WEEKLY MARKET OUTLOOK

FOR THE WEEK OF MAY 29, 2023

Welcome to the Traderverse Weekly Newsletter! We are thrilled to welcome you to our trading community!

Each week, we provide you with the most up-to-date stock, crypto, & real estate information and charts, so you can stay informed and optimize your trading decisions. Thank you for joining us!

Happy trading!

Important Prices

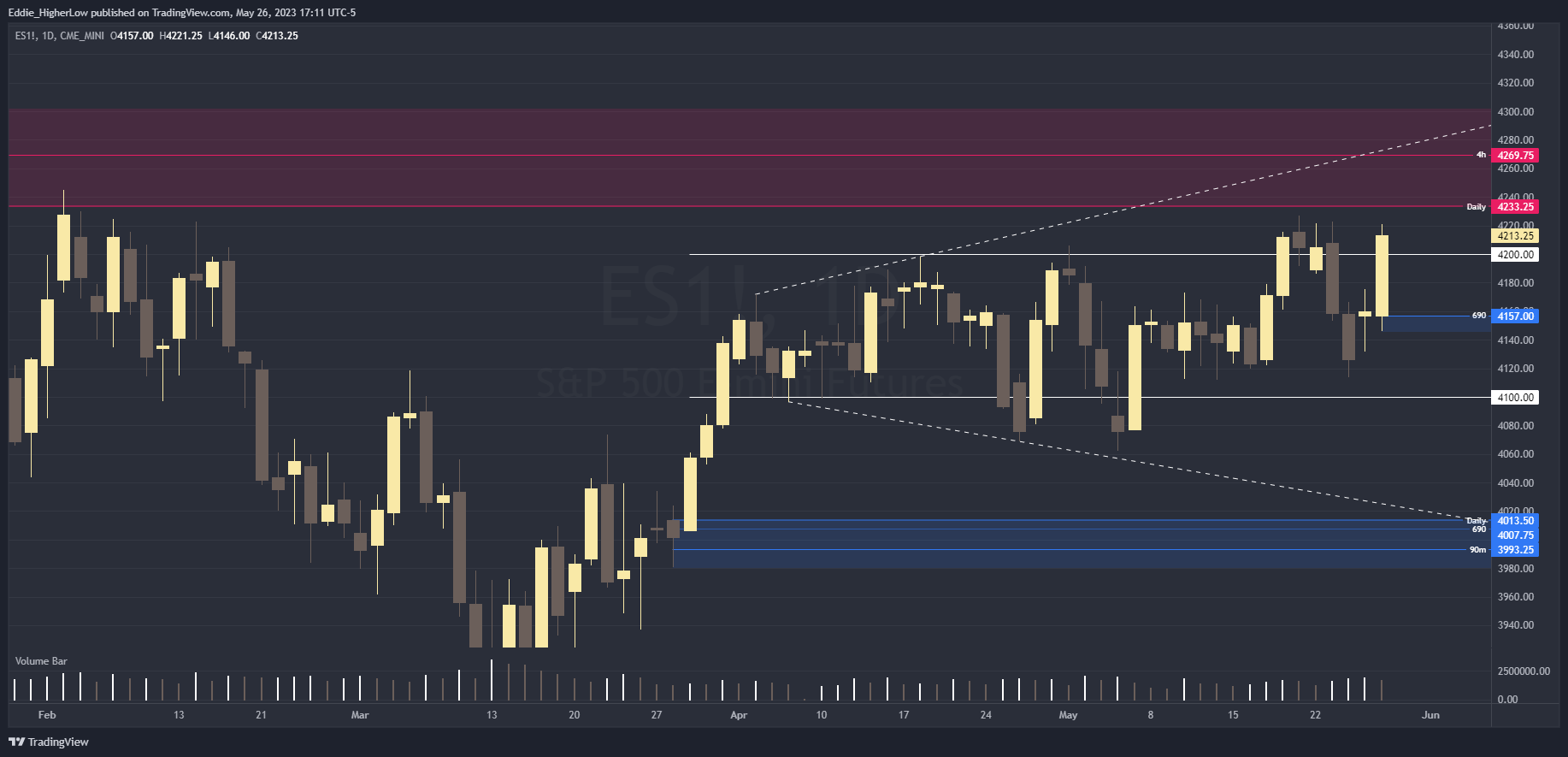

S&P Outlook

Bull Case: Bulls will want to continue holding 4200 but if price breaks below, there is a possible 690 minute Demand at 4157 which is within the range where price traded for 7 days which could act as support.

Bear Case: Possible supply just above at 4233.25 which has been tested so might not be as strong but there is a 4 hour consolidation within this supply that starts at 4269.75. This supply also lines up with the upper trend line where bears will want to defend.

What’s Moving The Markets?

Incoming AI Regulation

As the competition to create more powerful Artificial Intelligence services such as ChatGPT intensifies, some regulators are having to rely on existing laws to monitor a technology that could drastically alter the way organizations and societies function. The European Union is leading the charge in creating new regulations regarding AI that could be used as a worldwide standard for dealing with the privacy and security worries brought about by the swift progress of generative AI technology. Regulators are attempting to utilize existing regulations relating to everything from copyright and data privacy in order to regulate the data fed into AI models and the content these models produce. The EU AI Act will force companies to disclose any copyrighted material used to train their models and regulate government and financial institutions that may be using AI as a tool. This regulation set by the EU could be a springboard for more regulation to come in an industry that has become a hot topic worldwide.

US Debt Deal Race

Joe Biden and top congressional Republican Kevin McCarthy are closing in on a deal that would raise the government’s $31.4 trillion debt ceiling for two years while capping spending on most items. The final deal would specify the total amount the government could spend on discretionary programs like housing and education, but not break that down into individual categories. The two sides are just $70 billion apart on a total figure that would be well over $1 trillion. It is unclear precisely how much time Congress has left to act before the US defaults on its debt, however the Treasury Department was warned that it could be unable to cover all its obligations as soon as June 1, leading to distress across the financial markets.

Nvidia Crushes Earnings

Last Thursday, shares of Nvidia jumped over 25%, one of the largest one day value increases in a US stock, due to its optimistic revenue forecast. This strong showing indicated that Wall Street has yet to acknowledge the immense impact that AI could have on the company’s future. The results bode well for Big Tech companies, which have shifted focus to AI on hopes the technology would help attract demand at a time their money-makers of digital advertising and cloud computing are under pressure from a weak economy. Many are beginning to believe that we are really just seeing the tip of the iceberg when it comes to AI thus far and that this really could be another inflection point in technological history.

The New BRICS Dollar

China and Russia are speeding up their “cutting-edge” payment infrastructure technology to settle international trade with the new BRICS currency, looking to ramp up the payment system before the next BRICS summit in August. The new and yet-to-be-launched payment system will integrate the upcoming BRICS currency to settle cross-border transactions as the two nations continue their efforts to dethrone the US dollar from the global reserve status, where it has been for almost a century. A new BRICS currency could wreak havoc on the US dollar and affect a handful of financial sectors in America, especially oil, banking, and tech. All eyes are on the August summit where the fate of the US dollar will be put to the test.

Crypto Regulation Claims Another Victim

Unbanked, a crypto fintech firm specializing in crypto custody and payments services, has decided to close its operations, citing a harsh regulatory environment for cryptocurrencies in the United States. The founders explained that while other crypto companies thrived by operating offshore and evading strict regulations, Unbanked took a different approach by engaging with regulators and adhering to their complex processes to position themselves favorably in the market, resulting in substantial time wasted and excessive costs. Unbanked’s closure comes despite the firm’s recent successful partnerships with major companies, including a collaboration with Mastercard. Unbanked is just another name taken as companies continue to grapple with regulation in the US.

How A Default Of US Debt Could Affect Crypto

A US debt default would have enormous implications for the crypto market. While Bitcoin has become a safe-haven asset during the current banking crisis, it’s unknown that a debt default would have the same outcome. According to some crypto banks and analysts, a US debt default would make a “long Bitcoin, short Ethereum” strategy optimal, given Bitcoin’s much greater adoption as a form of payment and a store of value. At the end of the day nobody would really benefit from a debt default. Following extensive political maneuvering and late-night talks in Washington D.C., the most probable outcome in this scenario will be Congressional leaders reaching an agreement for raising the debt ceiling, thus enabling expenditure to persist until the next year.

EARNINGS RELEASE CALENDAR

FOR WEEK OF MAY 29th

Expert Insights & Predictions

Keeping with my philosophy of investing in stocks that have “low downside risk” and good upside, I entered a position in $YEXT at $7.75 recently. Last closed at $8.72. They are an “AI-ish” company and do Large Language Models (LLM) and conversational AI. They also boast some very large clients and have been in business since 2006. They have a $1B market cap and $400M of annual revenue. They trade at a very reasonable valuation for a tech company and are also very close to profitability. Their stock is up 33% ytd. Stock is in a Stage 2 uptrend and trading above all its moving averages. In my opinion, this is the perfect stock for me to be in, especially in this recent “AI” craze.

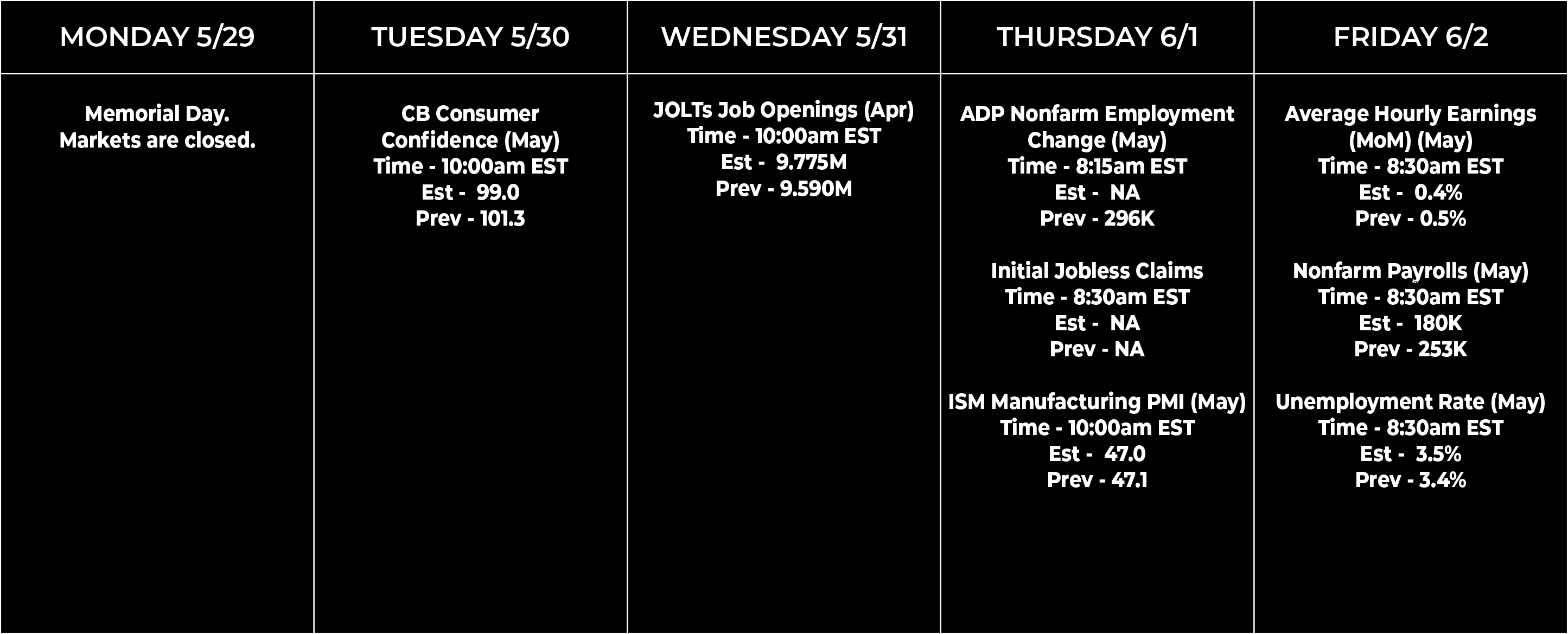

Economic Data Calendar