WEEKLY MARKET OUTLOOK

FOR THE WEEK OF March 27, 2023

Welcome to the Traderverse Weekly Newsletter! We are thrilled to welcome you to our trading community!

Each week, we provide you with the most up-to-date stock, crypto, & real estate information and charts, so you can stay informed and optimize your trading decisions. Thank you for joining us!

Happy trading!

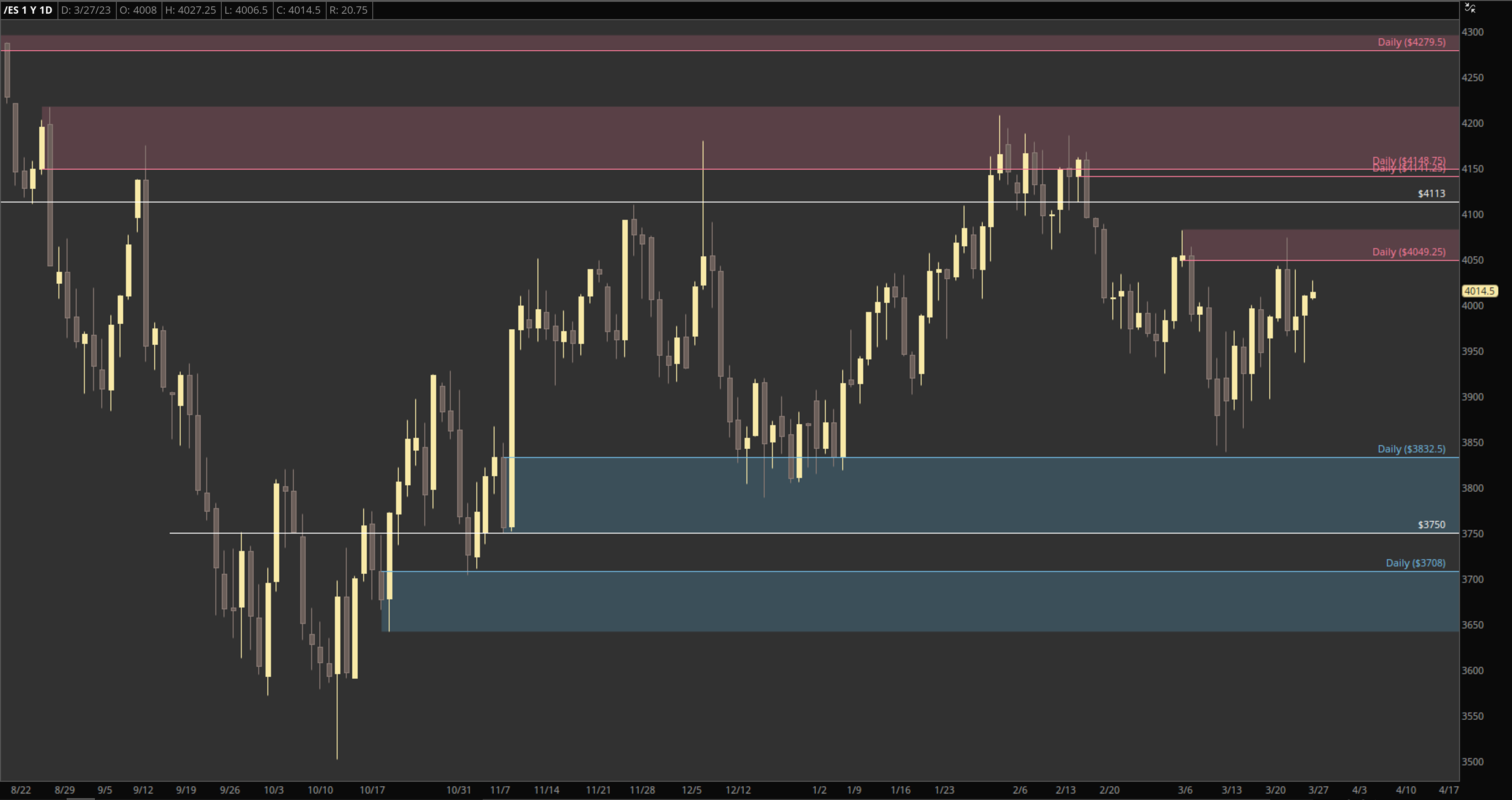

Bull Case: Price is still in between both major zones from last week but Bulls are showing strength keeping price above prior swing low at 3936. Strong supply still lies above at 4049.25, which will not be broken until price can break above 4082. Next major supply sits at 4141.25 (Daily).

Bear Case: Bears need to keep price below 4082 and ultimately break prior swing at 3936 with next target at Daily demand 3832.5. If price does break above 4082, next area for bears to possibly load sits at major untested supply at 4141.25

NEWS RECAP

3/20-3/26

Fed Raises Rates

The Federal Reserve approved another 25 bps increase but signaled that banking-system turmoil might end its rate-rise campaign sooner than seemed likely two weeks ago. This marks the Fed’s ninth consecutive rate increase aimed at battling inflation over the past year and brings the federal-funds rate to a range between 4.75% and 5%, the highest level since September 2007. Powell said Wednesday that it was possible that the banking turmoil would further tighten conditions, meaning there could be less of a need for the Fed to raise rates. The message that investors can take away from this is that policy makers are open to the idea of keeping interest rates steady at the next meeting in early May while they analyze the impact of banking issues on the economy, which may mean that no further rate hikes are necessary.

Nvidia Near Record Valuation

Nvidia’s share price has more than doubled over the past six months making it the best performing stock in the entire S&P 500 over that period of time. The majority of the company’s gains have come in the past three months, as the public launch of ChatGPT sparked a new wave of enthusiasm for generative AI, and how it could revolutionize services such as internet search, product design, writing and programming. Nvidia’s business related to generative AI depends almost entirely on capital expenditures by the world’s largest tech giants—Microsoft and Google, in particular. Analysts currently expect Nvidia’s annual revenue to top $46 billion in three years, which implies an annual growth rate averaging 20%—a notable pace for a chip maker at their scale. Nvidia may face growing competition from Advanced Micro Devices, which is rolling out its own GPU chips for data centers, as the megatrend that is artificial intelligence continues to steam forward.

Deutsche Bank Under Pressure

Investors sparked a selloff in Deutsche Bank’s stock Friday, pushing one of Europe’s most important lenders into the spotlight of concerns about the health of the global financial system. Shares of the largest lender in Germany fell as much as 15% on Friday following a spike in credit default swaps Thursday night, as concerns about the stability of European banks persisted. These concerns also emerged only days after Credit Suisse was forced into a takeover by its rival UBS. Despite these fears and unlike Credit Suisse, Deutsche Bank is a very profitable bank, reporting 10 straight quarters of profit. Analysts are now saying with confidence that Deutsche is not going to be the next Credit Suisse.

The Bitcoin Boom

Bitcoin, the world’s largest cryptocurrency, has risen 21% so far this month on the back of the banking crisis, bringing bitcoin’s rally to almost 70% so far this year, trading at around $28,000. Bitcoin has surged despite a federal regulatory crackdown on crypto companies and an increasingly risk-averse market environment. The banking turmoil that rattled the global financial markets has boosted the confidence of investors who view the digital currency as an alternative to the traditional banking system. Crypto’s recent rally has lured some investors back into the market, although they are remaining cautiously optimistic about the trajectory of bitcoin’s price.

Nasdaq’s Crypto Custody Services

Nasdaq is aiming to debut its crypto custody services by the end of Q2 2023, looking to fill the gap left by firms that have shut their doors in recent months, including FTX, Silvergate, and Signature bank.Crypto custody services are services that provide secure storage for digital assets using a combination of secure hardware, software, and processes to ensure that digital assets are kept safe from theft and manipulation. A strong appetite for crypto among the likes of institutions may prove to be a positive signal for mainstream cryptocurrency adoption.

Home Prices Drop

Home prices fell in February for the first time in over 11 years. The housing slowdown shows one of the main ways that the Fed’s aggressive interest-rate increases are rippling through the economy. A slow spring for home sales, typically the most active season, could weigh on revenues for home builders, mortgage lenders and real-estate brokerages, and reduce purchases of furniture, appliances and renovation services. This could translate into a slowdown in consumer spending, the primary driver of U.S. economic output. Many economists expect home prices to keep falling this spring, but home-buying affordability is likely to remain worse than it was a year ago.

EARNINGS RELEASE CALENDAR

FOR WEEK OF March 27

Expert Insights and Predictions

"After a whipsaw week, SPY actually bounced off the 390 support and price action remains sideways into the apex of this daily wedge. We rejected the upper trendline off Powell comments, but mostly fear was driven by Treasury Yellen, who happened to contradict Powell in the same hour on Wednesday, which created uncertainty in the market.

After another rejection of 400 levels yesterday fueled by more banking failure fears, the Bulls held the support with decent volume to close out the S&P 500 index green on the week. As we move towards the apex of this daily wedge, if no more banking fears, I do believe we can break out of this wedge next week as long as we stay above the 20day Moving Average. The 50Day Moving Average will be a challenge as bearish traders will move to defend that breakout.

I'm optimistic so far on the price action and set a mid term target of SPY at 430 using Post Thrust methodology.”

— @The_RockTrading

“From the Price action stand point on the daily since the October lows we have been making higher highs and higher lows, with the weekly candle structure also looking good on the price action. Price as long as it stays above 3900 bulls will retain control next week, with seasonality quite mixed quite mixed. Will be watching 4020 early in the week for a trend line breaking higher towards 4055 and 4080 next.

An important indicator: When Market closes below the December low (3770) at the end of Q1 it is an indication that there is more weakness to come for the rest of the year. So far we are looking good.”

— @ProblemSniper

FCX Trade Idea

Buy FCX 21APR 40 Call @ 1.20

Sell FCX 21APR23 42 Call @ 0.62

Sell FCX 21APR23 45 Call @ 0.23

Net Pay 0.35

“Looking to get long Copper, we like using our more liquid options proxy FCX. The stock has also been lagging Copper prices slightly which may provide some catch up opportunity.

The structure we opt for is a call ladder with breakeven around the highs by 21Apr. This gives a decent risk/reward if the stock can settle between 42-45 which we see as realistic if Copper can keep rallying.”

— @options_insight

SUPPORT AND RESISTANCE

Apple Inc. (AAPL)

Tesla Motor Co. (TSLA)

Invesco Trust (QQQ)

Alphabet Inc. (GOOG)

Amazon.com Inc. (AMZN)

BITCOIN (BTC)

S&P 500 ETF (SPY)

Nvidia (NVDA)

Economic Data Calendar