WEEK OF MARCH 25, 2024

Welcome to the Traderverse Weekly Newsletter!

Traderverse Update

Welcome back to our weekly newsletter, where we keep you in the loop on the latest updates and features as we gear up for an exciting launch! Each week, we’ll be diving into specific sections of Traderverse to give you a sneak peek into what’s in store.

Be sure to join the waitlist in order to create your very own Trader Profile and utilize Attributes feature and earn Badges!

Important Prices

What’s Moving The Markets?

Apple Acquires Canadian AI Company

Reddit’s (RDDT) successful debut on the NYSE, with its shares rising by 48%, suggests a resurgence in investor interest for IPOs of innovative yet unprofitable companies, with Reddit attracting attention through its data licensing deal with Google for artificial Intelligence training.

DOJ Accuses Apple Of Monopoly

The U.S. Department of Justice and 15 states have filed a lawsuit against Apple, accusing the company of monopolizing the smartphone market, harming smaller competitors, and inflating prices, as part of a broader crackdown on Big Tech, alongside previous actions against Google, Meta Platforms, and Amazon.

Fed Leaves Interest Rates Unchanged

The Federal Reserve, as anticipated by financial experts, has maintained unchanged interest rates for the sixth consecutive time, signaling a shift from a two-year tightening campaign against inflation to a current wait-and-see approach, prompting speculation on when Chair Jerome Powell and the Fed will opt to initiate rate cuts.

SEC vs Ethereum

The U.S. SEC is actively pursuing legal action to classify Ethereum as a security, issuing subpoenas to numerous US companies as part of an ongoing investigation, potentially jeopardizing the approval of a Spot Ethereum ETF and undermining industry-wide hopes.

MicroStrategy Purchases An Additional 9,245 Bitcoin

MicroStrategy, led by CEO Michael Saylor, has acquired an additional 9,245 Bitcoin, totaling 214,246 BTC worth over $7.5 billion, using proceeds from convertible notes and excess cash, with an average price of $67,382 per Bitcoin.

BlackRock Launching $100M Digital Asset Fund

BlackRock is launching a tokenized digital asset fund, initially seeded with $100 million in USDC stablecoin on the Ethereum Network, in partnership with Securitize, a tokenization firm.

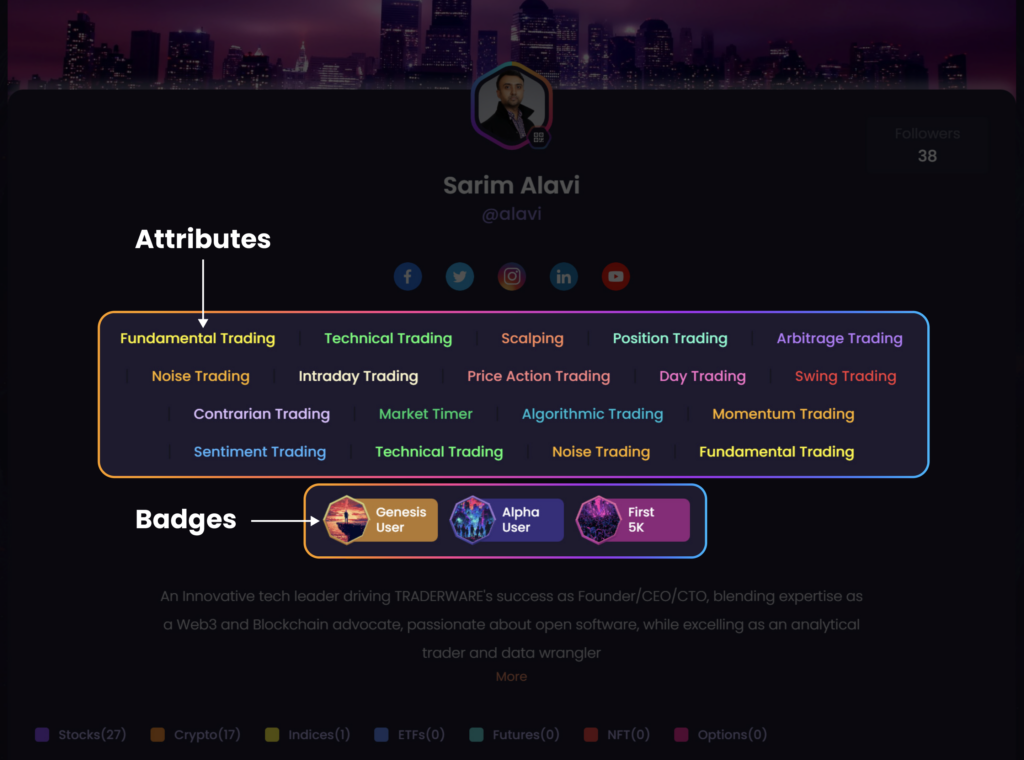

S&P Outlook

Bear Case:Bears aim to firmly maintain the market below the 5304 mark, a critical area characterized by significant supply accumulation. The immediate bearish objective is to push the price towards and below the pivot level of 5257.25, leveraging this strategic point to fuel a downward trajectory.

Bull Case: For bulls, the goal is to decisively break through and sustain above 5304, setting the stage for reaching new all-time highs. In the event of a price pullback, the 5257.25 pivot becomes crucial for maintaining bullish momentum. A breach below this pivot turns attention to 5239.75 as a potential demand zone to arrest the decline and reinitiate an upward push.

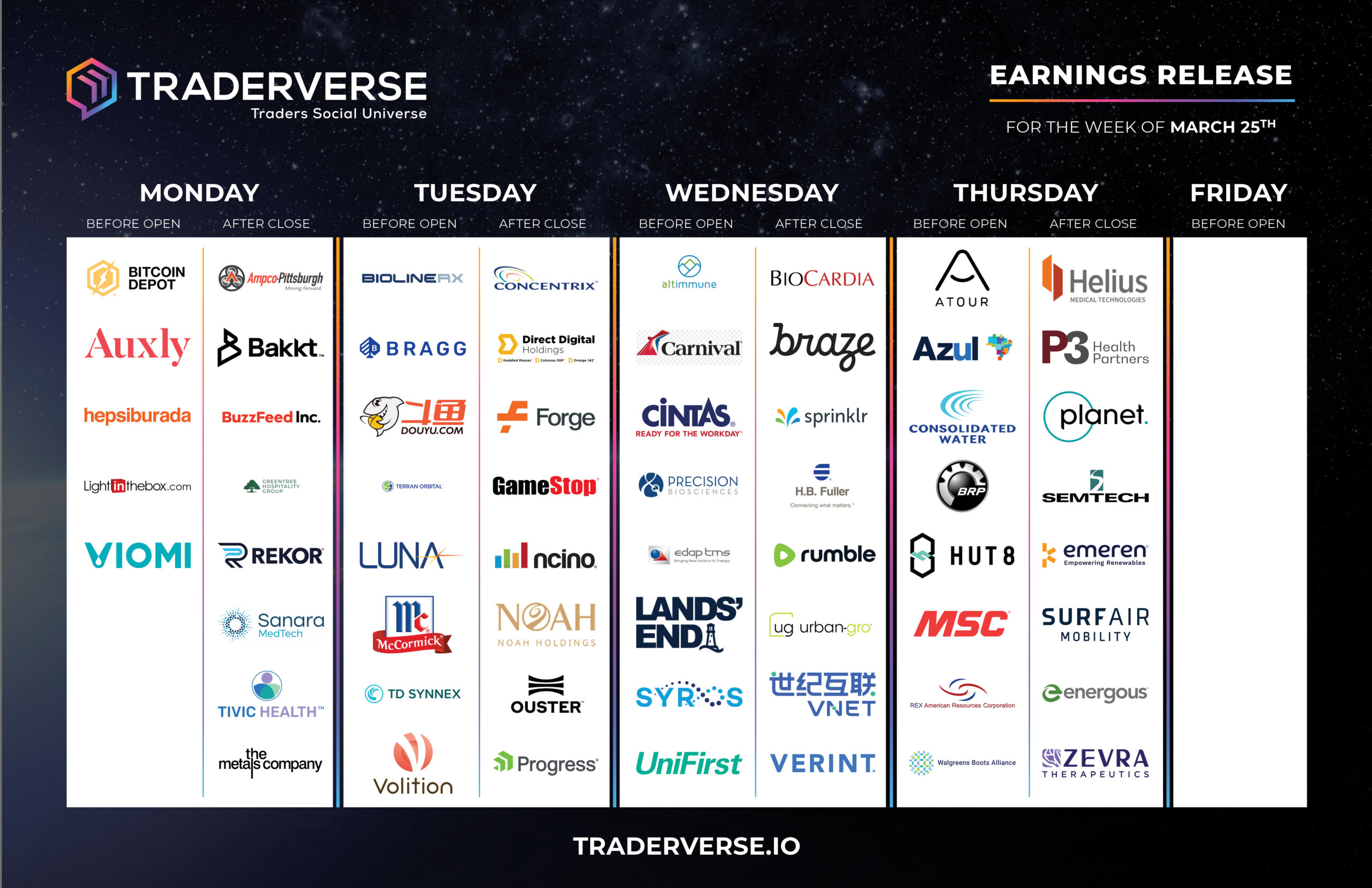

EARNINGS RELEASE CALENDAR

FOR WEEK OF MARCH 25th

Economic Data Calendar