WEEK OF MAY 6, 2024

Welcome to the Traderverse Weekly Newsletter!

Traderverse Updates

Welcome to another exciting edition of our newsletter series as we march closer to our much-anticipated launch! This week, we’re thrilled to spotlight one of the cornerstone features of Traderverse: Profit and Loss.

Exploring Profit and Loss:

Profit and Loss is a game-changer within Traderverse, powered by seamless integration with your brokerages, wallets, and exchanges. By connecting your accounts, you unlock a comprehensive view of your trading journey, showcasing winning trades, percentage gains, and more—all in one convenient location.

Verified Trade Data:

At Traderverse, we prioritize accuracy and transparency. That’s why we meticulously verify all trade data, ensuring that every insight displayed within Profit and Loss is reliable and trustworthy. With verified information at your fingertips, you can make informed decisions with confidence.

Privacy Controls:

We understand the importance of privacy in the trading world. With Traderverse, you’re in control. You have the power to customize your privacy settings, allowing you to choose which details you want to share with others and which you prefer to keep private.

Thank you for your unwavering support and enthusiasm. Together, we're reshaping the landscape of trading, one innovative feature at a time.

Important Prices

What’s Moving The Markets?

The Federal Reserve opts to hold interest rates steady at 5.25%-5.50%, maintaining a 23-year high, amidst speculation about potential rate cuts, showcasing a cautious stance in response to ongoing economic challenges and inflationary pressures.

Apple’s quarterly results and forecast surpassed expectations, with a groundbreaking $110 billion share buyback program boosting investor enthusiasm, despite a moderate revenue dip, reflecting confidence in its strategic moves and future growth prospects amidst challenges and market dynamics.

The FTC approves Exxon Mobil’s acquisition of Pioneer Natural Resources, barring former CEO Scott Sheffield amid allegations of colluding with OPEC, sparking industry criticism and raising concerns about the balance of power in the energy sector.

Amid speculation surrounding Warren Buffett’s succession, attention turns to Greg Abel as Berkshire Hathaway’s anticipated successor, with recent remarks from directors highlighting his strategic vision and preparedness for navigating the conglomerate’s future.

Former Binance CEO Changpeng Zhao has been sentenced to four months in prison for money laundering violations, signaling a significant milestone in cryptocurrency regulation and accountability efforts.

Pension funds, typically conservative investors, are increasingly venturing into cryptocurrencies, prompted by recent Spot Bitcoin ETF approvals, as indicated by Fidelity’s research in the midst of a notable financial shift.

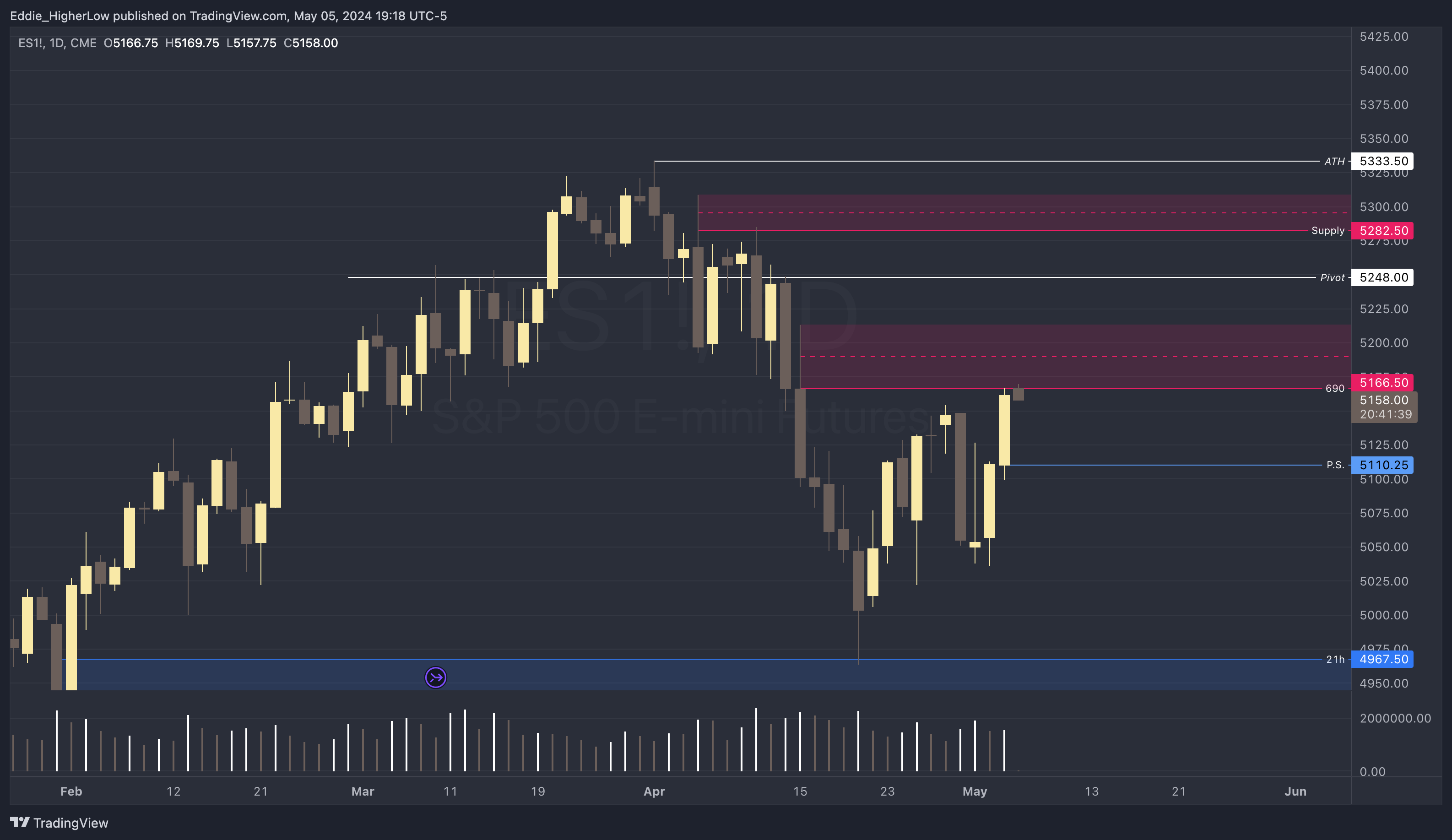

S&P Outlook

Bear Case: Bears are currently facing a critical test as the price reaches a significant supply area starting at 5166.50. This level is pivotal for bears looking to maintain downward pressure. For a continued bearish trend, it’s essential that they push the price below the 5035 mark, solidifying their control and potentially initiating a stronger downward movement.

Bull Case: Bulls have managed to keep the price stable above 5122, yet they now encounter a challenging supply zone. Should the price experience a retracement, the 5110.25 level is seen as a potential support area that could bolster the bullish stance. To effectively overcome the current resistance and drive further gains, bulls must strive to break above 5213.25.

EARNINGS RELEASE CALENDAR

FOR WEEK OF MAY 6th

Economic Data Calendar