WEEKLY MARKET OUTLOOK

FOR THE WEEK OF MAY 1, 2023

Welcome to the Traderverse Weekly Newsletter! We are thrilled to welcome you to our trading community!

Each week, we provide you with the most up-to-date stock, crypto, & real estate information and charts, so you can stay informed and optimize your trading decisions. Thank you for joining us!

Happy trading!

Important Prices

S&P Outlook

Bull Case: Price is retesting Daily Demand at 4137.50 where bulls have been able to defend. Bulls would ideally want to continue defending current demand and 4100 the level. Below 4100, there is not strong demand until 4013.50. Resistance above still sits at 4195.25. Supply will be considered invalidated once price breaks above 4204 with the next strong supply at 4233.25.

Bear Case: Bears were able to defend 4195.25 (8 Hour supply) and will need to break below current the demand zone, ultimately breaking the 4100 level with 4013.50 as the possible target. Above this is 4195 supply, 4233.25 (Daily) then 4269.75 (untested 4 hour supply). Price has been consolidating within this range for the past 6 days so expect a big move once this range breaks.

What’s Moving The Markets?

This Week’s FOMC Expectations

At the last FOMC meeting in March, the Fed raised the target range for its benchmark interest rate by 25bps to a range of 4.75%-5.00%. The latest Fed dot plot suggests rates will continue to tick higher in 2023, but only slightly, with benchmark interest rates seen peaking at 5.1% this year. Investors believe there is now a 83.9% chance that the Fed will raise rates by 25bps at the Fed’s meeting on Wednesday with a target rate of 5.00%-5.25%. Many also believe that this will be the last interest-rate increase before the end of the year with a 70% chance of a rate pause at the FOMC meeting on June 14th and the Fed holding rates steady for the rest of the year. Expect markets to be volatile this week as the market attempts to anticipate the Fed’s next move.

First Republic Up For Grabs

The U.S. Federal Deposit Insurance Corporation (FDIC) is holding an auction for First Republic Bank where the highest bidder will take control of the institution and attempt to bring it back to a safe and sound condition. This process will likely include restructuring, selling off assets, or other measures. JPMorgan Chase and PNC Financial are among the big banks bidding on First Republic in a potential deal that would follow an FDIC seizure of the troubled regional bank. If there is a buyer for First Republic, the FDIC would likely be stuck with some money-losing assets, as was the case after it found buyers for the viable portions of SVB and Signature after it took control of those banks. A failure of First Republic will cement their name in history as the second largest bank failure, replacing Silicon Valley Bank which collapsed earlier this year.

Q1 GDP Lower Than Expected

U.S. economic activity grew at a slower pace than expected in Q1 2023, flashing further signs that the economy is slowing down as recession fears swirl and the Fed considers more interest rate increases. According to the latest data released by the Commerce Department on Thursday, Q1 GDP has risen by 1.1%, less than the expected growth of 1.9%. The numbers came in significantly cooler than the previous two quarters, which saw annualized growth at 2.9% and 3.2% respectively. The slowdown in growth came due to a decline in private inventory investment and a deceleration in nonresidential fixed investment. Many analysts and Investors still expect the economy to eventually tip into a recession, though the timing is uncertain.

More Nations Challenging The US Dollar

BRICS is an acronym for the powerful grouping of the world’s leading emerging market economies, namely Brazil, Russia, India, China and South Africa. It is no surprise that these countries are making significant strides in their effort to replace the US dollar as the global reserve currency and international currency for trade, with 19 nations having submitted membership requests ahead of their annual summit. China and Russia have already demonstrated their commitment to the cause, by executing a large portion of their trade in their respective local currencies, while Argentina has started to pay for Chinese imports in Chinese Yuan. This shift could lead to a power imbalance in the global economy, with BRICS countries having more economic control. This could open up new markets and opportunities for the members of the group, as well as new opportunities for global economic growth in foreign countries.

Venmo Offering Crypto Transfers

Paypal recently announced plans to roll out a feature that allows over 70 million Venmo users to transfer Bitcoin, Ethereum, Litecoin, and Bitcoin Cash to each other on the Venmo app, external wallets, and other crypto exchanges beginning in May 2023. Venmo introduced crypto on its platform about two years ago, in April 2021, allowing customers to buy and sell cryptocurrency directly in the Venmo app. After this they allowed credit card customers to use cash back earned on their card purchases to purchase crypto from their accounts automatically. Paypal’s CEO stated in 2022 that people would “start seeing some significant changes over the next five years” in the crypto community, noting that the company has further stated its intention to continue rolling out more crypto services and products in the coming year.

MasterCard’s Crypto Expansion Plan

Mastercard’s head of crypto and blockchain stated that the payment company intends to grow its cryptocurrency payment card program by looking for further collaborations with crypto businesses, citing the desire to give people access to crypto in a secure manner as the motivation behind Mastercard’s expansion plans. Mastercard has hundreds of existing international partners that supply crypto card programs and has worked with a number of cryptocurrency exchanges, including Binance, Nexo, and Gemini. Mastercard released that they have invested into many different crypto analytics technologies and claim to be “very excited about the underlying blockchain technology behind cryptocurrency”. The company anticipates an increase in cash flow this year despite the heightened regulations around cryptocurrencies as retail traders accumulate crypto at the fastest pace in history.

Crypto Framework In Hong Kong

Hong Kong’s desire to become a global crypto hub is finally coming to fruition with the Securities Futures Commission of the region reportedly rolling out cryptocurrency exchange licensing guidelines in May 2023. The upcoming regulations will assist cryptocurrency trading platforms that will be permitted to provide trading services to retail investors. With regulations in place, verified exchanges will be able to provide retail traders with access to trading in popular cryptocurrencies like Bitcoin and Ethereum, among others. Hong Kong’s government has taken a proactive approach to regulating digital assets, recognizing the potential of this new technology, and creating a supportive environment for blockchain-based businesses. This has positioned Hong Kong to be a hub for Web3 and virtual assets, allowing businesses to access the Asian market with confidence and certainty.

EARNINGS RELEASE CALENDAR

FOR WEEK OF MAY 1ST

Expert Insights and Predictions

This week will make or break the markets in my opinion, we haven’t been this range bound since 2017. I still believe this is a drawn out BMR, many higher timeframe technical and liquidity factors give me multiple points of confluence such as; a strong downtrend in positive money flow, strong bearish divergence, repeated failure to break the previous high of 4208 on 2/2/23, @dharmatrade SPX Fair Value formula incorporating the central banks of US, Japan, China, UK pointing to a significant divergence in price, and @ka1n0s DEDO Fed Liquidity formula which has top/bottom ticked the past 9 major moves.

Earnings for top companies such as $AAPL which make up 7.19% of the SP500 is a major factor along with top $SMH chip holdings such as $AMD, $QCOM. In order to confirm this BMR I would like to see relative weakness is $AAPL & $NVDA. If you look at the RRG you can see $SMH finally leaving Leading and has entered into Weakening.

However we have broken past the +1 Standard Deviation Channel(chop zone), positive money flow is pointing up with a gap to the daily Supply Zone as a potential scenario. A break of 4208 could push us further to 4260-4279 where I would expect a nasty rejection. It’s hard to say for certain but I would expect us to push higher into the week based purely off technicals. But with the amount of high impact economic news this week, all of that could completely invalidate the short term TA and finally send us lower depending on the data.

Bitcoin has struggled to break higher for the past 6 weeks at this crucial level. Its recent volatility I would attribute to the banking crisis of $SI $SVB $MCB $FRC. If people rushing to withdraw cash from banks with risk exposure and max bidding BTC couldn’t break the range, that’s even more confirmation for another leg down lower for me. Negative money flow is pointing down and there is a fair value gap down to 25.4k-25.5k which seems very likely. Also $COIN earnings this week along with their SEC debacle could be catastrophic and send us even lower depending on the outcome of both.

That’s not even factoring in how whales have been accumulating from 6/22-1/23 and are now selling heavily into retail buying pressure for the past 4 months.

As always, none of this is financial advice, just my analysis and perspective. – @_d3f4ult

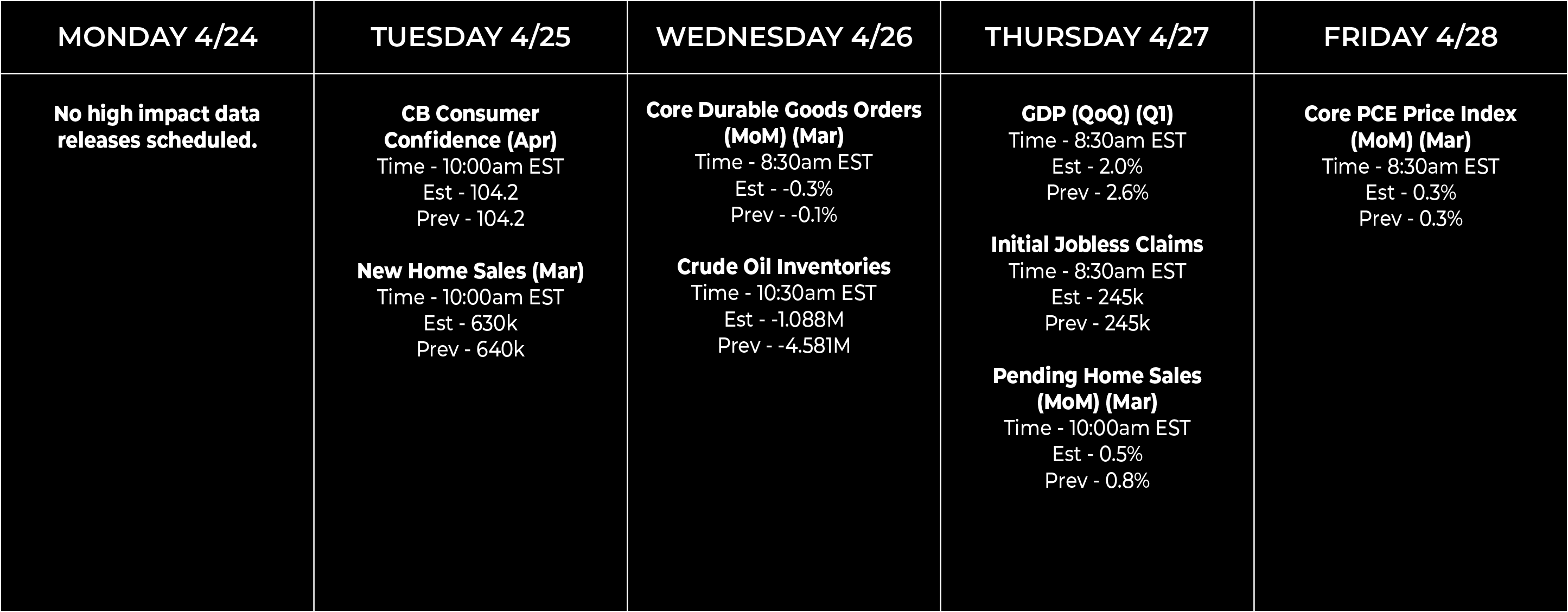

Economic Data Calendar