WEEK OF APRIL 22, 2024

Welcome to the Traderverse Weekly Newsletter!

Traderverse Updates

Welcome to our newsletter series, where we unveil updates and features as we gear up for our upcoming launch! This week, we’re diving into one of the most powerful features of Traderverse: Portfolios.

Exploring Portfolios:

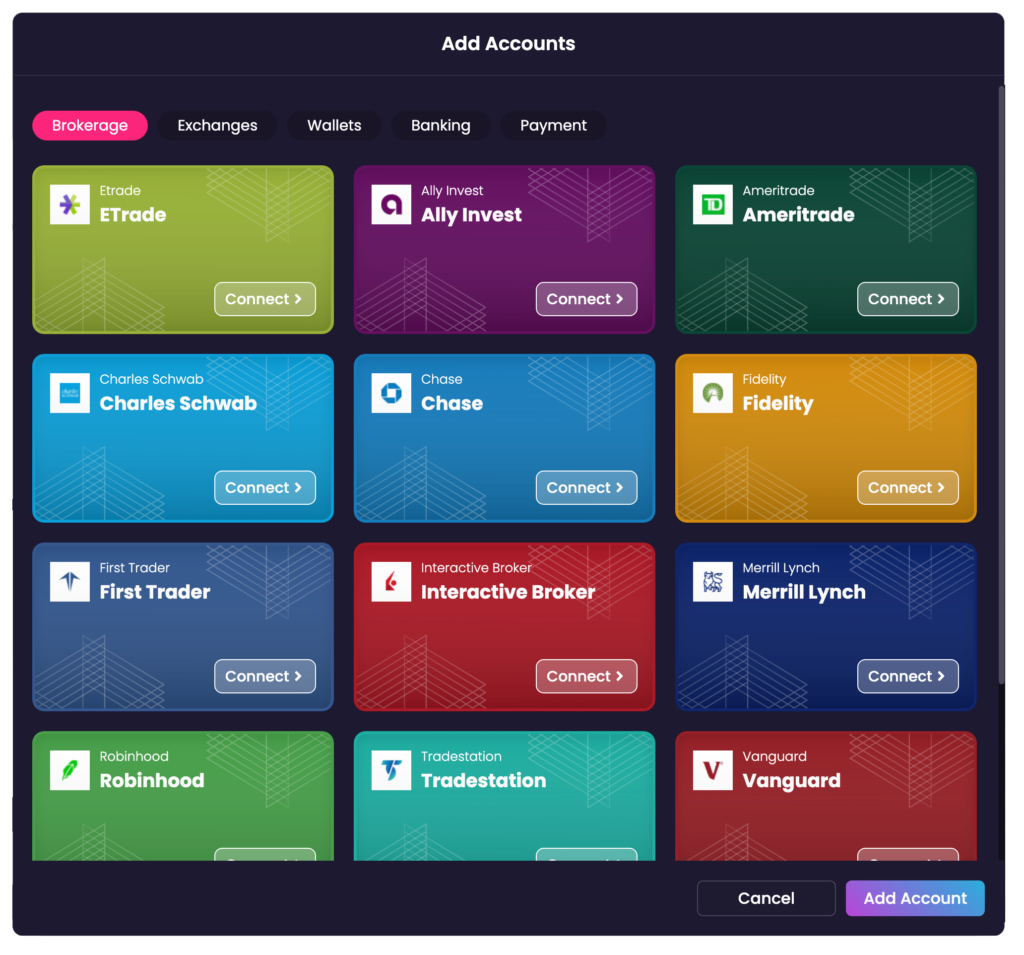

Portfolios integration is what makes Traderverse truly stand out. By linking your account to over 20 brokerages and wallets, you’ll have the ability to view your entire portfolio in one centralized place.

Verified Trade Data:

At Traderverse, we understand that credibility is key. That’s why we ensure that all trade data is verified, providing you with accurate insights into your portfolio’s performance.

Privacy Controls:

We also recognize the importance of privacy. With Traderverse, you have full control over what information you choose to display. Whether you want to show or hide specific details, the choice is yours.

Thank you for your continued support and enthusiasm. Together, we're revolutionizing the way traders manage their portfolios.

Important Prices

What’s Moving The Markets?

Google announced that they are strategically laying off employees, offering internal transfers, and focusing on investment hubs like India and Dublin amidst industry-wide job cuts, all while maintaining commitments to AI and other emerging technologies.

Netflix shifts focus from reporting quarterly subscriber numbers to prioritizing revenue and operating margins, aiming for sustainable growth amidst industry uncertainties and investor concerns.

Meta claims that their Llama 3 AI revolutionizes open-source large language models with enhanced capabilities, widespread availability across major platforms, a commitment to responsible usage through trust and safety tools, and a promise of ongoing innovation, setting a new standard in the field.

TSMC anticipates a significant sales surge in the second quarter, driven by soaring demand for AI processors, highlighting its pivotal role in catering to AI innovators and solidifying its position as a global semiconductor leader poised for substantial growth.

Apple complies with Chinese government order, removing foreign messaging apps from its China App Store amid national security concerns, highlighting challenges for multinational tech companies in navigating regulatory complexities.

Binance FZE secures a Virtual Asset Service Provider (VASP) license in Dubai, expanding its offerings while adhering to regulatory standards, amidst reports of potential return to the Indian market and the introduction of the Megadrop platform.

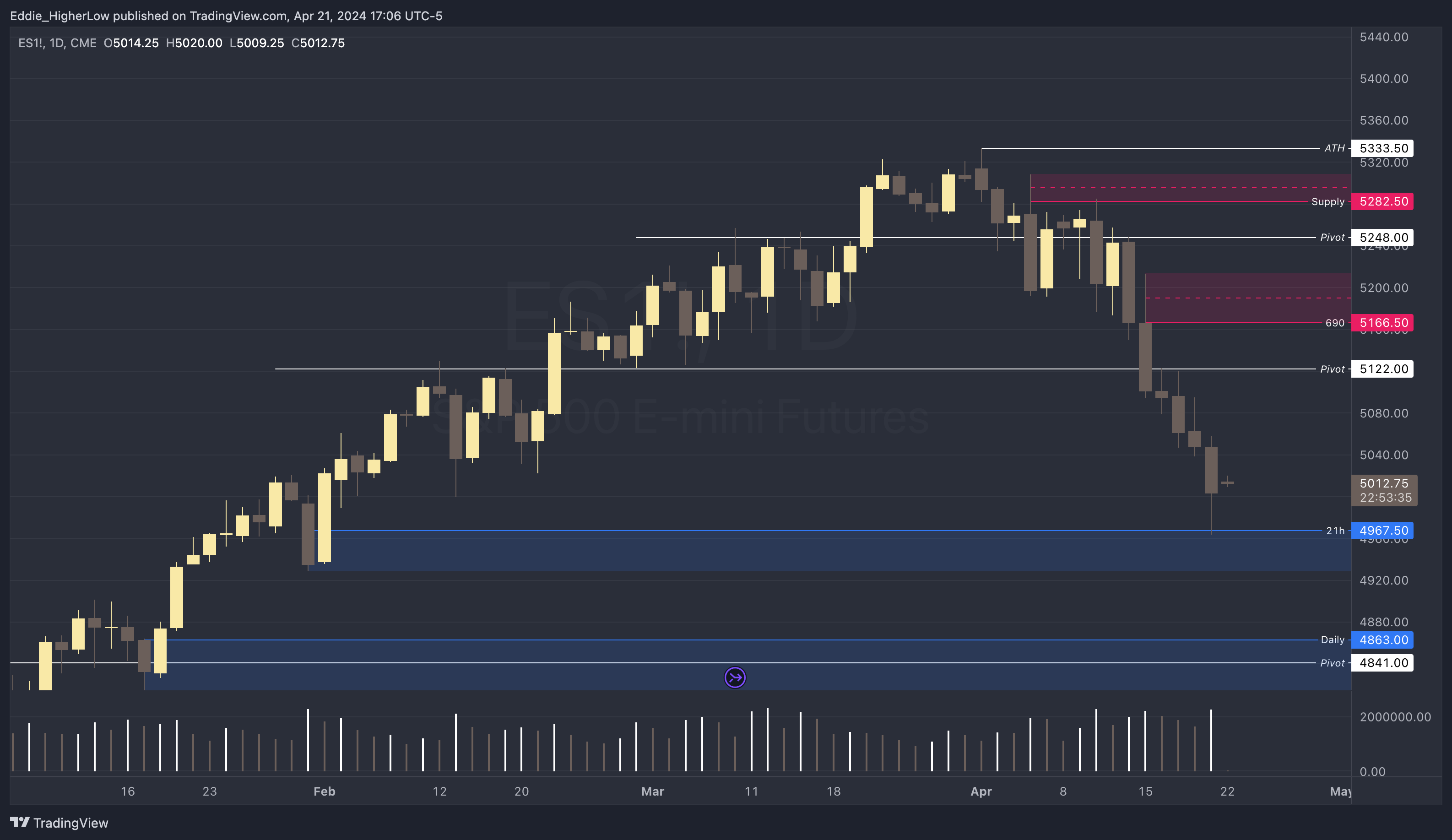

S&P Outlook

Bear Case: Bears have effectively managed to drive the price below critical pivot levels in recent weeks. Their current objective is to sustain this downward pressure by keeping the price firmly below the 5122 pivot. This continued control is crucial for further validating the bearish momentum in the market.

Bull Case: Bulls are focusing their efforts on a recently tested demand zone, aiming to maintain support and eventually push above the 5122 level. Breaking this pivot is vital for initiating an upward move, with the next significant resistance anticipated at 5166.50. However, if the price falls below 4929, bulls face a challenging situation with minimal support until the 4863.

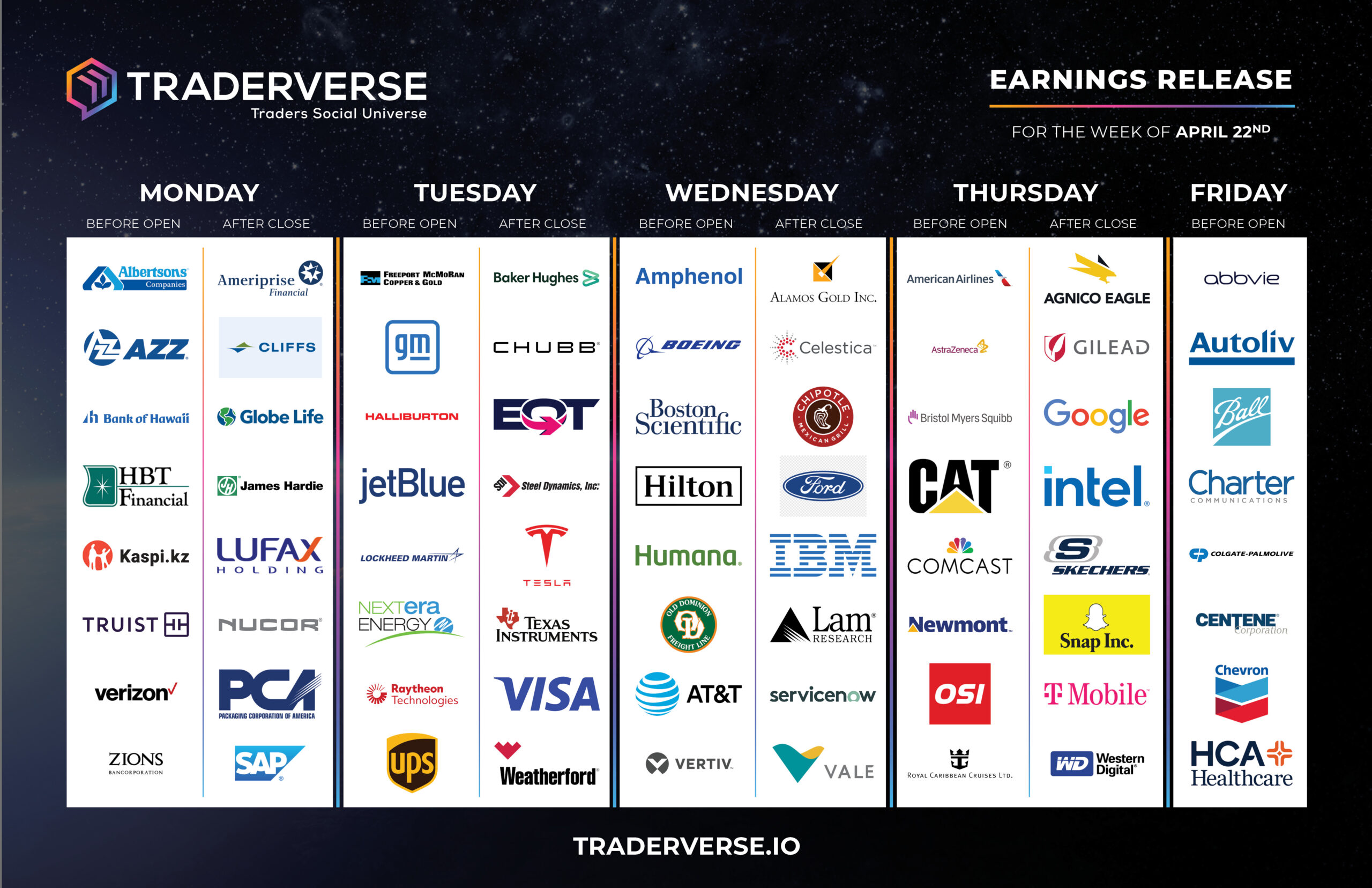

EARNINGS RELEASE CALENDAR

FOR WEEK OF APRIL 22nd

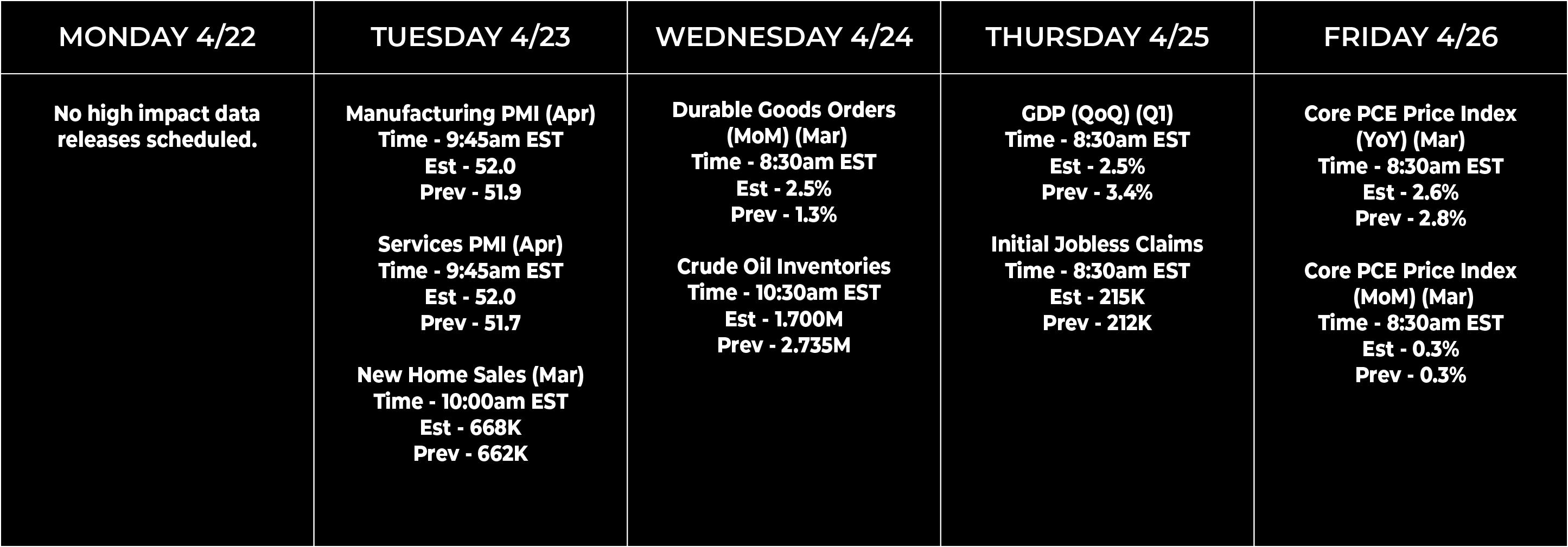

Economic Data Calendar