WEEKLY MARKET OUTLOOK

FOR THE WEEK OF MAY 15, 2023

Welcome to the Traderverse Weekly Newsletter! We are thrilled to welcome you to our trading community!

Each week, we provide you with the most up-to-date stock, crypto, & real estate information and charts, so you can stay informed and optimize your trading decisions. Thank you for joining us!

Happy trading!

Important Prices

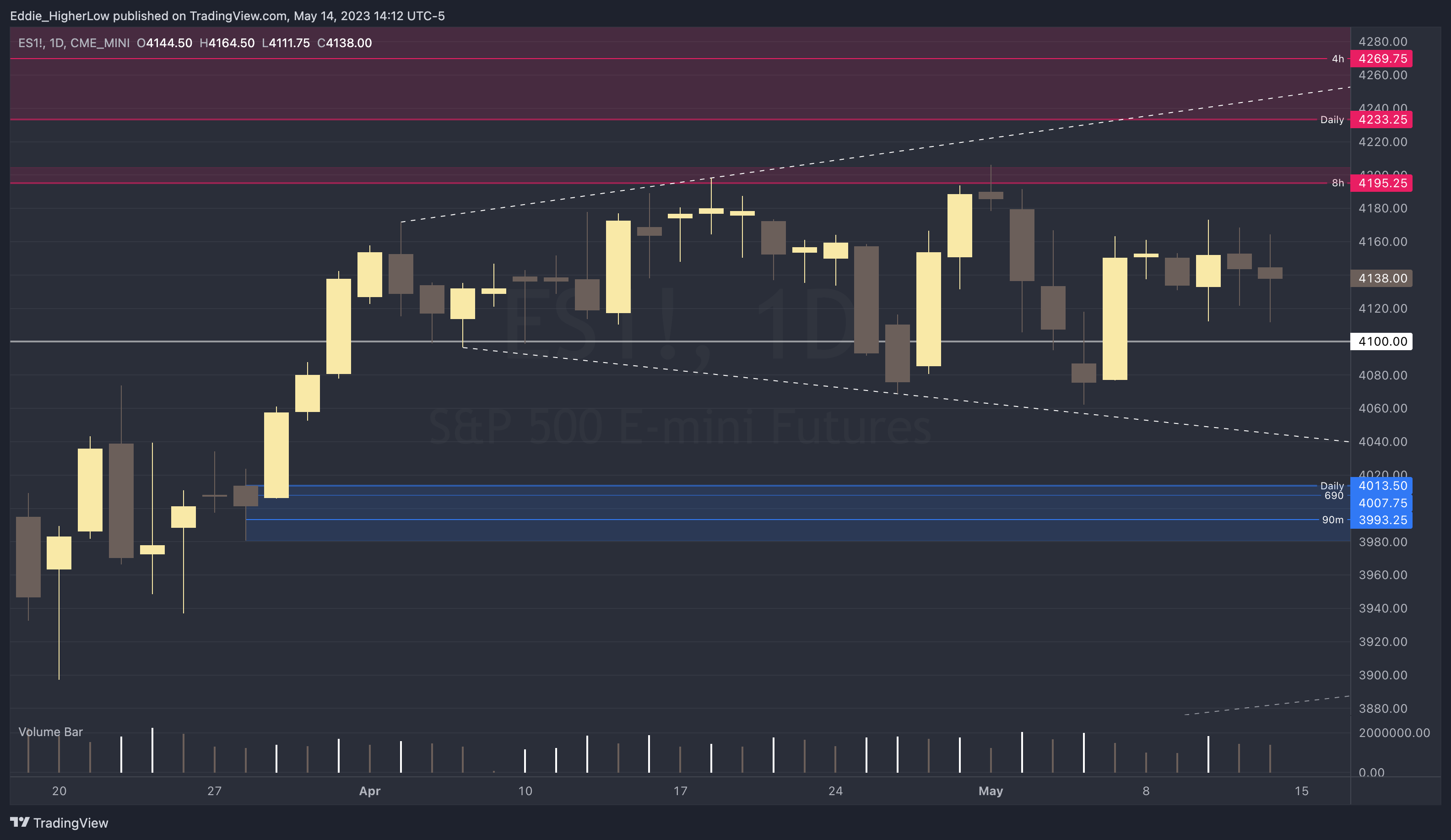

S&P Outlook

Bull Case: Bulls continue to defend the 4100 psychological level but still need to break above 4204.75 to invalidate supply above which starts at 4195.25. Price has consolidated once within that zone so I do not believe it will as strong on the second test but just above we have a Daily supply at 4233.25 and a tighter consolidation that starts at 4269.75

Bear Case: Bears need to break and hold price below 4100 to see any true continuation to the downside but If price does continue higher, I will keep an eye on 4244.75 which is a level that has rejected price twice and it also sits within the Daily supply.

What’s Moving The Markets?

Inflation Falls

US CPI data showed that inflation had fallen to 4.9%, down from 5% in March. This decrease was driven by increases in housing, fuel, used automobiles, and some of the food components. In its previous FOMC meeting, the Fed did not disclose if it will increase, decrease or pause interest rates. Fed Chair Jerome Powell stated that they are getting close to, or may even be done with rate hikes with the current inflation rate sitting at two times the FED’s 2% target inflation rate. This news may provide some positive price action in both the stock and crypto markets as investors have long predicted that a halt in rate hikes in an effort to reduce inflation would be followed by a series of rate cuts. Nonetheless, Powell indicated last week that if prices take time to drop, it might not be wise to lower rates.

BRICS To Launch Common Currency

The BRICS Alliance, a group of nations representing more than 40% of the world’s population, is set to discuss the potential launch of a common currency used for international trade during their annual summit on August 22nd as part of a wider effort to dethrone the US dollar’s domination of global trade. Potential expansion of the group is also expected to be discussed at the summit with more than 20 countries having already submitted membership requests to join the collective. As the idea of the US dollar being dethroned becomes a little bit more real, the shift to a common currency could lead to a power imbalance in the global economy, with BRICS countries having more global economic control.

Google Is Rolling Out More AI

Google is planning to roll out more artificial intelligence for its core search product, hoping to create some of the same consumer excitement generated by Microsoft’s update to rival search engine Bing. Last Wednesday, Google offered a new version of its engine. Called the “Search Generative Experience” that can craft responses to open-ended queries while retaining its recognizable list of links to the Web. Google is not only integrating generative AI into it’s search engine, but into other products such as Gmail, which can create draft messages, and Google Photos, which can make changes to images like centering figures and coloring in empty space. US consumers will gain access to the Search Generative Experience in the coming weeks via a wait list and a trial phase, during which Google will monitor the quality, speed and cost of search results.

Powerhouses Of Finance & Tech Forge A New Blockchain Network

A new blockchain network aimed at financial institutions is in the works from a conglomerate of participants in the finance and tech space, including the likes of Microsoft, Goldman Sachs, and Deloitte. The Canton Network will be a privacy-enabled interoperable blockchain network aimed at those working with institutional assets. It will allow the synchronization of financial markets that were “previously siloed.” The network will begin testing its capabilities in July, with the system set to feature “better privacy and controls than currently available.” This collaborative effort could be vital to ledger technology in the finance market with the collective working to link “disparate institution applications,” which could have a positive effect on the industry as a whole.

Florida & Texas vs CBDC

Florida Governor, Ron DeSantis, has officially banned Central Bank Digital Currencies (CBDCs) within the state. The legislation is set to protect Floridians from the arrival of a Federal Reserve-issued digital currency this summer in which he has been outspoken in his belief that the government-controlled digital currency would be “about surveillance and control.” Following in Florida’s footsteps, Texas introduced a bill last week to ban a CBDC in the state.The bill stated that the adoption of a CBDC “could lead to unprecedented levels of government surveillance and control over private cash holdings and transactions.” The regulation against a CBDC could prove to be good news to preexisting cryptocurrencies, such as bitcoin, as it would create more demand for an alternative store of value.

Bittrex Crypto Exchange Files For Bankruptcy

Early last week, crypto exchange Bittrex filed for chapter 11 bankruptcy, having an estimated $500 million to $1 billion in assets and liabilities according to a bankruptcy petition filed in Wilmington, Delaware. This comes just under a month after the SEC accused Bittrex of disregarding security rules over the course of multiple years, alleging that the exchange was operating an unregistered exchange, broker, and clearing agency. Several companies in the crypto industry have fallen into bankruptcy over the past year following a drop in asset prices, renewed regulatory scrutiny, and the fallout of once prominent crypto exchange FTX creating a feeling of uncertainty in the crypto sector.

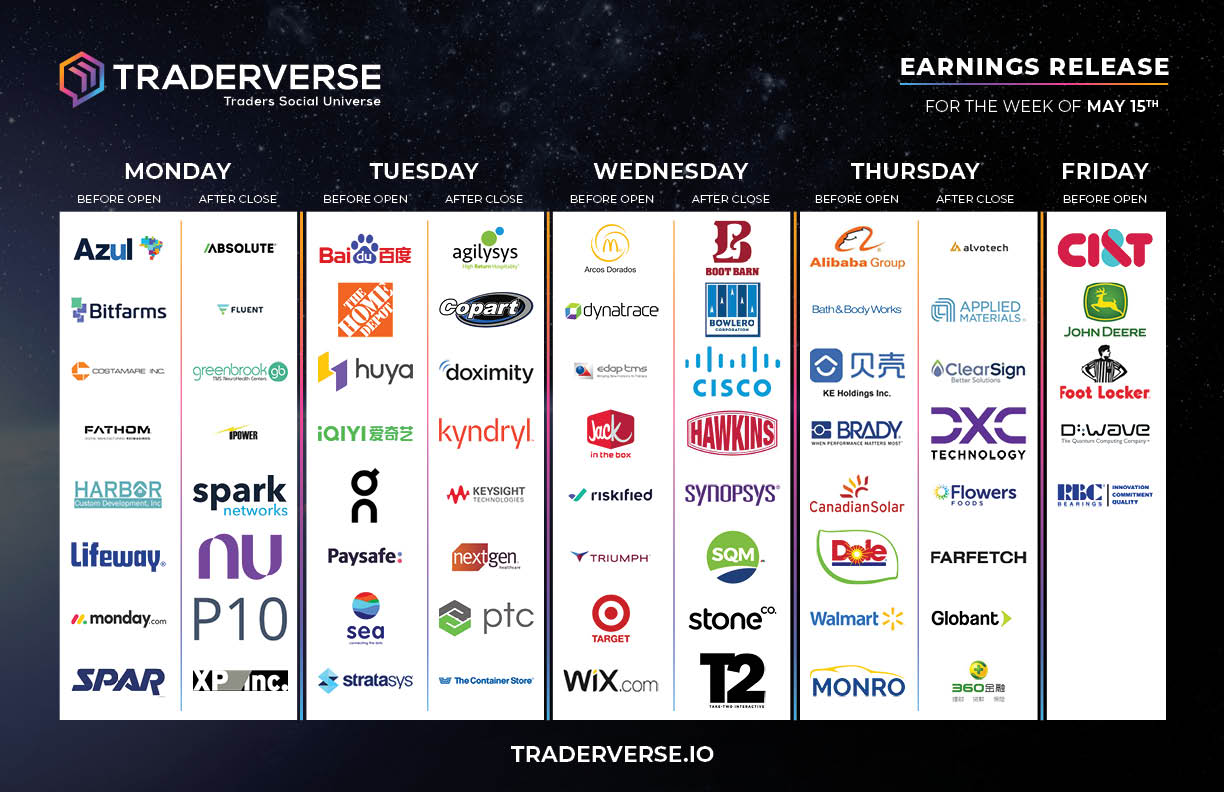

EARNINGS RELEASE CALENDAR

FOR WEEK OF MAY 15th

Expert Insights and Predictions

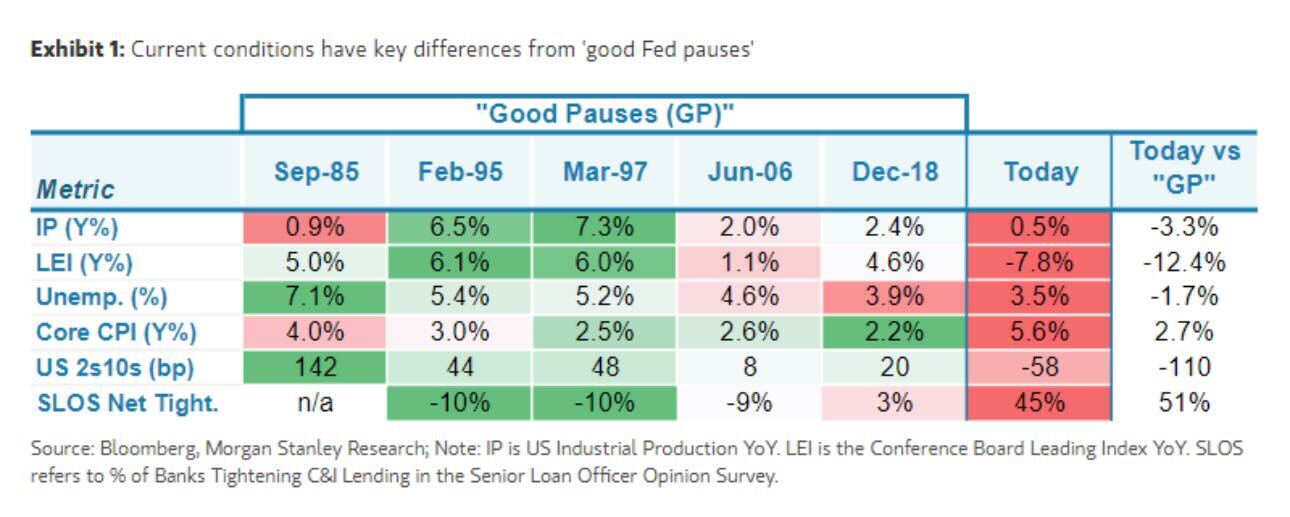

Why a fed pause isn’t good for stocks:

The US sees inflation decline for a 10th straight month, following a series of aggressive interest rate hikes. The Federal Reserve (Fed) may be considering a pause – no more rate hikes or cuts – until significant data changes. Historically, such a pause has been positive for stocks, but that’s only half the story.

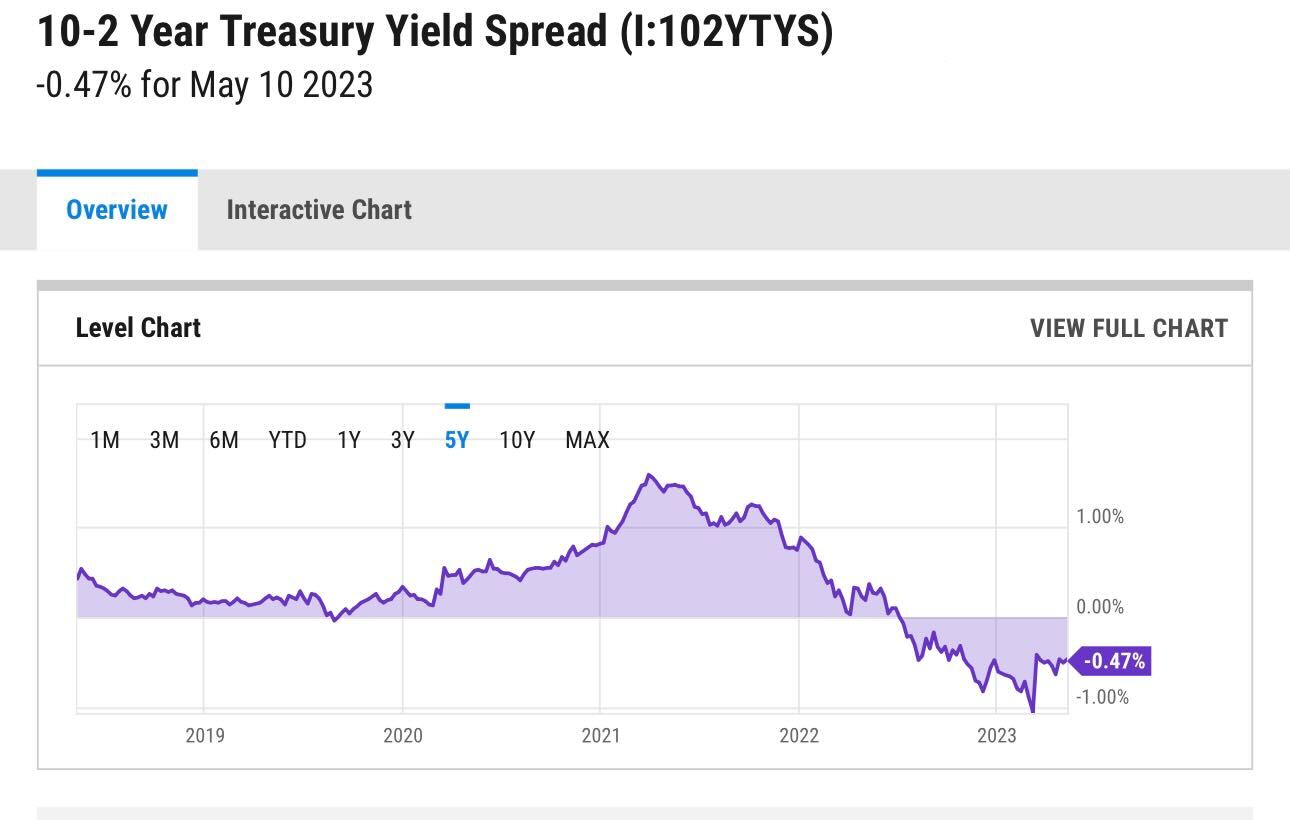

When the yield curve is inverted, as it is today, the feel-good effect for stocks dissipates. Coupled with a challenging macroeconomic landscape, the current situation looks starkly different from past periods of ‘good pauses’ (1985, 1995, 1997, 2006, 2018) where the economic indicators were more favourable.

Back then, industrial production was growing, leading indicators signaled robust growth, unemployment was high enough to curb inflation spikes, core CPI inflation was mild, the yield curve was upward sloping, & banks were easing lending standards.

Today: industrial production is stagnant, leading indicators have collapsed, there’s no buffer in unemployment, core inflation’s uncomfortably hot, the yield curve is sharply inverted, & banks are tightening their lending standards significantly.

What does this mean? Either this pause won’t be as ‘good’ for stocks as previous ones, or the Fed may not pause at all, instead being forced to cut interest rates to ward off a sharp recession.

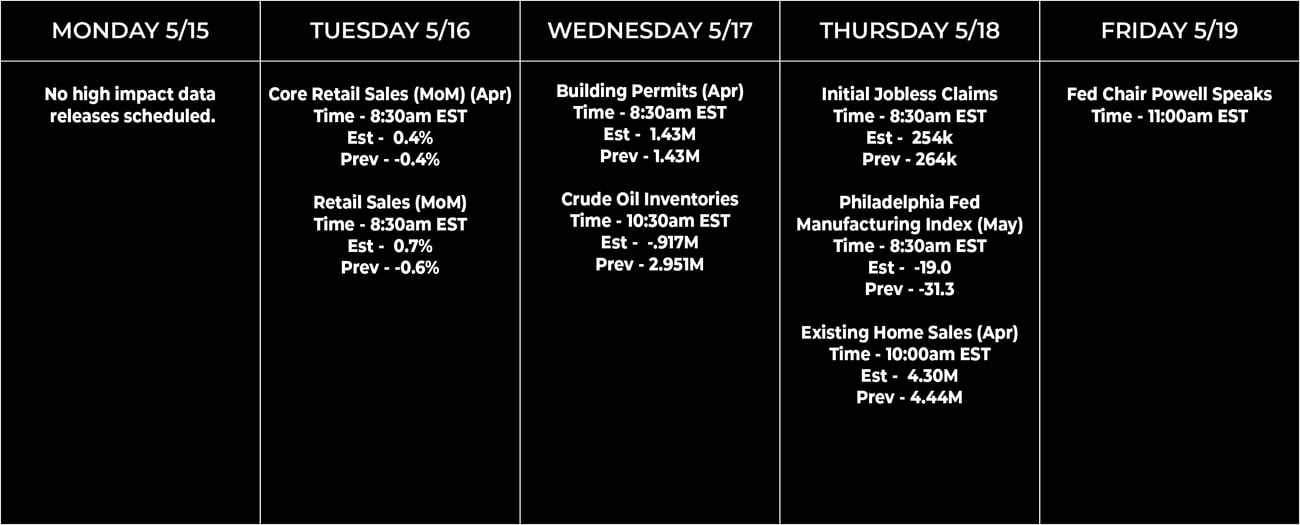

Economic Data Calendar