a relaunch with the new management group at the firm already beginning to listen to proposal submissions from parties interested in restarting the exchange.

MicroStrategy Buys 12,333 BTC for $347 Million

Michael Saylor, the founder of MicroStrategy, recently shared his company’s the ongoing accumulation of Bitcoin, acquiring 12,333 Bitcoins for a total of $347 million, as institutional investors continue to expand their cryptocurrency portfolios.

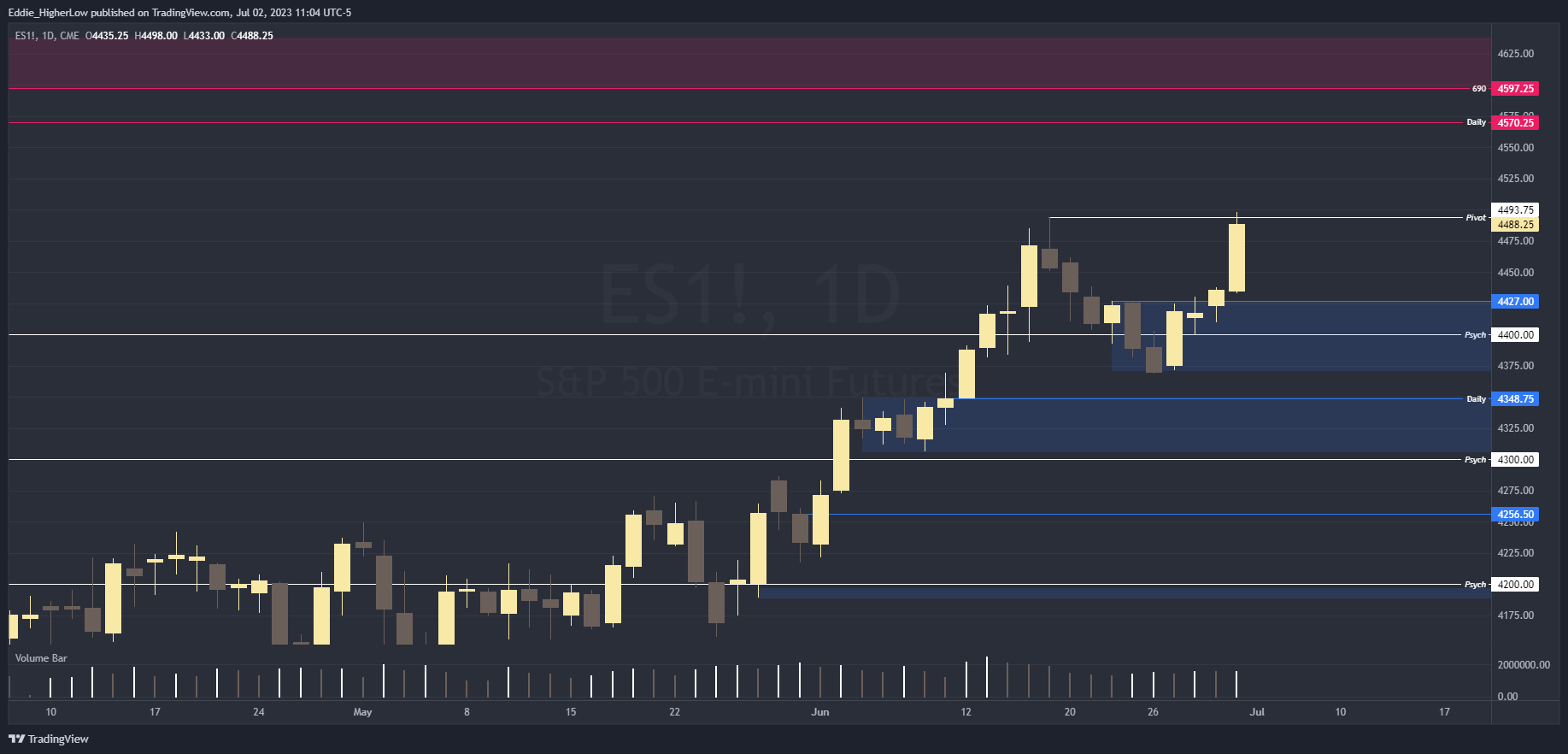

S&P Outlook

Bull Case: Bulls continue to buy the dips and held price above 4400. Price tested prior pivot at 4493.75, which will be key this week. If price does continue to trade lower, possible demand sits at 4427 where price consolidated for 5 trading days. Below, 4400 psych level and 4348 .75 could act as possible support.

Bear Case: Bears will want to continue defending pivot at 4493.75 but will ultimately need to break below 4368 to begin creating lower lows. If price continues to trade above 4493.75, an untested Daily supply sits at 4570.25 and a 690 minute supply at 4597.25 which could act as strong resistance.

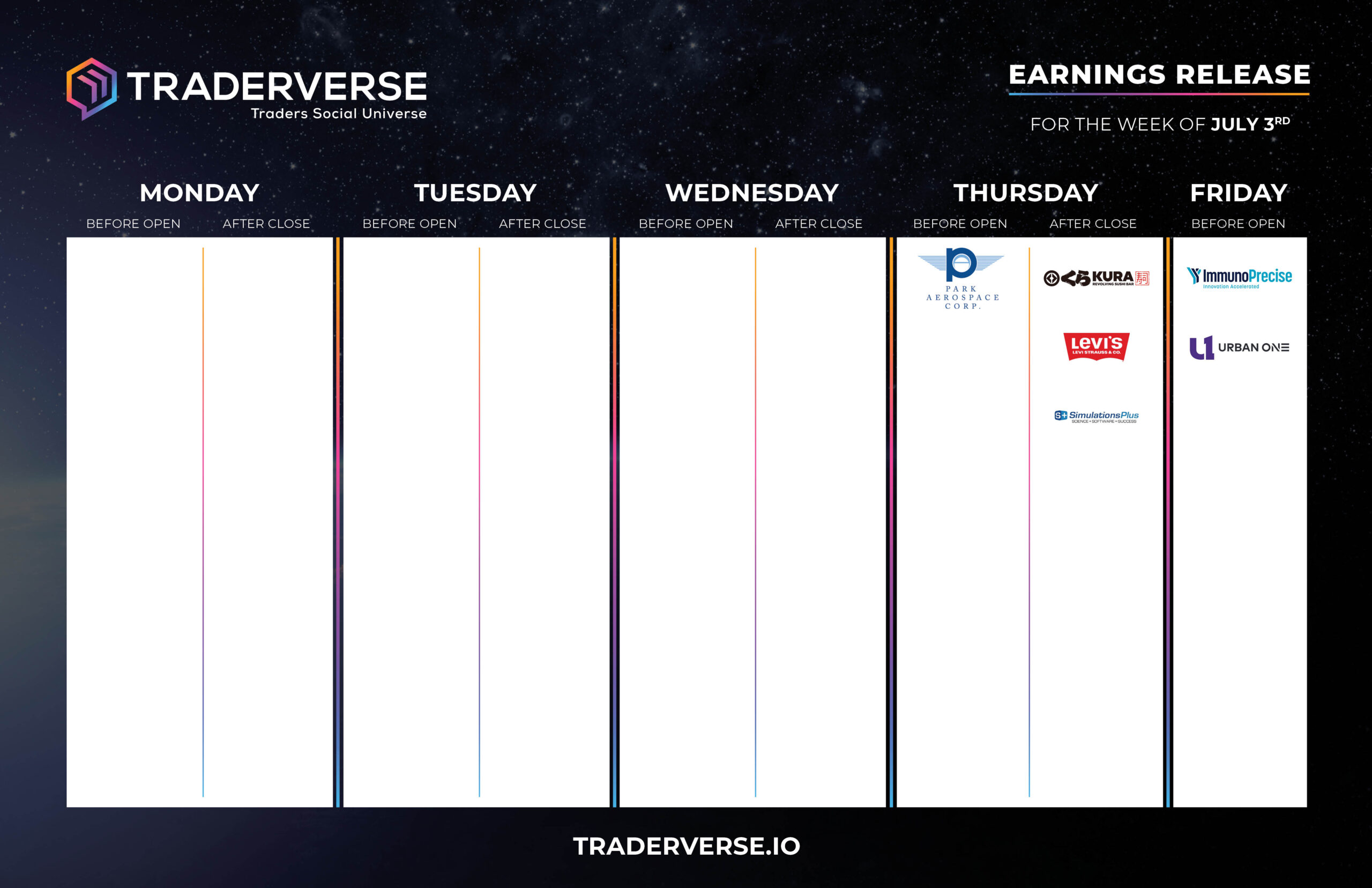

EARNINGS RELEASE CALENDAR

FOR WEEK OF JULY 3rd

Expert Insights & Predictions

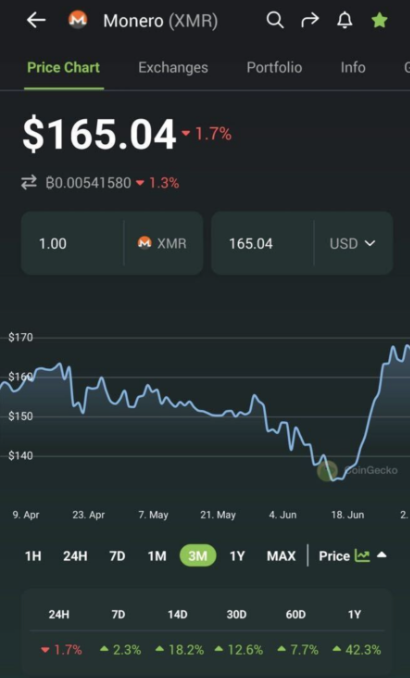

Welcome to “The Subverse,” with your guest host, MineYourBiz. OK, ultra-cringe dad joke is out of the way. So, why do I proudly tweet the daily close of Monero ($XMR) every single day? It’s a reminder and a mindset.

My thesis is simple, really, if “cash is king” in traditional main street business (the middle 50% of the market), then decentralization and privacy should be the corollary for crypto!

While Monero proper has faced tremendous challenges in adoption via centralized exchanges, the simplest way to find opportunities to increase privacy is through permissionless, decentralized Defi protocols. This might not even include monero for most investors!

Recent reports on the state of decentralized perpetuals trading platforms offer a gleam of hope: the idea virus is spreading. Even if you’re not an early adopter, or an early bandwagoner, there are still plenty of early opportunities to discover alpha, stay decentralized, and protect your anonymity.

Economic Data Calendar