WEEK OF JUNE 17, 2024

Welcome to the Traderverse Weekly Newsletter!

Traderverse Updates

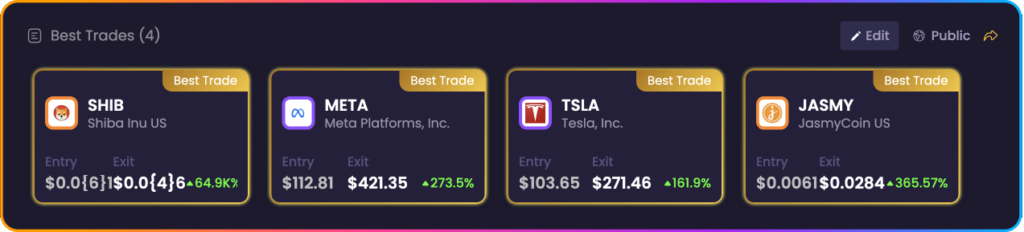

Welcome to our newsletter series, where we unveil updates and features as we gear up for our upcoming launch! This week, we’re excited to introduce one of the standout features of Traderverse: Best Trades.

Showcasing Best Trades:

The Best Trades section is designed to let you showcase your most successful trades based on your inputted PnL (Profit and Loss) data within Traderverse. This feature allows you to highlight your trading achievements and share your successes with the community.

Verified Trade Data:

At Traderverse, we prioritize accuracy and credibility. That’s why all trade data displayed in the Best Trades section is verified, ensuring that the information is reliable and trustworthy.

Share and Inspire:

The Best Trades section is not just about showcasing your successes; it’s also about inspiring others. By sharing your best trades, you can provide valuable insights and strategies that can benefit fellow traders within the Traderverse community.

Stay Tuned:

As we continue to ramp up to our launch, we’ll be breaking down more sections of Traderverse in the coming weeks. Keep an eye out for our upcoming newsletters as we explore the features that make Traderverse the ultimate platform for traders.

Thank you for your continued support and enthusiasm. Together, we're revolutionizing the way traders share and celebrate their successes.

Important Prices

What’s Moving The Markets?

Apple unveiled its AI strategy, featuring the “Apple Intelligence” technology integrated across its apps and incorporating OpenAI’s ChatGPT, with a focus on enhancing user experience and privacy, though Wall Street reacted lukewarmly to the announcement.

The Federal Reserve decided to maintain current interest rates, signaling a cautious yet stable economic outlook, with future adjustments contingent on inflation and labor market data, as market reactions and economic projections remain positive.

Tesla shareholders have approved Elon Musk’s $56 billion pay package, while also endorsing key corporate changes and expressing trust in Musk’s leadership amidst concerns about governance and his divided attention.

The Biden administration is set to expand sanctions targeting semiconductor chip sales and other goods to Russia, including third-party sellers in China, as part of a broader strategy to counter Russia’s circumvention of Western sanctions and support Ukraine’s defense efforts.

Elon Musk has dismissed his lawsuit against OpenAI and its CEO Sam Altman, which accused them of straying from their original mission of developing AI for humanity’s benefit, amid ongoing tensions and competition in the AI industry.

MicroStrategy is raising $700 million through the sale of convertible senior notes to purchase additional Bitcoin, reinforcing its status as the largest corporate holder of the cryptocurrency and reflecting strong institutional interest and confidence in Bitcoin’s long-term value.

S&P Outlook

Bear Case: Bears will need to see price break and hold below 5393 to continue seeing bearish momentum. If price does break below 5393, next possible target sits at 5315.

Bull Case: Possible new demand formed starting at 5427 where Bulls may look to defend. Not much strong supply above until ATH.

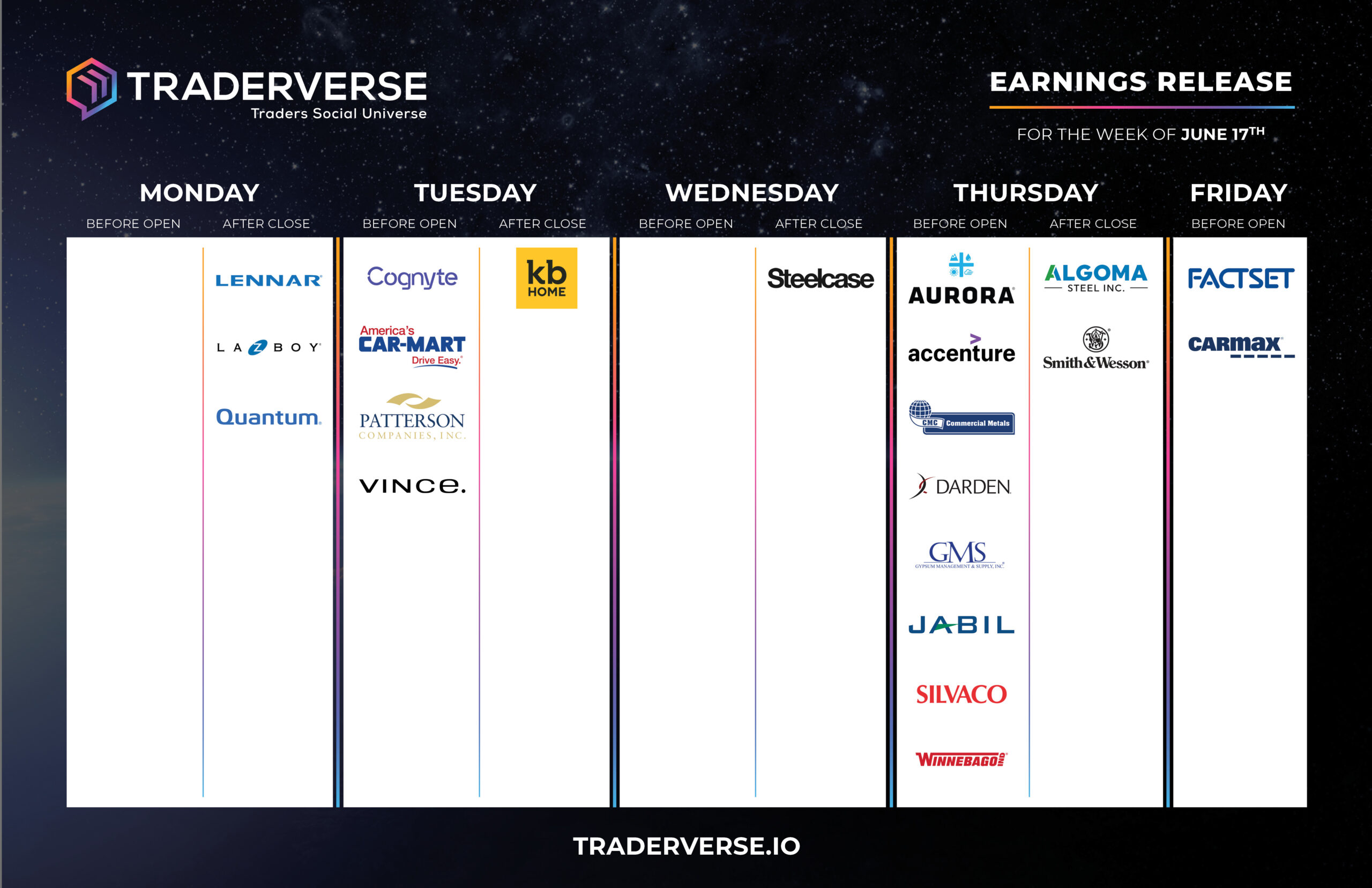

EARNINGS RELEASE CALENDAR

FOR WEEK OF JUNE 17th

Economic Data Calendar