WEEK OF JULY 24, 2023

Welcome to the Traderverse Weekly Newsletter!

Important Prices

What’s Moving The Markets?

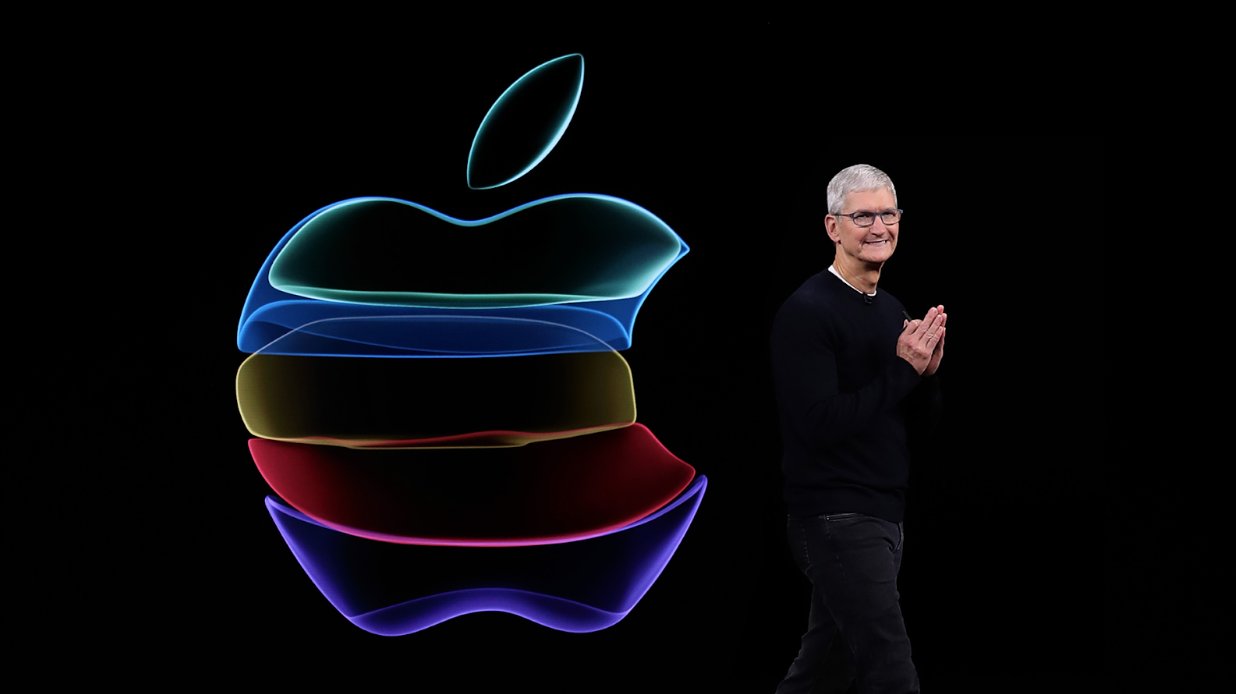

Apple Entering The AI Race

Following similar attempts taken by other tech giants, Apple has announced that they are working on developing its own rival to OpenAI’s ChatGPT, aiming to compete in the emerging generative AI sector.

Congress Stock Trading Ban

Senators are introducing a bipartisan ban on owning stocks for executive and legislative branch officeholders and their families, including Congress.

UAE Moving Away From The U.S. Dollar

India and the United Arab Emirates (UAE) have formulated a deal to conduct trade in Indian Rupee instead of the U.S. dollar, aiming to bolster the Rupee and reduce foreign exchange transaction expenses by eliminating dependence on the U.S. dollar.

More BRICS Applications

A total of 22 countries have officially submitted applications to join the BRICS alliance.The increasing interest from numerous countries seeking BRICS membership signals potential risks for the U.S. dollar, potentially shifting global powers from West to East.

Crypto Oversight Proposal

Prominent Republican members of the US House of Representatives have unveiled a bill to provide a framework for governing crypto markets following the recent XRP ruling, aiming to clarify when and how firms should register with the SEC or the CFTC .

8 Bitcoin ETF Applicants on Federal Register

The US SEC will commence the approval process for Spot Bitcoin ETFs following applications from eight entities, including BlackRock and Fidelity, potentially signaling a shift in sentiment due to traditional financial firms’ involvement.

S&P Outlook

Bull Case: For pullbacks, bulls will ideally want to continue to hold 4490 – 4500. If price breaks below, not much demand until roughly 4427. If price is able to trade above 4638.25, not much supply until 4705.50.

Bear Case: Price just below an untested supply zones that start at 4615 (4 Hour). If price is able to stay below 4615, bears will need to hold price below 4490 to gain any momentum.

EARNINGS RELEASE CALENDAR

FOR WEEK OF JULY 24th

Expert Insights & Predictions

Tesla’s most underrated domestic competitor has seen a huge uptick in interest over the past month. Mainly due to the administration’s focus on clean energy investments, the overall electric vehicle sector is beginning to show life off recently at time lows.

Rivian has accumulated lots of short interest alongside Carvana’s epic short squeeze and is doing measures to drive its way into more market share.

Last week they addressed two audiences missing from their demographic:

- Affordability

- Performance

Hence announcing the dual-motor option R1T and R1S in an effort to reduce costs and attract more consumers. In addition, they also added a performance package for those looking for that EV supercar feel.

Price analysis:

Since the epic 100% run up from late June, the price is consolidating for another large directional move.

Bull Case: Hold the 4 hour zone (24.52-24.89) and take that those new highs for a 30 move as we see lots of 7/28 call flow

Bear Case: Cut through the 4 hour zone (24.52-24.89) and take out the previous lows (23.50-23.75) as the daily has a price gap imbalance sitting at 21.77. — @thankskuya

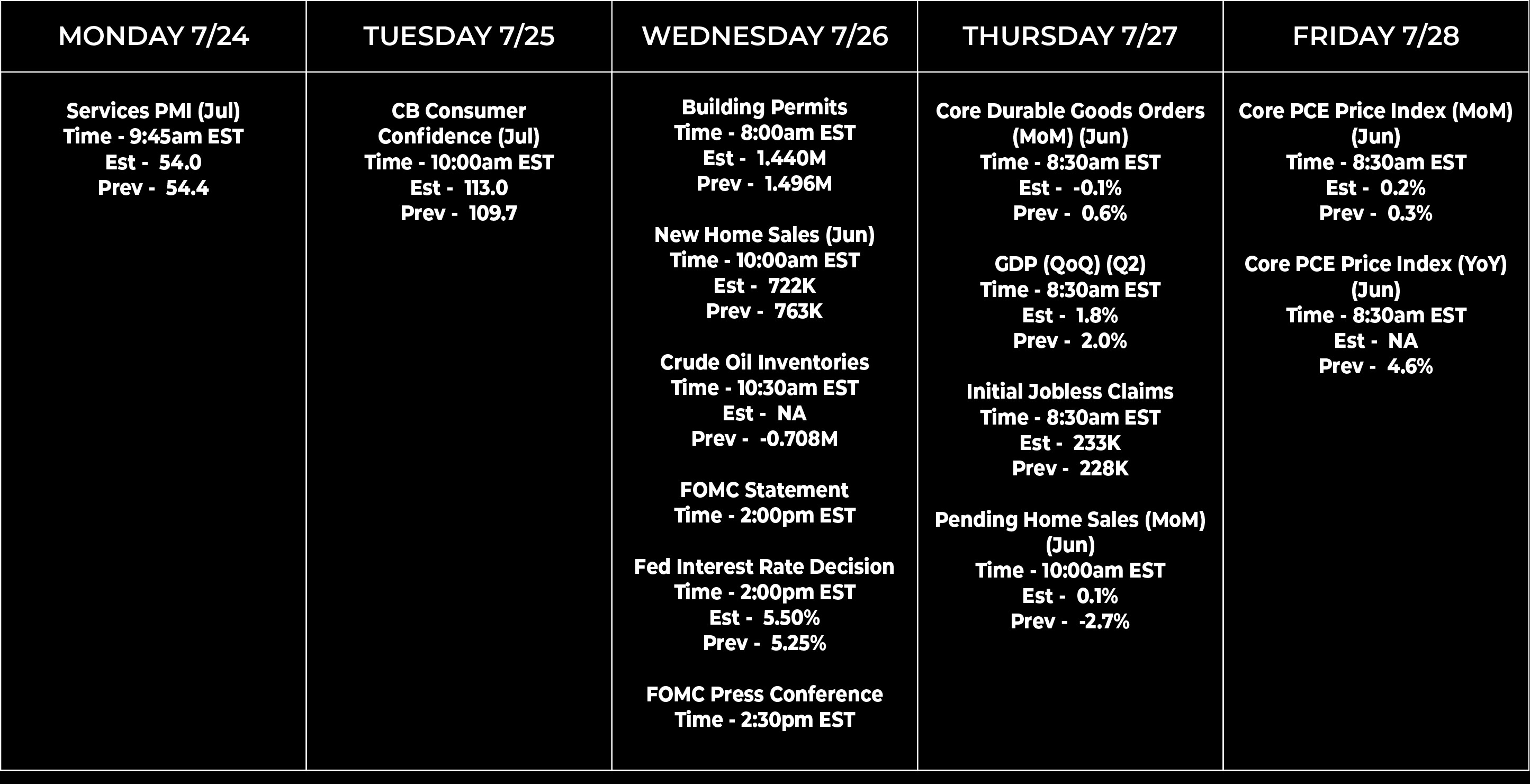

Economic Data Calendar