WEEK OF JUNE 19, 2023

Welcome to the Traderverse Weekly Newsletter!

Check out our newly formatted version here!

Important Prices

What’s Moving The Markets?

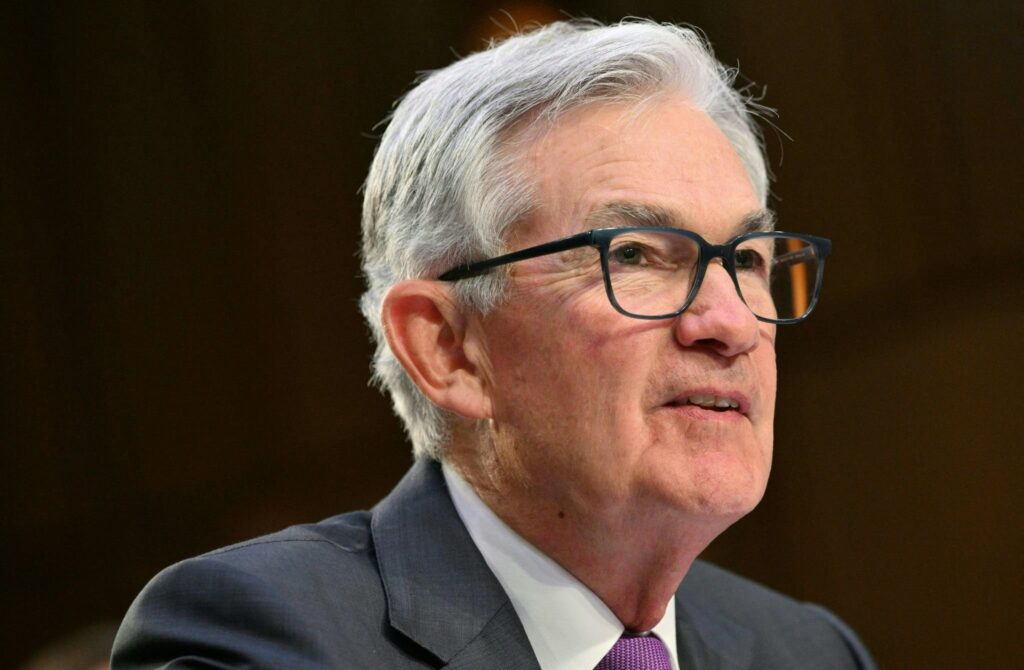

More Interest Rate Hikes To Come

Last week, the Fed ended its run of 10 consecutive rate hikes when policymakers decided to keep the benchmark overnight interest rate in a range of from 5% to 5.25%, but signaled that rate hikes will likely resume.

Though Fed chair Powell said no decision had been made in regard to interest rates at the upcoming July Fed meeting, investors and other analysts broadly expect the Fed to resume rate increases.

Countries Dropping The US Dollar

Over the past week we have seen more countries opting out of using the US dollar with Egypt and Pakistan being the most recent countries to do so.

Pakistan recently used Chinese yuan to pay for their latest import of Russian oil and Egypt is set to pay for imports from India, Russia, and China in local currencies.

New Countries Apply To Join BRICS

The list of candidates attempting to join the BRICS alliance continues to increase as nearly 20 countries are reportedly set to apply.

Discussions continue on what could be the criteria for joining the BRICS nations with expansion plans set to be enacted this summer at the organization’s August summit.

AI Regulation

Regulators are scrambling to adapt existing rules and create new guidelines to govern the use of generative AI as people are growing optimistic of the prospect for global coordination on artificial intelligence.

The EU is moving ahead with its draft AI Act, which is expected to become law this year, while the United States is leaning toward adapting existing laws for AI rather than creating new legislation.

Bill Introduced To Fire Gary Gensler

US Congressman, Warren Davidson, has filed legislation that would restructure the SEC and fire its chair, Gary Gensler.

The legislation follows recent enforcement action taken by the SEC last week against crypto exchanges Coinbase and Binance.

The call for a change in leadership has been consistent due to concern regarding how the SEC’s actions could affect the industry, pushing digital asset development away from the US.

Intel Invests $4.6 Billion Into Chip Factory

Intel plans to invest up to $4.6 billion in a new semiconductor assembly and test facility near Wrocław, Poland, as part of a multi-billion dollar investment drive across Europe to build chip capacity.

The US chipmaker last year announced plans to build a big chip complex in Germany along with facilities in Ireland and France as it seeks to benefit from European Commission’s eased funding rules and subsidies as the EU looks to cut its dependence on US and Asian supply.

Blackrock Files For Bitcoin ETF

BlackRock, the world’s biggest asset manager, filed for a bitcoin exchange-traded fund (ETF) that would allow investors to get exposure to the cryptocurrency.

The move comes at a time when the global cryptocurrency industry has been caught in the crosshairs of the US securities regulator on alleged violations of securities laws.

BlackRock’s iShares Bitcoin Trust will use Coinbase Custody as its custodian, but has not yet been approved by the SEC.

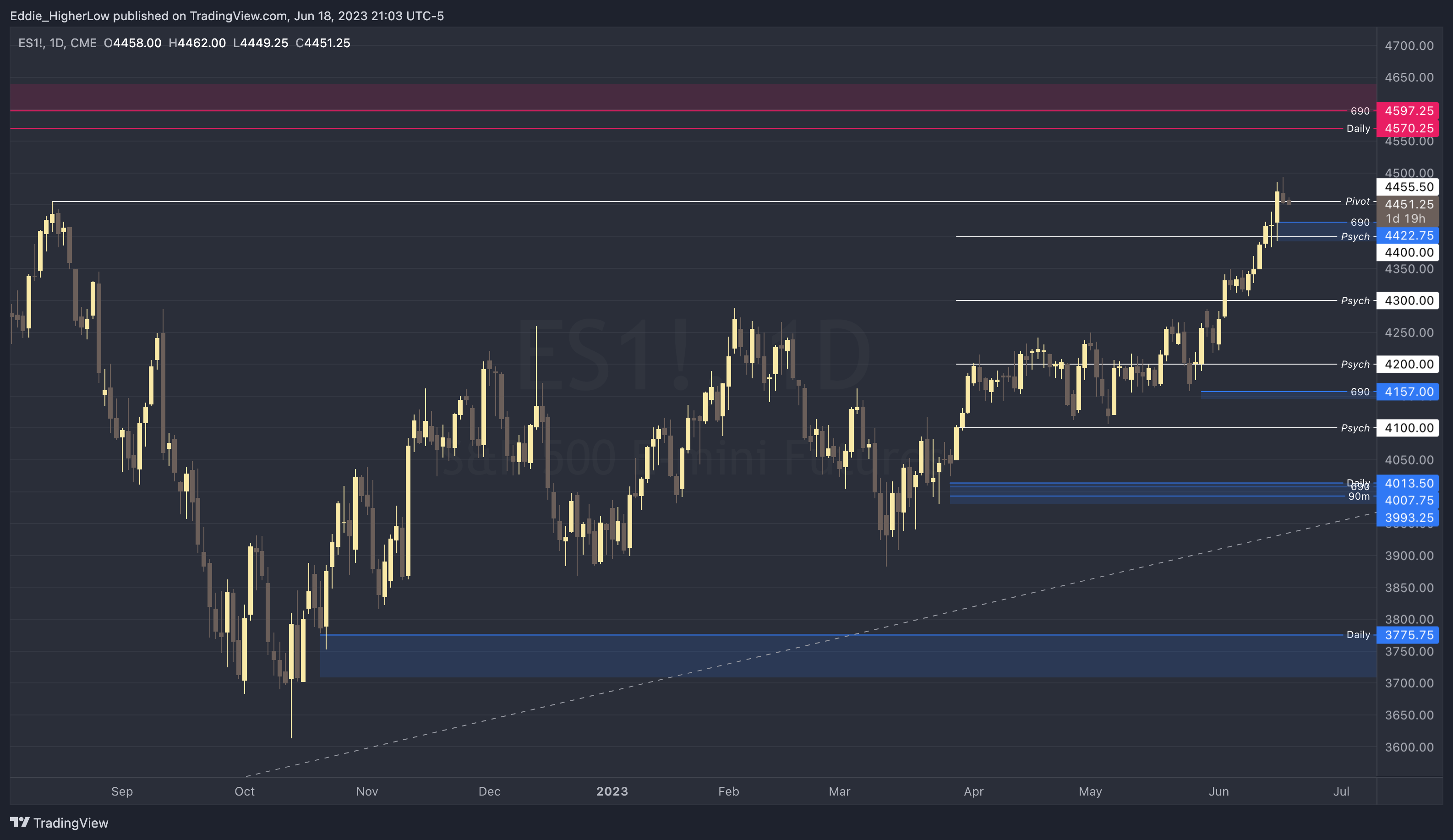

S&P Outlook

Bull Case: Bulls will want to continue to hold above prior major pivot at 4455.50 but if price trades below, possible 690 minute demand at 4422.75 and 4400 psychological level. If price does hold, not much resistance until Daily supply at 4570.25 and a 690 minute supply at 4597.25.

Bear Case: Bears will need to break below 4455.50 and ultimately break below 4300 to break current higher higher trend. If price does break below 4300, not much strong demand until 4200. To upside, strong untested supply at 4570.25 – 4639 which could act resistance.

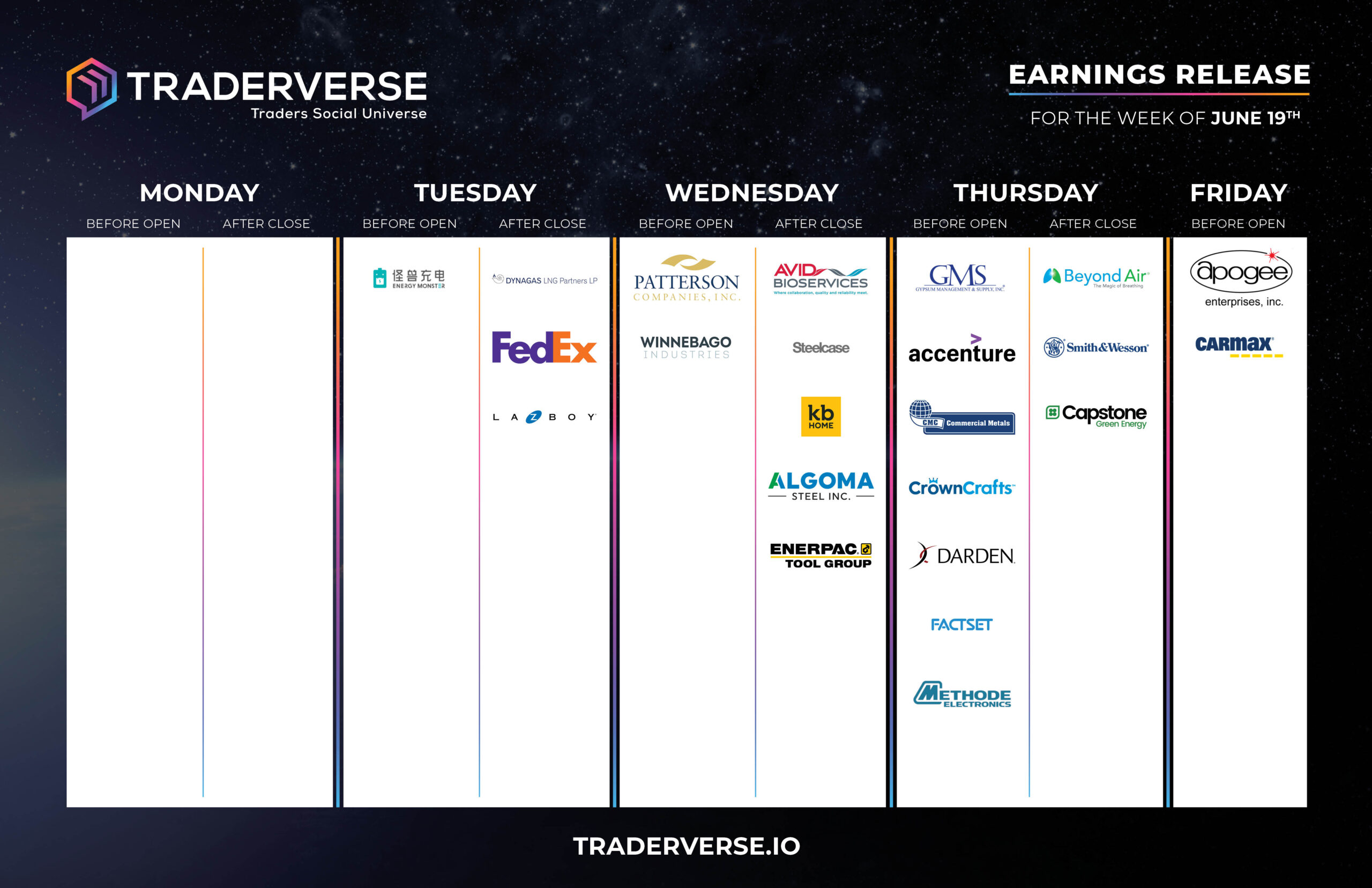

EARNINGS RELEASE CALENDAR

FOR WEEK OF JUNE 19th

Expert Insights & Predictions

The Behavioral Analysis Model remains bearish into July-August of 2023 with an eye on our proprietary “hidden retest” @ 22,200 as early as 7/4-7/8.

We also have one additional ZOS (Zone Of Strength) on the board projected into about 7/22 but bounces will trigger additional sell signals per our work.

Bitcoin / BTCUSD has tracked our Behavioral Analysis Model accurately for many years and although new data will be generated as we trade forward, downside hidden retest levels remain on the board as we trade into Q1 2024= @ 21,000, 18,450, and 15,750.

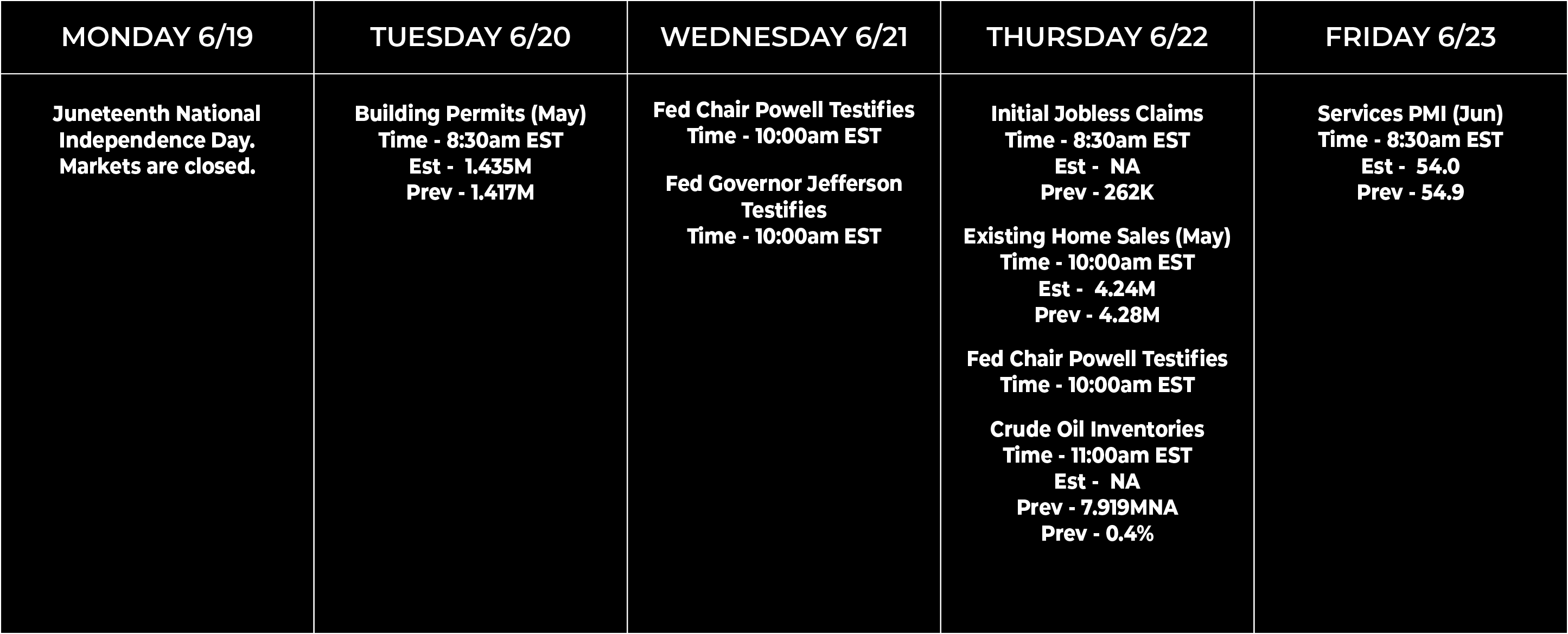

Economic Data Calendar