WEEK OF MAY 27, 2024

Welcome to the Traderverse Weekly Newsletter!

Traderverse Updates

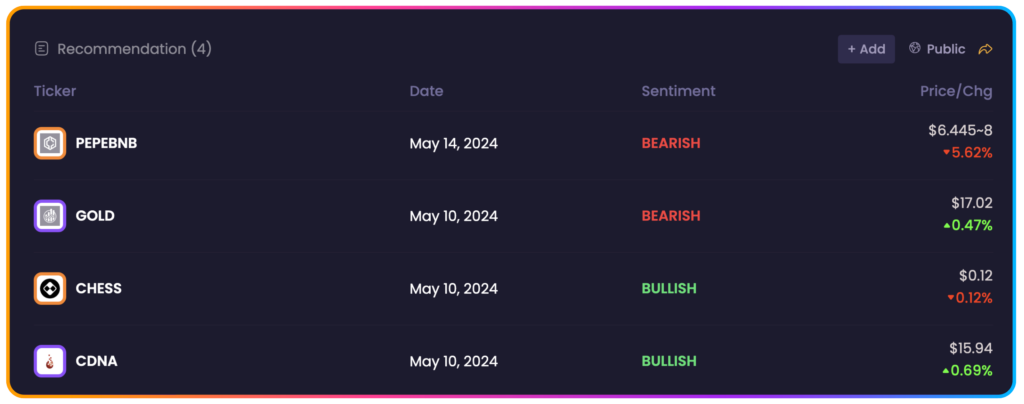

Welcome to our newsletter series, where we unveil updates and features as we gear up for our upcoming launch! This week, we’re excited to spotlight another powerful feature of Traderverse: Recommendations.

Exploring Recommendations:

The Recommendations section is a standout feature that allows you to express your market outlook. Whether you’re bullish or bearish on an asset, you can share your insights with the Traderverse community.

Market Sentiment:

At Traderverse, we understand that having a pulse on market sentiment is crucial. Our Recommendations feature enables you to see how other traders view various assets, providing a broader perspective on market movements.

Personalized Insights:

With Traderverse, you can make informed decisions based on the collective sentiment of the community. Whether you’re gauging the mood on stocks, commodities, or cryptocurrencies, our platform offers valuable insights tailored to your trading style.

Engagement and Discussion:

The Recommendations section isn’t just about sharing opinions; it’s about fostering discussion. Connect with other traders who share your views or challenge your perspective, creating a dynamic environment for learning and growth.

Thank you for your continued support and enthusiasm. Together, we're revolutionizing the way traders share insights and make decisions.

Important Prices

What’s Moving The Markets?

Nvidia (NVDA) impressed investors with a forecasted revenue above estimates and a ten-for-one stock split, causing its shares to surge past $1,000, marking a record high and a significant increase in market value driven by strong AI optimism and robust financial performance.

Apple (AAPL) has launched a significant discount campaign on its official Tmall site in China, offering up to 2,300 yuan ($318) off select iPhone models to counter increasing competition from local rivals like Huawei.

Microsoft’s (MSFT) agreement with UAE-backed AI firm G42, involving the potential transfer of advanced AI components, has raised national security concerns among U.S. lawmakers, prompting calls for stricter export regulations to safeguard against misuse, particularly by Chinese entities.

Rising sea levels threaten global oil infrastructure, especially in Asia, potentially disrupting crude oil shipments and energy security for import-dependent countries like China, South Korea, and Japan, as highlighted by the China Water Risk think tank and the IPCC.

Global venture capital investment in crypto companies surged to $2.4 billion in Q1 2024, signaling a tentative return of investor confidence after seven consecutive quarters of decline, largely influenced by renewed optimism, regulatory support, and Bitcoin’s rebound.

The U.S. SEC has approved the issuance of Spot Ethereum ETFs, marking a significant shift in accessibility for institutional investors and signaling a change in the regulatory stance on cryptocurrencies following the earlier approval of Spot Bitcoin ETFs.

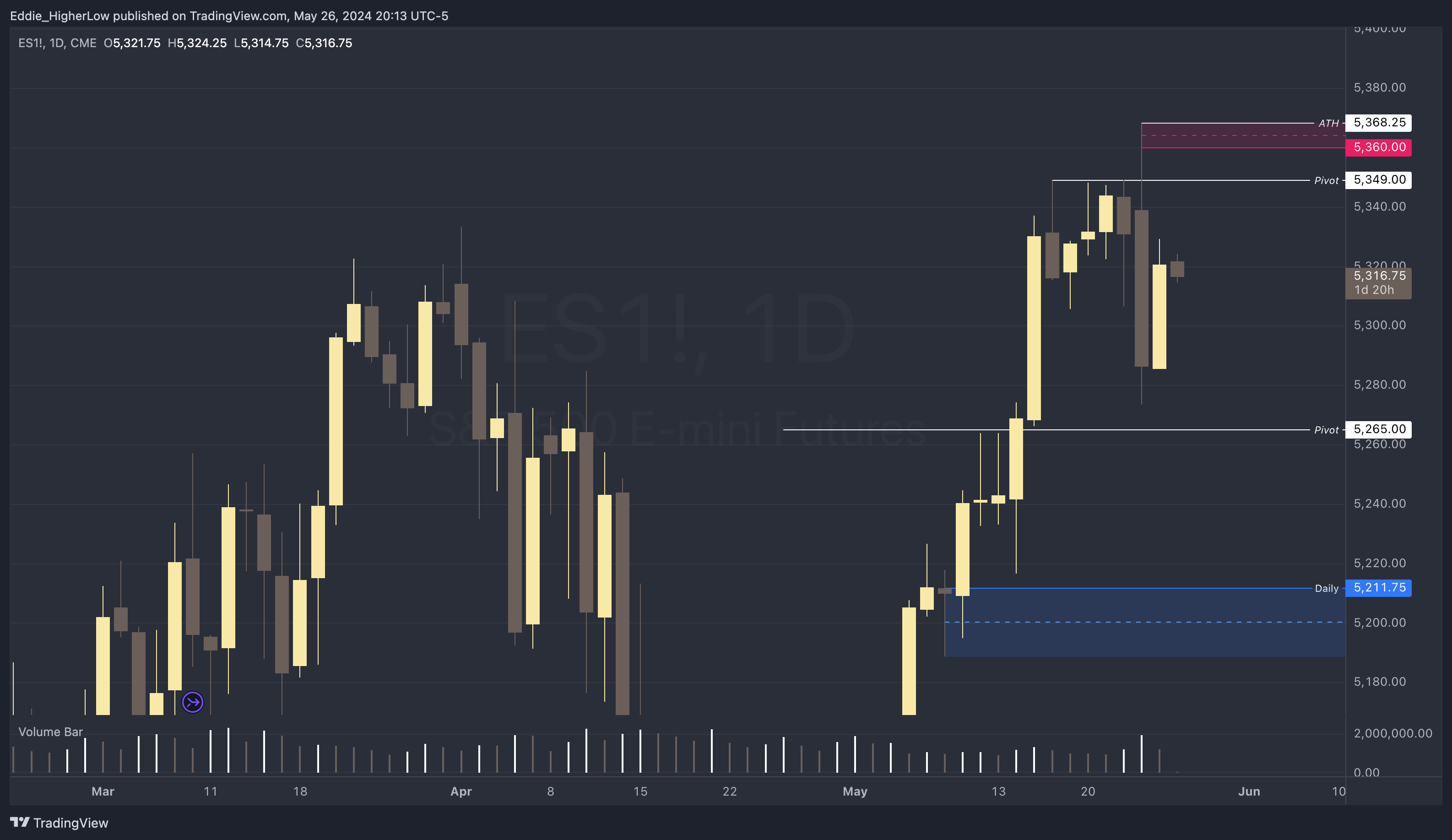

S&P Outlook

Bear Case: The primary objective for bears is to ensure that the price remains below the 5349 pivot, aiming for further suppression beneath the 5265 level to consolidate control. Should the price break above 5349, bears might take advantage at the 5360 mark, a dense supply zone. This area is critical as it may prompt exits from trapped longs, offering an opportunity for bears to defend and potentially push the price back down.

Bull Case: Bulls are tasked with maintaining the price above the 5265 level and striving to breach and sustain above the 5349 pivot. Overcoming this barrier is crucial for further bullish momentum. If the price approaches the 5360 supply zone, it’s essential for bulls to defend the 5349 level during any retracement to ensure continued upward movement.

EARNINGS RELEASE CALENDAR

FOR WEEK OF MAY 27th

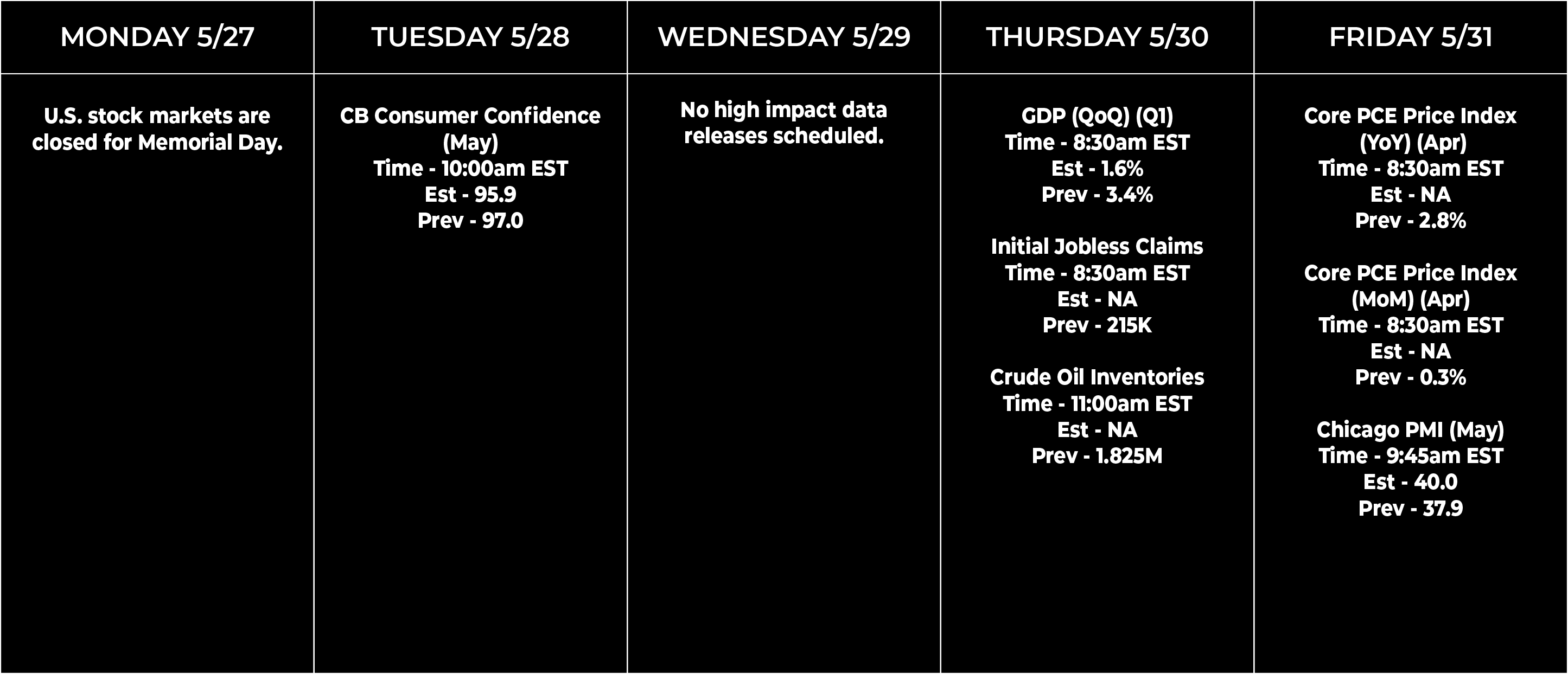

Economic Data Calendar