WEEK OF APRIL 15, 2024

Welcome to the Traderverse Weekly Newsletter!

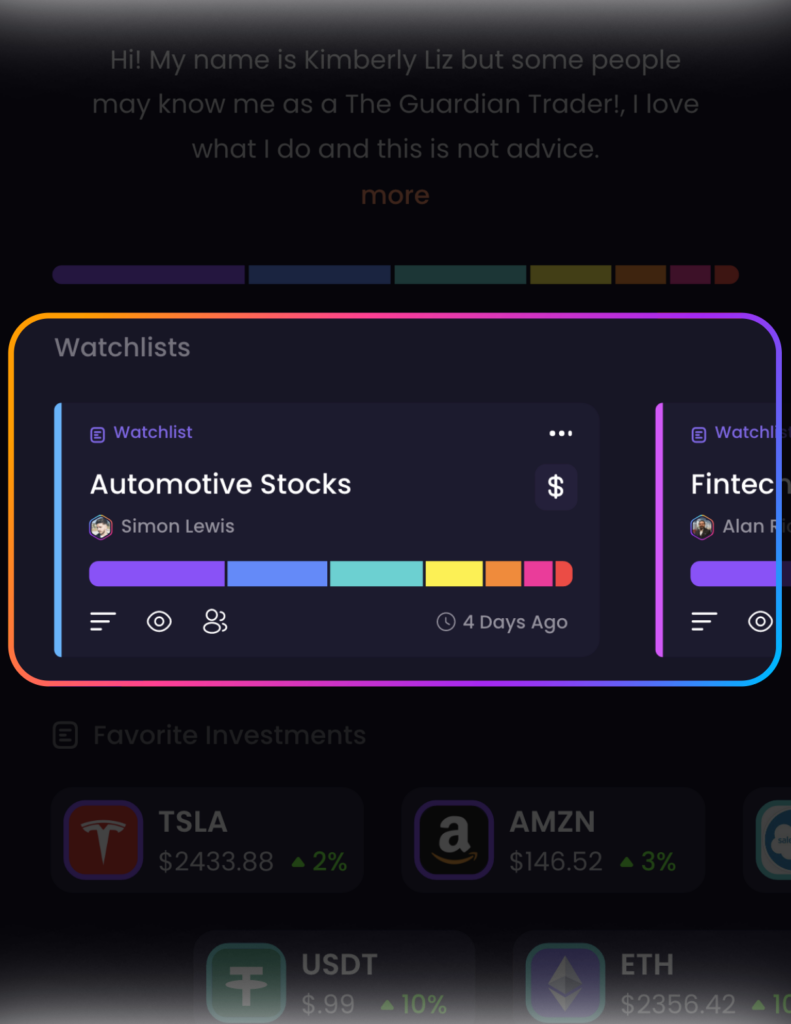

Traderverse Updates

Welcome to our newsletter series, where we unveil updates and features as we gear up for our upcoming launch! Each week, we’ll be dissecting different sections of Traderverse to give you an exclusive glimpse into what’s to come.

This week, we’re delving into Watchlists on Traderverse. Consider them your personal canvas, where you have complete control over how you set them up. Whether you prefer to organize them by sector, market outlook, or specific timeframes, the choice is yours.Why

Watchlists Matter:

Watchlists are your tool for staying on top of market movements and tracking assets of interest. By customizing them to fit your unique trading style and preferences, you can streamline your decision-making process and focus on what matters most to you.

What to Expect:

- Customization Options: Set up your Watchlists exactly how you want them, tailoring them to your individual trading strategy and goals.

- Flexibility: Whether you’re a short-term trader or a long-term investor, Watchlists adapt to your needs, providing real-time insights and updates.

- Empowerment: With Watchlists, you’re in control. Take charge of your trading journey by curating lists that align with your interests and objectives.

Be sure to join the waitlist in order to create your very own Trader Profile and see your full investment portfolio!

Important Prices

What’s Moving The Markets?

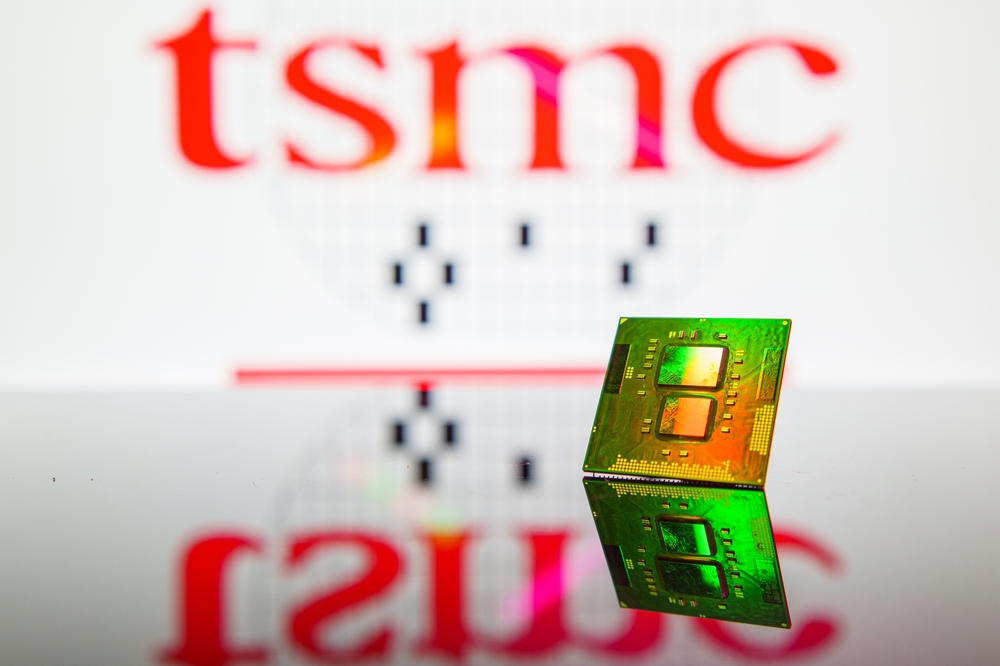

TSMC Wins $6.6B U.S. Subsidy

The U.S. Commerce Department announced a $6.6 billion subsidy and up to $5 billion in loans for TSMC’s U.S. unit to bolster advanced semiconductor production in Phoenix, Arizona, as TSMC expands its investment to $65 billion by 2030, including the production of 2 nanometer technology starting in 2028.

Fed Rate Cut Expectations For 2024

Futures traders are scaling back their expectations of Federal Reserve rate cuts for the year, with reduced bets indicating confidence in the ongoing strength of the U.S. economy.

Apple Undergoes Spyware Attack

Apple has alerted users in India and 91 other countries to potential “mercenary spyware attacks,” omitting the term “state-sponsored” previously used, after discovering attempts to remotely compromise iPhones.

Neuralink Rival Prepares Large-Scale Implant Trial

Synchron Inc, a competitor to Elon Musk’s Neuralink, is gearing up to recruit patients for a significant clinical trial aimed at gaining commercial approval for its brain implant device, with plans to launch an online registry and garnering interest from over 120 clinical trial centers.

Hong Kong To Approve Bitcoin & Ethereum ETF

Hong Kong is poised to greenlight Bitcoin and Ethereum ETFs by Monday, with Harvest Fund Management Co. and a collaboration between Bosera Asset Management (International) Co. and HashKey Capital expected to secure approval.

SEC Files Lawsuit Against Uniswap

The U.S. SEC has filed a lawsuit against decentralized cryptocurrency exchange Uniswap, prompting its founder Hayden Adams to express disappointment but readiness to defend the legality of the platform in the face of regulatory scrutiny.

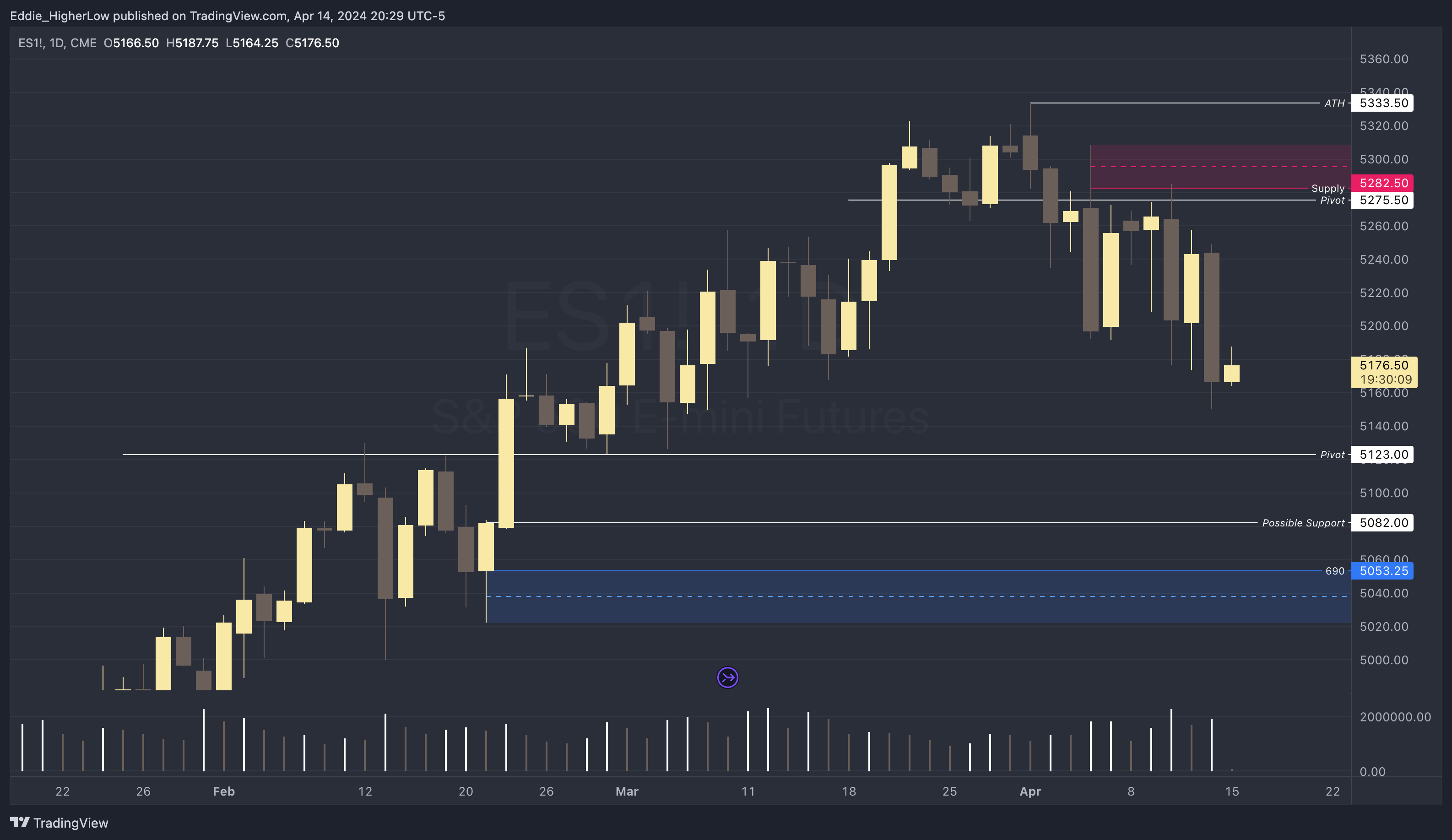

S&P Outlook

Bear Case: Bears successfully fortified their position in the supply zone starting at 5282.50, as highlighted in last week’s analysis. Their current strategy is to keep the price below 5248, setting the stage for a potential move towards lower targets at 5123 and then 5082. These steps are critical for extending bearish control over the market dynamics.

Bull Case: Bulls are focused on defending the pivotal 5123 level to stabilize the market. Their next objective is to breach and sustain above the 5248 level, aiming to reverse the recent bearish pressure. If the price were to fall below 5123, the 5082 mark is anticipated to provide necessary support, enabling bulls to regroup and potentially push back

EARNINGS RELEASE CALENDAR

FOR WEEK OF APRIL 15th

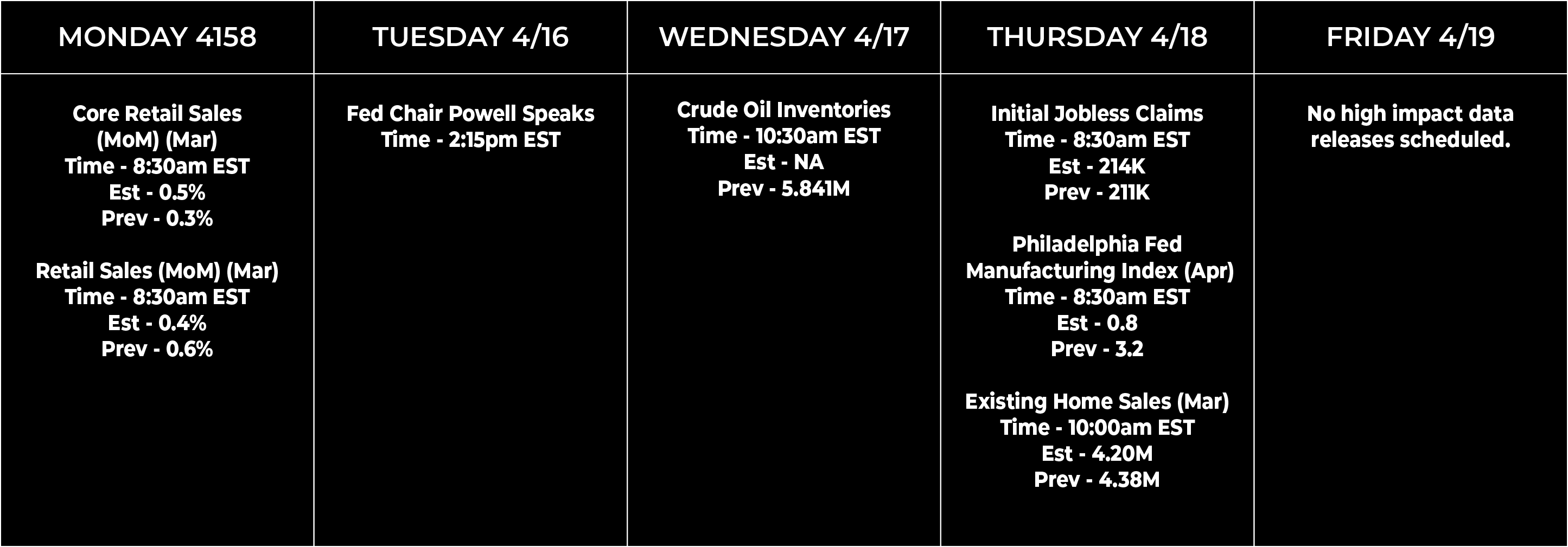

Economic Data Calendar