WEEKLY MARKET OUTLOOK

FOR THE WEEK OF APRIL 24, 2023

Welcome to the Traderverse Weekly Newsletter! We are thrilled to welcome you to our trading community!

Each week, we provide you with the most up-to-date stock, crypto, & real estate information and charts, so you can stay informed and optimize your trading decisions. Thank you for joining us!

Happy trading!

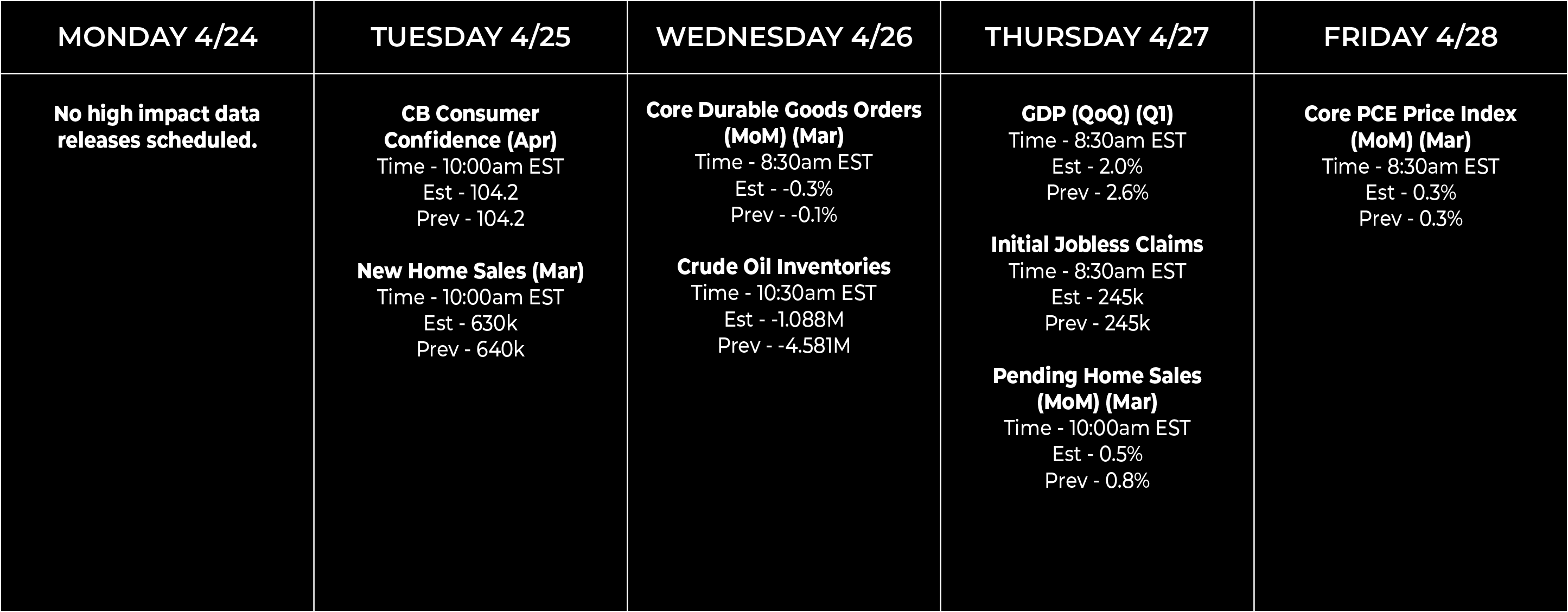

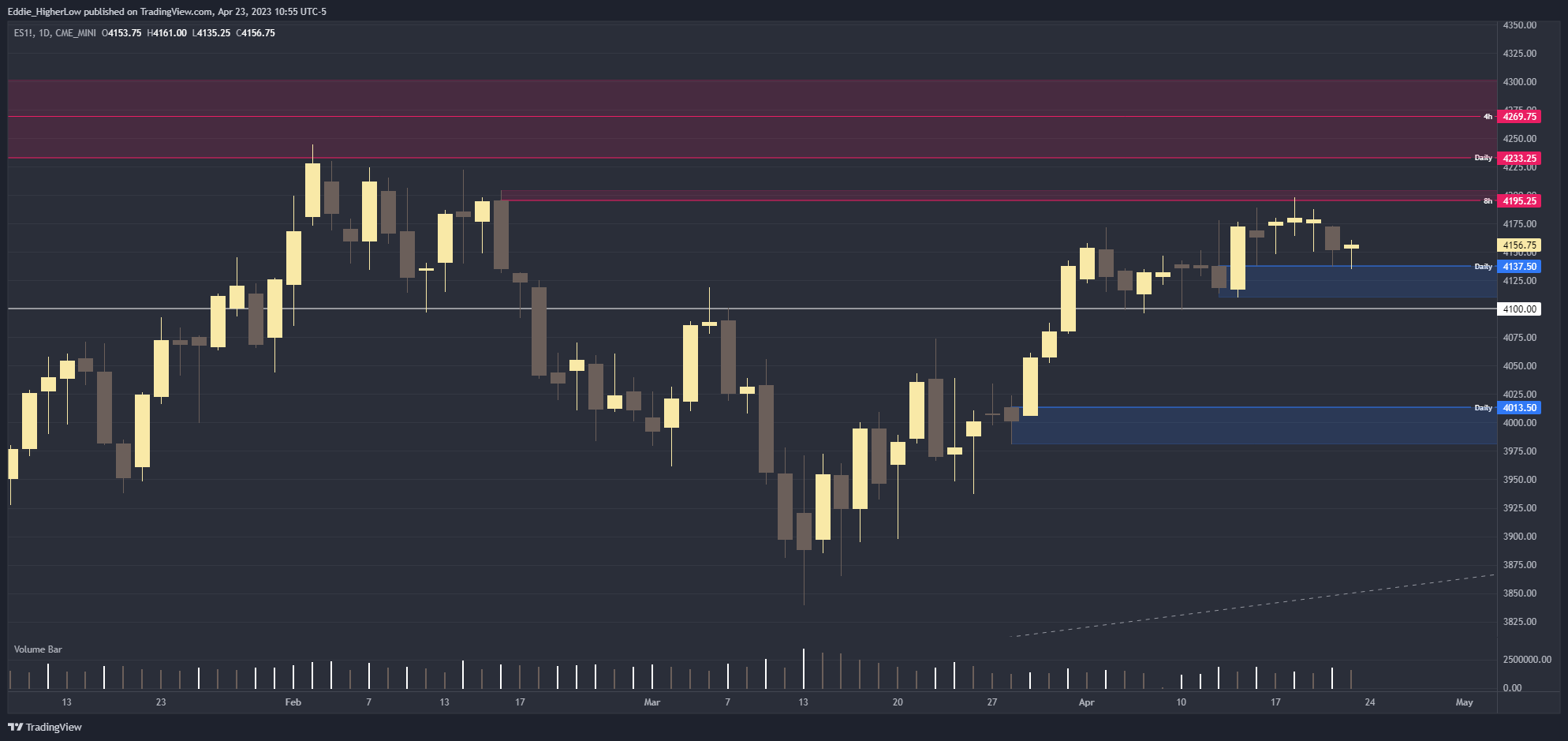

Important Prices

S&P Outlook

Bull Case: Price is retesting Daily Demand at 4137.50 where bulls have been able to defend. Bulls would ideally want to continue defending current demand and 4100 the level. Below 4100, there is not strong demand until 4013.50. Resistance above still sits at 4195.25. Supply will be considered invalidated once price breaks above 4204 with the next strong supply at 4233.25.

Bear Case: Bears were able to defend 4195.25 (8 Hour supply) and will need to break below current the demand zone, ultimately breaking the 4100 level with 4013.50 as the possible target. Above this is 4195 supply, 4233.25 (Daily) then 4269.75 (untested 4 hour supply). Price has been consolidating within this range for the past 6 days so expect a big move once this range breaks.

What’s Moving The Markets?

Busy Earnings Week For Big Tech

Another busy earnings week for big tech, big pharma, and major energy players is among us. Alphabet, Microsoft, Meta, Amazon, PepsiCo, Eli Lilly, Merck, and Exxon are all among some of the big names set to release their earnings this week. The coming reports will provide clues to investors about how companies fared in the first quarter of 2023 as the recent banking crisis, continuing layoffs in sectors such as technology, and inflation weighed on the economy. The quarterly updates come as Fed officials signal that they could raise interest rates at their next meeting in early May to combat stubbornly high inflation and tight labor markets, despite a greater likelihood of recession later this year.

Demand For Microchips Decreases

Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s largest contract chip manufacturer, reported weak Q1 earnings showing a 5% decline in revenue compared to the same period last year and a 16% decline quarter-over-quarter. The chip industry is facing an abundant supply of chips, with companies needing 132 days to turn over inventory compared to a historical average of 85. Consumer demand for gadgets is soft, with global smartphone and PC shipments dropping 12% and 29% respectively in Q1. Although China’s reopening has helped, it is not enough to offset the headwinds, which are expected to continue. This drop in demand confirms a grim outlook for the semiconductor industry in the near future.

Chile Plans To Nationalize Lithium

Last Thursday, Chile’s President said he would nationalize the country’s lithium industry to boost its economy and protect its environment. Chile is currently the world’s second largest producer of the metal which is essential in electric vehicle (EV) batteries. This poses a fresh challenge to EV manufacturers who are now scrambling to secure battery materials, as more countries look to protect their natural resources. Future lithium contracts from Chile would only be issued as public-private partnerships with state control and is likely to spur a shift in future investment in lithium to other countries including Australia, the world’s biggest producer.

Bitcoin Outperforms Traditional Assets in Q1

Bitcoin’s value increased from just under $17,000 on December 31 2022, to over $28,000 on March 31 2023, making it the asset that had the greatest ROI during the first three months of 2023. The revival of the cryptocurrency asset can be attributed to “increased volatility from the banking crisis” and to the decision made by Binance to stop a portion of its zero-fee incentive plan for bitcoin transactions. Bitcoin increased by 72.4% quarter over quarter (QoQ), with the Nasdaq index and gold coming in second and third place among the most outstanding performers, increasing 15.7% and 8.4% respectively.

Crypto Pulls Back

In the past five days, Bitcoin is down nearly 10% and Ethereum has dropped more than 12%. The cause of the market downturn is likely linked to a combination of factors. On one hand, investors may be reacting to reports of simmering inflation, which has caused some to move funds away from riskier assets like cryptocurrencies. On the other hand, investors may also be pricing in the possibility of a recession, which would likely cause a global economic slowdown and further weigh on the crypto markets. The situation is further complicated by the fact that tech giants are due to report earnings over the span of this week, which could have a significant impact on the stock market and, in turn, the crypto markets. It remains to be seen whether the market will continue to decline or if the current weakness is a temporary pullback before seeing higher highs.

Bankrupt FTX Could Be Revived

Tribe Capital, a venture firm that previously invested in FTX, is reportedly considering a new capital injection of $250 million to help resurrect the crypto exchange, which filed for bankruptcy back in November 2022. The company is still in the early stages of evaluating the idea of a restart and this idea would require a significant cash infusion, potentially from more third-party investors. FTX’s new CEO, is expected to decide in Q2 whether a restart is feasible with considerable regulatory and compliance obstacles. FTX’s exchange token (FTT) experienced a 17% increase in response to the news of Tribe Capital’s potential involvement in the exchange’s revival.

EARNINGS RELEASE CALENDAR

FOR WEEK OF APRIL 24th

Expert Insights and Predictions

“Over the past month and a half bitcoin went on an impressive rally, breaking the $31,000 mark, up over 50% since its low of around $19,500 on March 10th. Since then we have seen a pullback of about 10% back down to $27,500 levels.

Back in November of 2021, the US government seized 50,676 BTC ($1.12 billion) from Silk Road exploiter James Zhong. On March 14, a court filing showed that the government sold 9,861.17 of their seized bitcoin for almost $216 million, explaining the pullback we saw in March. The filing also showed that the government intends to liquidate the remaining 41,490 bitcoins in four tranches over the course of this calendar year.

My suspicion is that the government has once again been selling and will continue to sell more of their seized bitcoin which they will announce sometime in Q2. If one thing is certain it is that the government is a bunch of paper handed retail traders that are at best, terrible at trading. I believe that each time they sell, it will become a generational bottom and this will only result in a push higher for bitcoin in the near future. My advice would be to stay steady as this is merely a little bit of bullish selling.”

Economic Data Calendar