WEEK OF JUNE 26, 2023

Welcome to the Traderverse Weekly Newsletter!

Important Prices

What’s Moving The Markets?

Interest Rates Expected To Rise

Federal Reserve Chair Jerome Powell expressed during his testimony at the US House Financial Services Committee’s semi-annual monetary policy hearing that raising interest rates two more times this year would be appropriate.

JP Morgan Fined After Deleting

The SEC is fining JP Morgan Chase after the bank “accidentally” deleted 47 million banking records, in the form of tens of millions of emails from employees, that the company was required under SEC rules to keep for three years.

Bitcoin Hits Highest Level In Over A Year

Bitcoin reached a level of over $31,400 on Friday, its highest level since 2022. Bitcoin is up roughly 85% year-to-date with Its most recent gains coming after a wave of interest in crypto from financial giants.

SEC Approves First Ever Leveraged Bitcoin ETF

The SEC has approved its first leveraged Bitcoin Futures ETF, set to begin trading on Tuesday under the ticker “BITX”, and is now the first ETF of its kind to be available in the United States. A handful of other large financial institutions, such as $1.5 trillion asset manager Invesco, have also begun filing for bitcoin ETFs all throughout last week.

Financial Giants Launch New Crypto Platform

Citadel, Fidelity, Charles Schwab, Sequoia Capital, Virtu Financial, and Paradigm have collaboratively launched a new crypto exchange called “EDX Markets” that “aims to deliver exceptional benefits to its customers, including enhanced liquidity, competitive quotes, and a unique non-custodial model that addresses conflicts of interest.”

Deutsche Bank Applies For Crypto License

Germany’s $1.4 trillion asset manager has applied for a regulatory license to operate a custody service for assets like crypto.This initiative is intended to notch up the bank’s fee income and echoes the efforts of the Bank’s investment arm to bolster income from digital asset-related offerings.

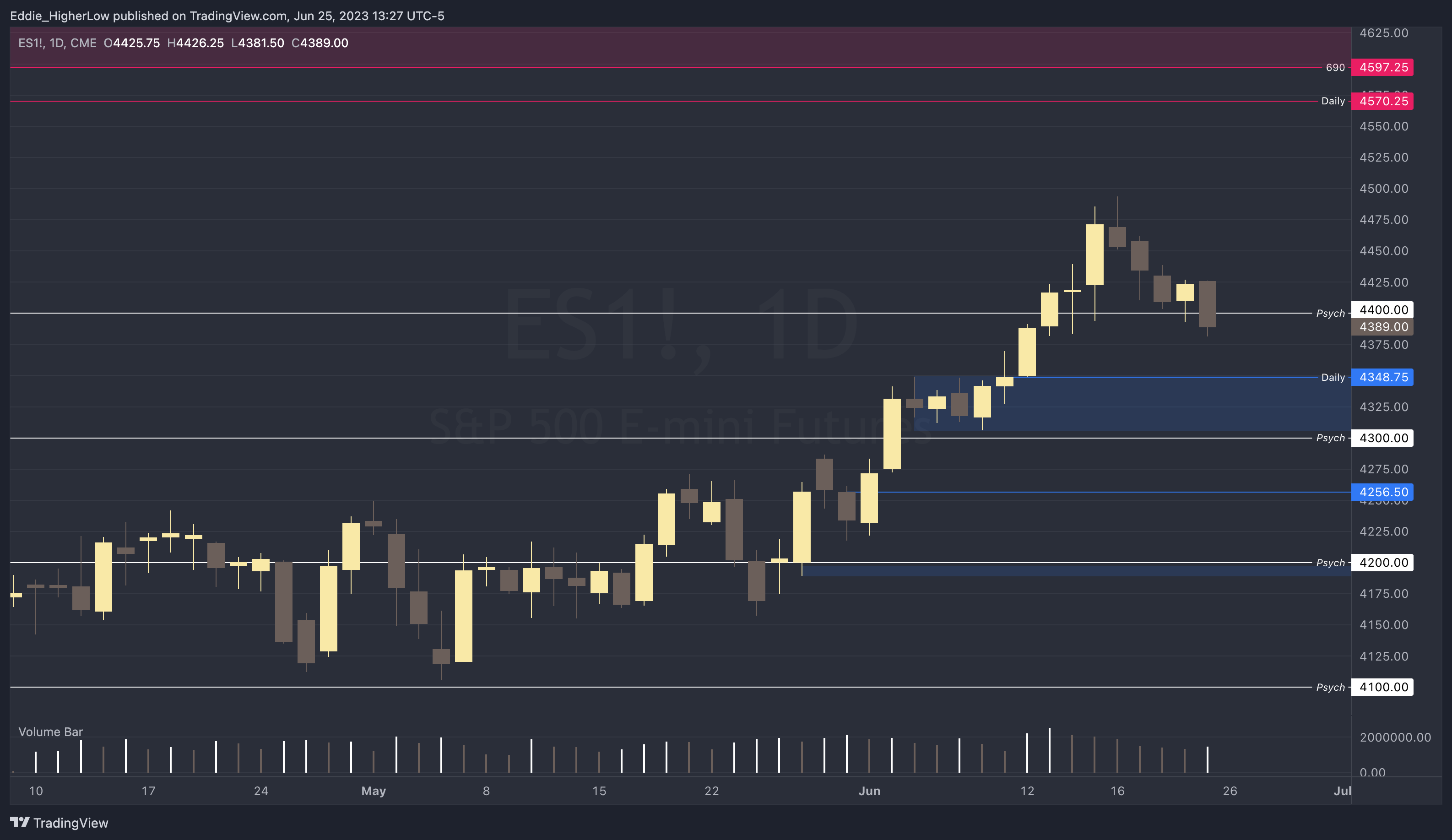

S&P Outlook

Bull Case: Price trading just below psychological 4400 but keep watch around 4348.75 where price traded for 5 days before moving up so might act as possible demand. If price breaks below 4300, next possible levels of support, 4256.50 and psychological level at 4200.

Bear Case: Bears ideally would want to keep price below 4493 to continue lower high trend but if price breaks above, a possible untested Daily supply sits at 4570.25 and a 690 minute one within the Daily supply at 4597.25.

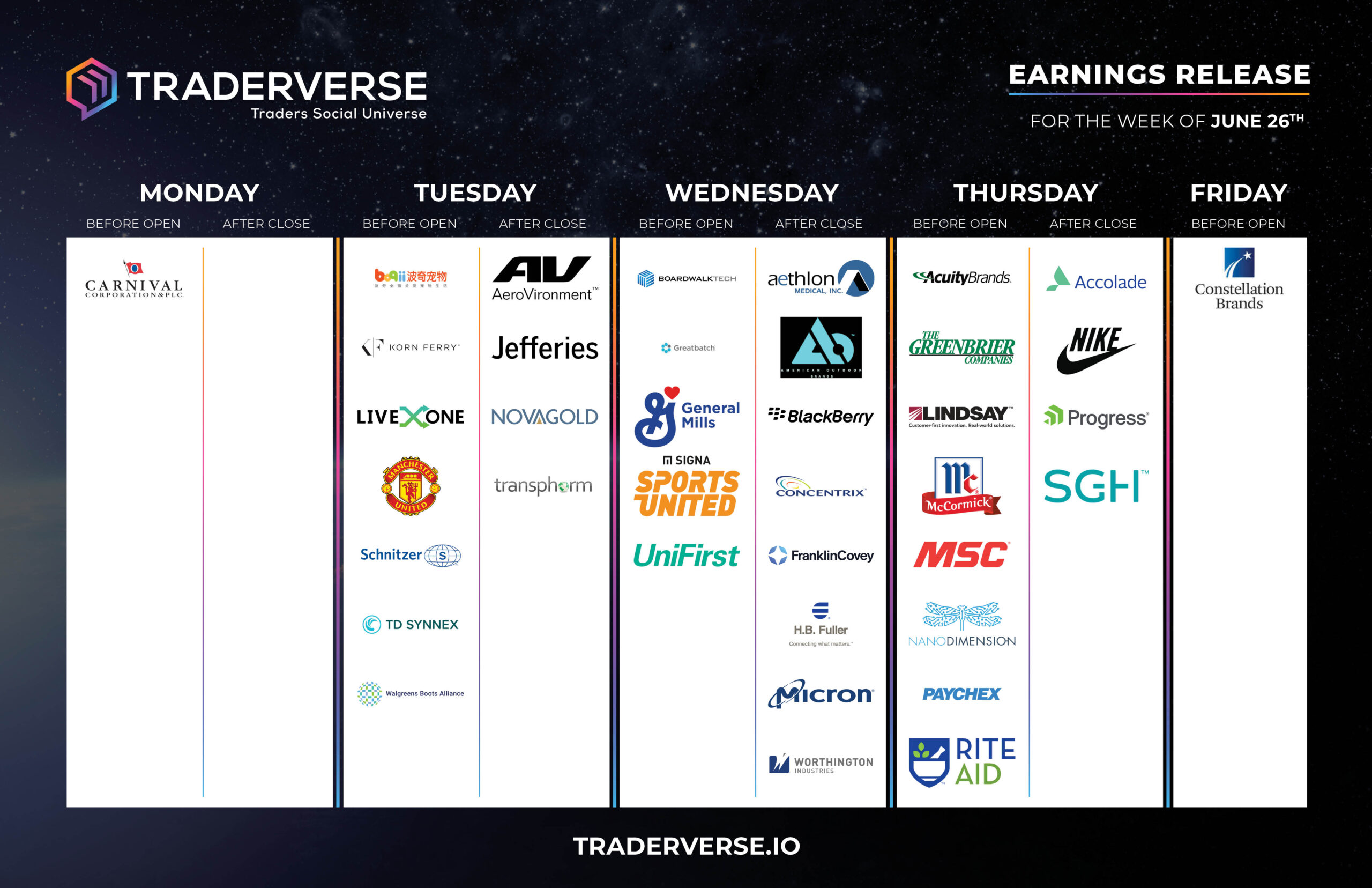

EARNINGS RELEASE CALENDAR

FOR WEEK OF JUNE 26th

Expert Insights & Predictions

Depending on the market sentiment, there are some trades I’m looking at and I’m interested in:

$AMD – retested right to the 50 daily EMA, strong support around $109 and also filled the gap from May 25th. Potential long trade if it bounces. If not, stop loss right below $107/108.

$KRE – (regional bank ETF) – with increasing rates in Europe, and potential increasing future rates in the USA, bank stocks have to watch rates and shape of yield curve. This could be a good short swing trade. KRE also broke below the trendline in the last couple of trading days.

$MDB – held up well last week and looks like it could potentially breakout higher.

We can see some relative strength for sure.

$JPM – I will be keeping my eye on this stock. Sold off back to the 50 daily EMA and I’ll be looking for a potential bounce.

$SHOP – tested the 10 and 20 daily EMA and bounced there twice. If this support is broken and stock fails to hold $62, we can see $56/57 as the next support. If there’s a relative strength, and the overall market is corresponding, I’d take this trade long.

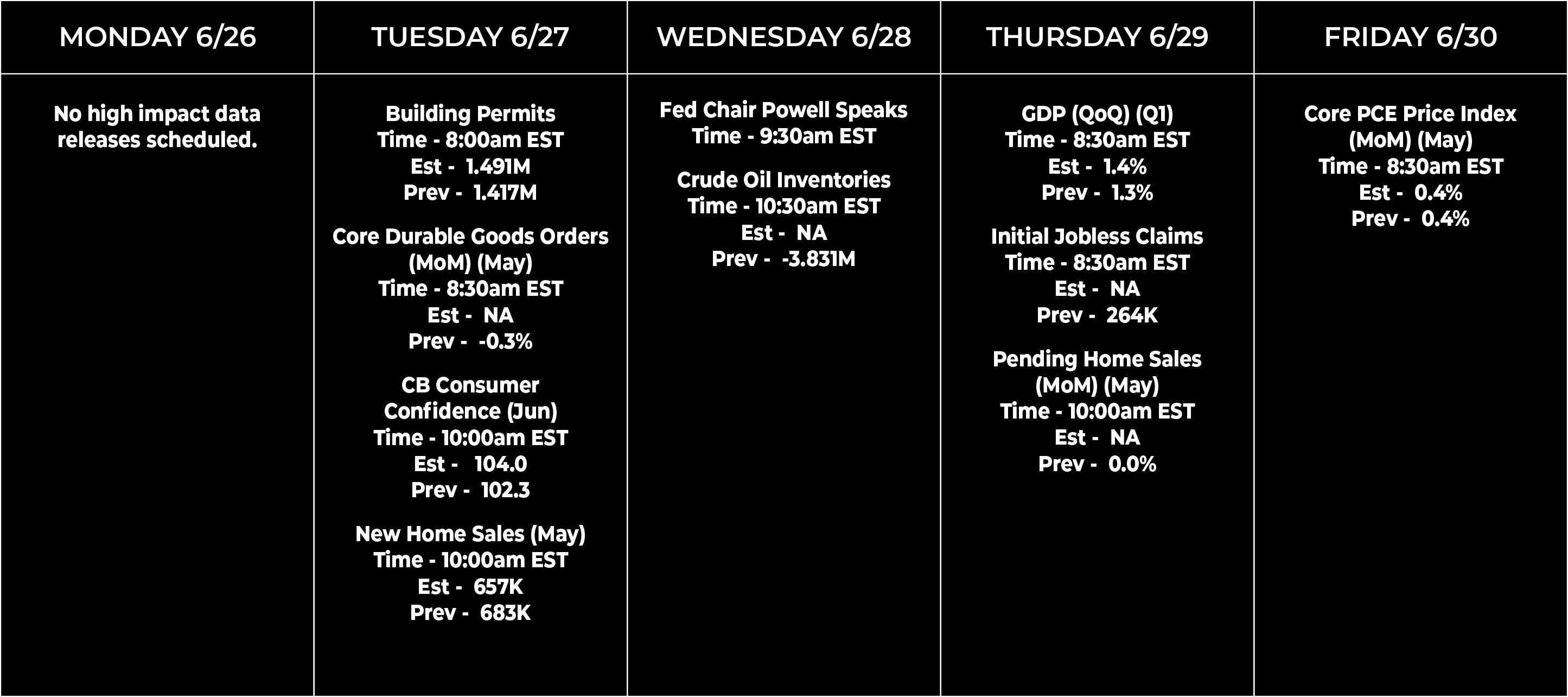

Economic Data Calendar