WEEKLY MARKET OUTLOOK

FOR THE WEEK OF MAY 8, 2023

Welcome to the Traderverse Weekly Newsletter! We are thrilled to welcome you to our trading community!

Each week, we provide you with the most up-to-date stock, crypto, & real estate information and charts, so you can stay informed and optimize your trading decisions. Thank you for joining us!

Happy trading!

Important Prices

S&P Outlook

Bull Case: Bulls continue to defend the 4100 psychological level but still need to break above 4204.75 to invalidate supply above which starts at 4195.25. Price has consolidated once within that zone so I do not believe it will be as strong on the second test, but just above we have a Daily supply at 4233.25 and a tighter consolidation that starts at 4269.75

Bear Case: Bears need to break and hold price below 4100 to see any true continuation to the downside but If price does continue higher, I will keep an eye on 4244.75 which is a level that has rejected price twice and it also sits within the Daily supply.

What’s Moving The Markets?

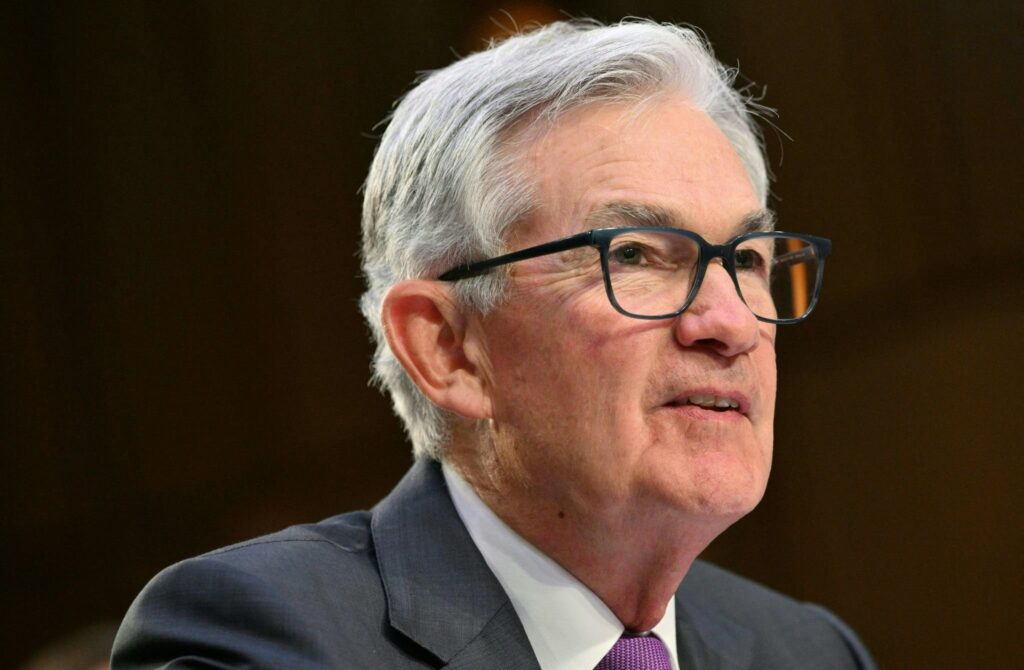

Fed Continues Its Fight Against Inflation

Last Wednesday, the Fed decided to raise interest rates by another 25 bps, bringing the federal funds rate to 5.00%-5.25%. Powell explained that the Fed forecasts “a mild recession” amid the current economic climate and stated that they would characterize it as “one in which the rise in unemployment is smaller than has been typical in modern recessions.” Alternatively, Powell still maintained his belief in the economy’s ability to avoid that outcome. He stated that “The case of avoiding a recession is, in my view, more likely than that of having a recession.” Powell also discussed the fight against inflation, and why interest rate cuts won’t be sacrificed because of that conflict. Powell stated that the Fed has a view that “inflation is going to come down, but not so quickly.”

Powell’s Insight On The Banking Sector

In the FOMC meeting last week, Fed Chair Jerome Powell addressed the proverbial elephant in the room: the banking sector. Despite the recent fallout of First Republic Bank, Powell referred to the industry as “sound and resilient” while remarking that “conditions in that sector have broadly improved since early March.” Powell assured that the banking sector did not massively factor into the current inflation fight and stated the Fed remains “strongly committed to bringing inflation back down to our 2% goal.” This is a positive sign for investors as Powell’s remarks indicate that despite the recent downturn of First Republic Bank, the banking sector is still in a strong and resilient position.

BofA NOT CONCERNED ABOUT BRICS

BRICS currency has been a topic of hot debate over the past few months, with many arguing whether its mission to replace the US dollar as the global reserve currency will succeed or fail. The BRICS alliance plans on establishing a new currency for its nations to use, which will replace and overshadow the US Dollar. Bank of America said that the global dominance of the US dollar is not in any way under threat, due to there being “no other currency alternatives” available. The BRICS Alliance has a summit scheduled for this August, where new members and the new currency will be a trending topic with multiple nations already united in the idea of ditching the US dollar.

El Salvador Eliminates Taxes On Tech Innovations

El Salvador’s President signed a law, eliminating taxes on technology innovations, noting that the Innovation and Technology Manufacturing Incentive Act will eliminate taxes on income, property, important tariffs for technology innovations, and capital gains on both stocks & cryptocurrencies. This law reinforces El Salvador’s perspective as a haven for technology development, with the new act protecting technology innovations, software and app programming, AI, computer, and communications hardware manufacturing. Various developments in the tech sector have been marred by regulatory action, specifically generative AI & crypto, having seen unclear regulations halting their development. The Innovations and Technology Manufacturing Incentives Act in El Salvador will likely attract tech developments to the country, presenting an economic benefit to a host of companies.

Proposed 30% Tax On Crypto Mining

The Biden Administration has officially introduced a proposed 30% tax on electricity used for Bitcoin mining in the newest budget for the fiscal year 2024. The proposal, titled the Digital Asset Mining Energy (DAME) Excise Tax, is set to be phased in over the course of the next three years, taking aim at crypto mining’s energy consumption and environmental impact. The administration stated that “the DAME tax encourages firms to start taking better account of the harms they impose on society.” Though the tax is currently set to be phased in at the start of the next fiscal year, only time will tell how the proposal is received and affects the industry.

Coinbase Launches International Crypto Exchange

Popular crypto exchange, Coinbase, has now decided to go international, implementing the chapter of the exchange’s global expansion strategy. The exchange originally decided to become a public company in the US because it believed the country could embrace fundamental innovation, However the firm has now chosen to also focus on international markets, where many nations are trying to establish themselves as crypto hubs. The new international exchange will allow institutional users based in the US to trade Bitcoin and Ethereum perpetual futures contracts, with all trades settled in USDC. The company stated that “building out a global perpetual futures exchange for digital assets will help support an updating of the financial system by making Coinbase’s trusted products and services more accessible to users of digital assets who live outside of the US.”

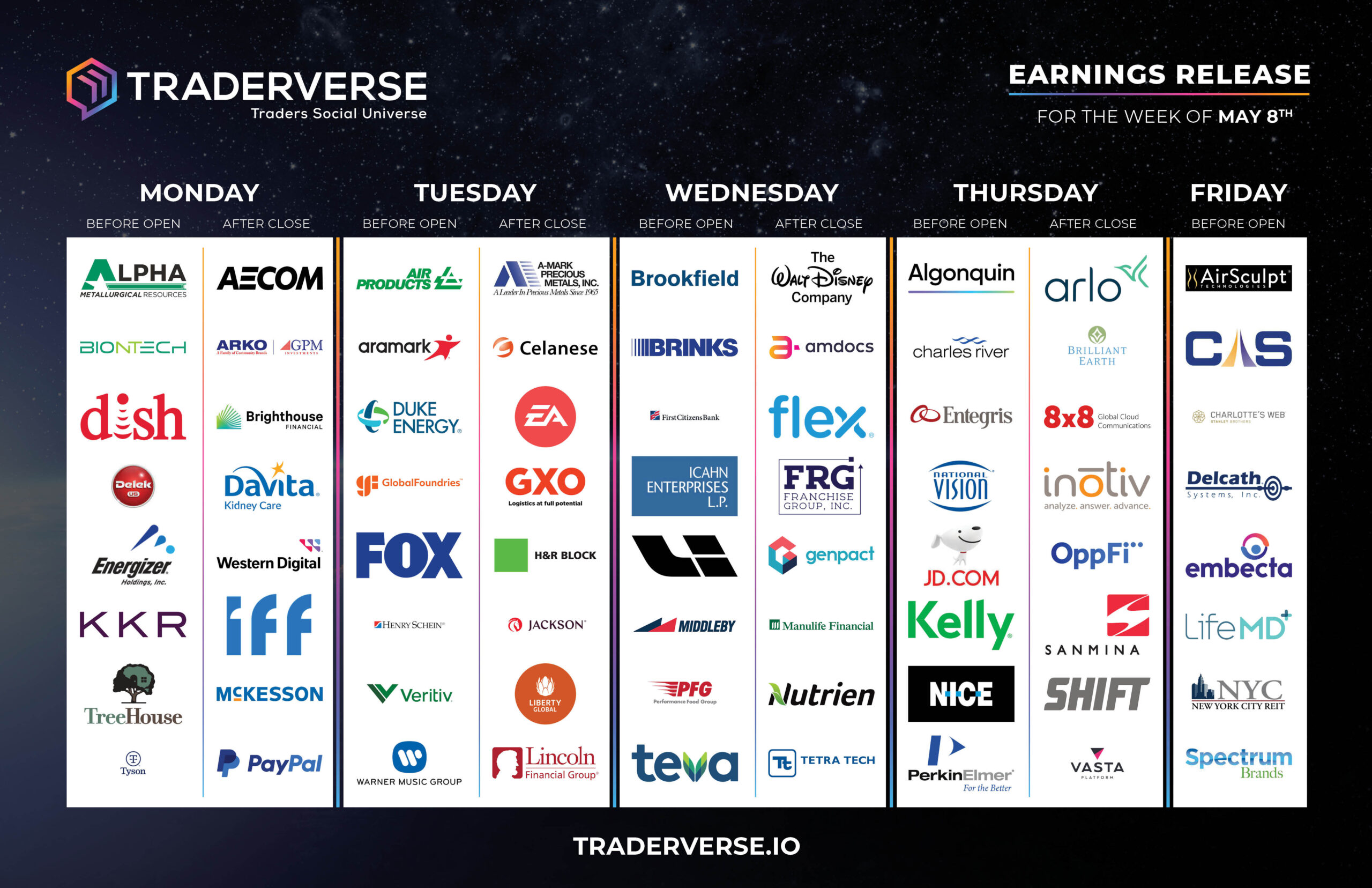

EARNINGS RELEASE CALENDAR

FOR WEEK OF MAY 8th

Expert Insights and Predictions

Hello everyone! My name is Keith Kern. I have been a full time trader for 23 years and trade a little bit of everything. Once a week, I like to take a minute to look at the bigger picture charts in terms of indices to get a feel for what might be coming in the week ahead.

Upon my weekend review, I’m finding that the pattern of the week seems to be a “coiled up” pattern. I like to call a setup that has significant resistance and support on a collision course a “coil”. This pattern reminds us of a coiled spring, one that is about to let loose one way or the other. The beauty of these patterns is that they can be played long or short, depending on which way the coil breaks and eliminates trader “bias”.

Below you will find a few index setup that are coiled up. I will wait for them to give us a trigger, depending on which way they breakout. Thoughts are on each pattern in the charts below.

Another way one could use these bigger picture coil patterns is to wait for a significant break in a direction, and then pick a few stocks in the sector that have been leaders in the group. You then go in that direction with a handful of names. Hope this helps and good luck!

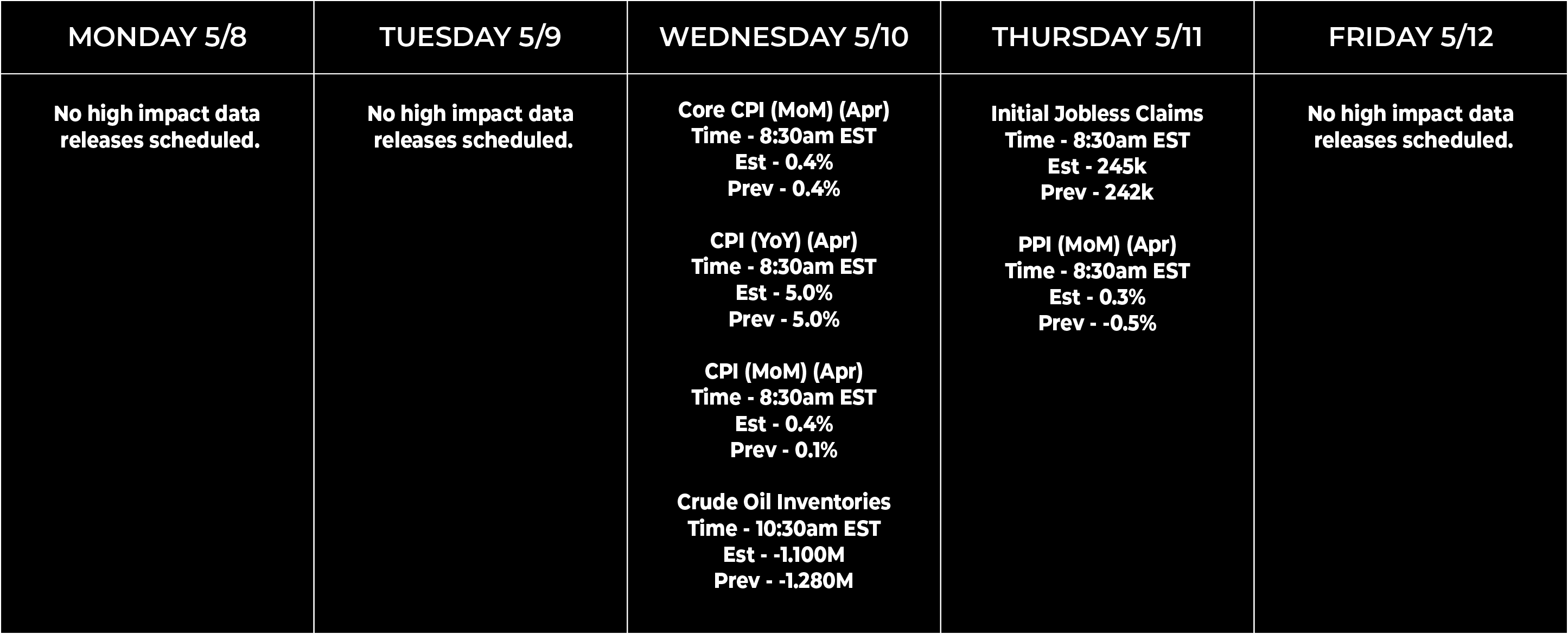

Economic Data Calendar