WEEK OF MARCH 18, 2024

Welcome to the Traderverse Weekly Newsletter!

Traderverse Update

Welcome back to our weekly newsletter, where we keep you in the loop on the latest updates and features as we gear up for an exciting launch! Each week, we’ll be diving into specific sections of Traderverse to give you a sneak peek into what’s in store.

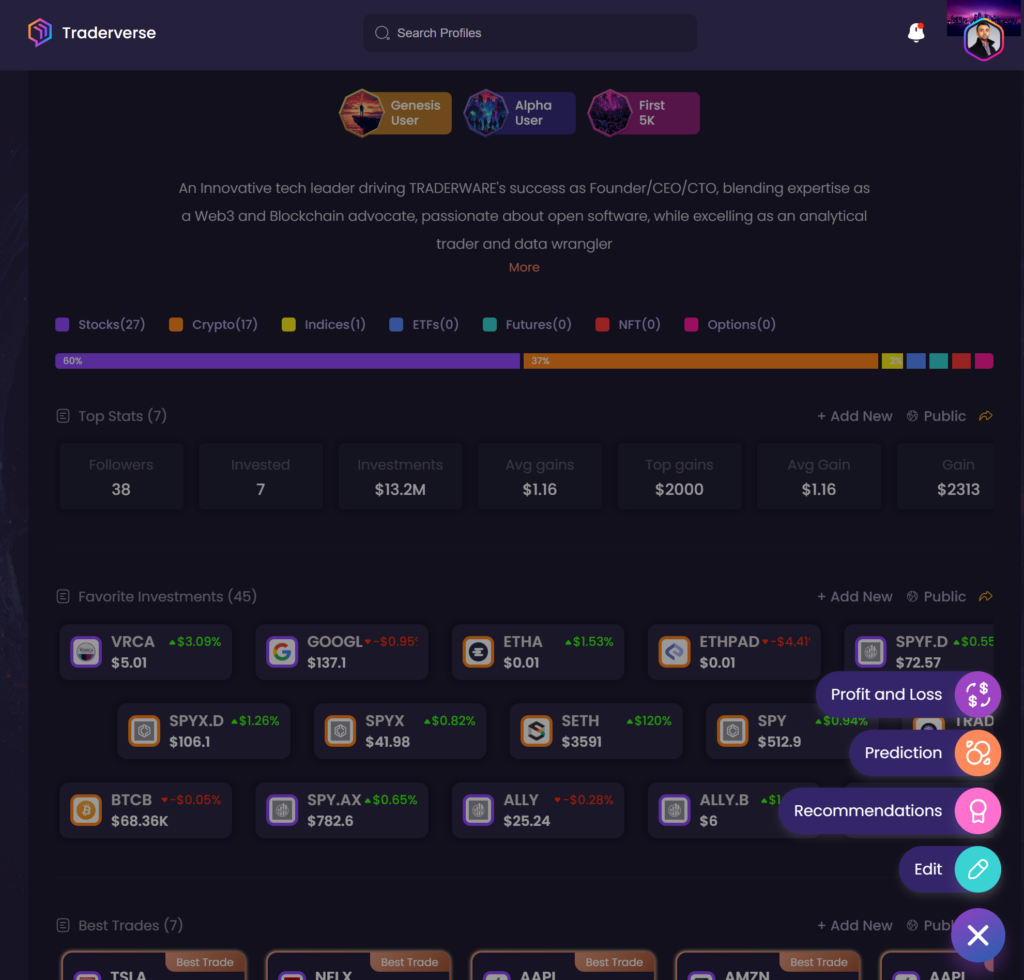

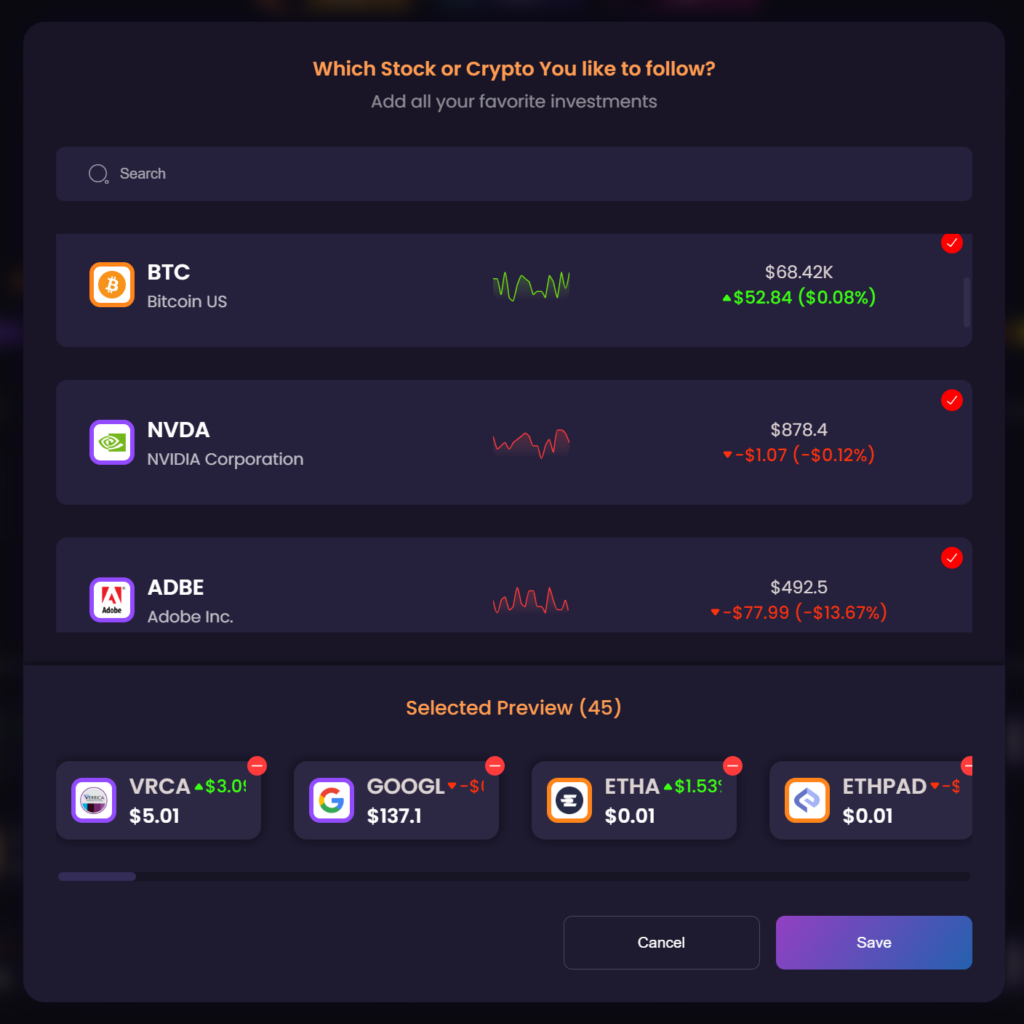

Your favorite investments are more than just tickers on a screen – they’re the companies you believe in for the long haul, with a vision of sustained growth. We’re thrilled to introduce our “Favorite Investment” feature, designed to enhance your trading experience by spotlighting the companies you’re invested in and foreseeing long-term success.

How to Setup Your "Favorite Investments"

Locate Your Default Profile

- In the image to the left, find your default profile.

- Look for the plus sign icon in the bottom right corner.

- Click on the plus sign to expand a menu.

Add or Edit “Favorite Investments”

- In the expanded menu, if it’s your first time creating this section, select “Favorite Investments.”

- If the section is already in your profile, click on “Edit.”

Select and Arrange Your Investments

- Use the simple search function to find and select all the assets you wish to add to your favorite investments list.

- As you select them, they will compile into a list along the bottom.

- Drag and drop them into any sequence you prefer.

- Once you’ve finished arranging them, click on “Save” to confirm your selections.

That’s it! You’ve successfully set up your “Favorite Investments” section. Now, you can easily access and track the companies you believe in for long-term growth.

Be sure to join the waitlist in order to create your very own Trader Profile and utilize this "Favorite Investment" feature!

Important Prices

What’s Moving The Markets?

Apple Acquires Canadian AI Company

Apple has acquired Canada-based AI company DarwinAI, known for its innovative AI technology focused on compactness and speed, to enhance its own artificial intelligence capabilities in various industries and potentially integrate the technology into its devices.

Boeing's Safety Crisis

Airline executives are grappling with Boeing’s safety crisis impacting their business strategies while facing limited alternatives in the competitive large aircraft market, as Europe’s aviation regulator warns of potential halts in indirect approval of Boeing’s jet production.

Big Push For Digital Currencies

A recent study by the US-based Atlantic Council reveals that 134 countries, comprising 98% of the global economy, are progressing towards digital currency implementation, with over half already in advanced development, pilot, or launch stages, indicating widespread global adoption, though the United States lags behind.

Solana Becomes 4th Largest Cryptocurrency

Solana (SOL) has surged past Binance Coin (BNB) to claim the 4th position in global cryptocurrency market cap rankings, amidst a period of impressive growth highlighted by record-breaking decentralized exchange (DEX) volumes.

Bitcoin Surpasses Gold In Portfolio Allocation

According to a report by JPMorgan Bank, Bitcoin’s investor allocation has surpassed that of Gold by 3.7 times, driven by the approval and performance of Spot Bitcoin ETFs, with analysts suggesting the Bitcoin ETF market could reach $62 billion, leading to all-time highs in 2024 and a broader surge in the crypto market’s trading volume and prices.

El Salvador Moves Bitcoin To Cold Wallet

El Salvador, led by President Nayib Bukele, recently transferred approximately $400 million worth of bitcoin into a cold wallet, significantly increasing the nation’s known bitcoin holdings, with sources indicating various acquisition methods including selling passports and mining.

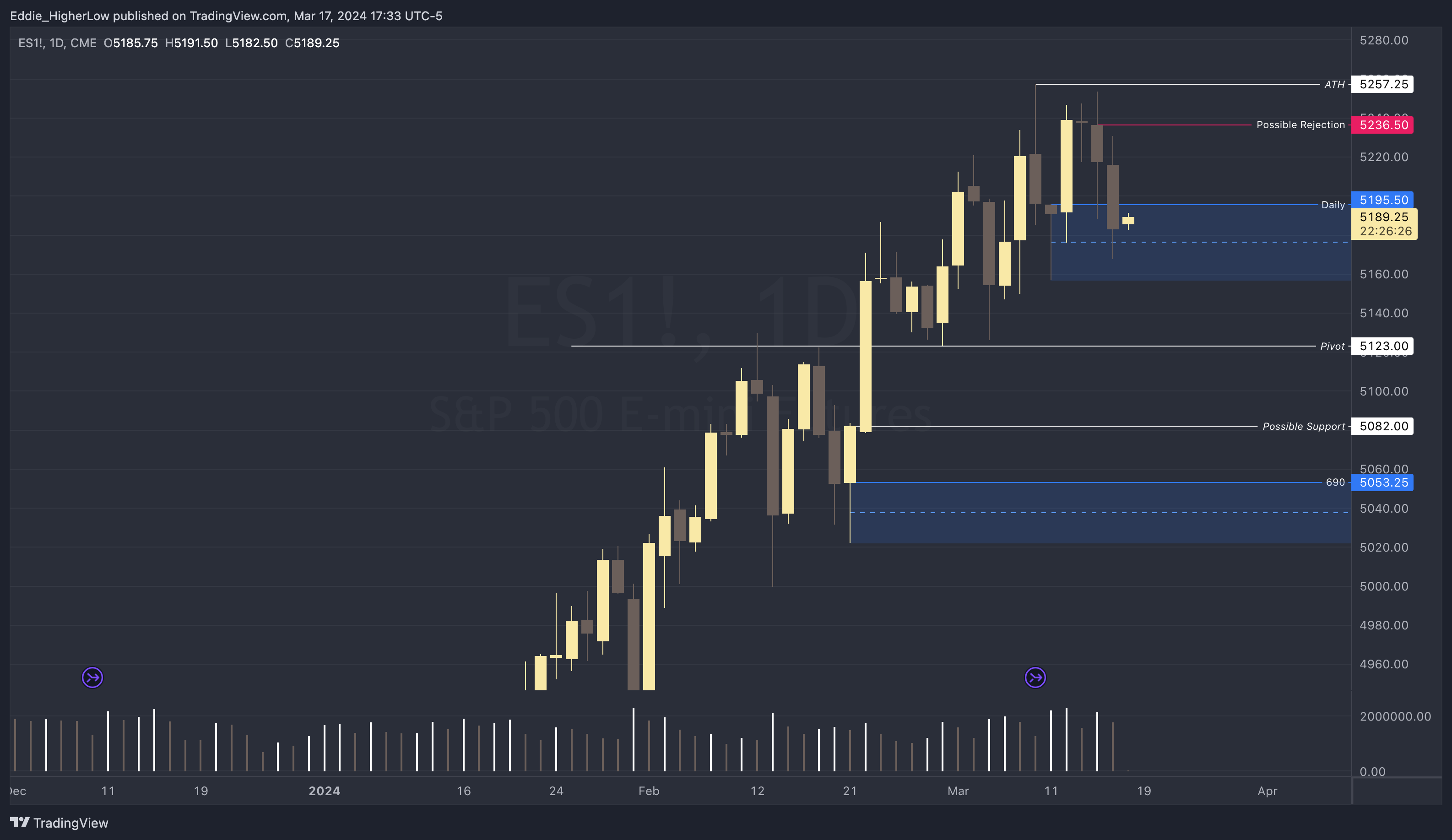

S&P Outlook

Bear Case: Bears are focused on maintaining the price below 5236.50, marking the beginning of a significant supply zone. The key goal for bears is to push the price below 5123, as doing so is crucial for initiating a strong downward momentum and challenging the bulls’ dominance.

Bull Case: Bulls currently maintain the upper hand with the price above 5123, indicating their control over the market’s direction. Should the price slip below 5123, the 5082 level is eyed as a potential support to halt further declines. For further bullish momentum, breaking and sustaining above 5236.50 is essential, with the next objective being to reach and surpass the all-time high (ATH) at 5257.25.*

* Transition to June Contracts for ES

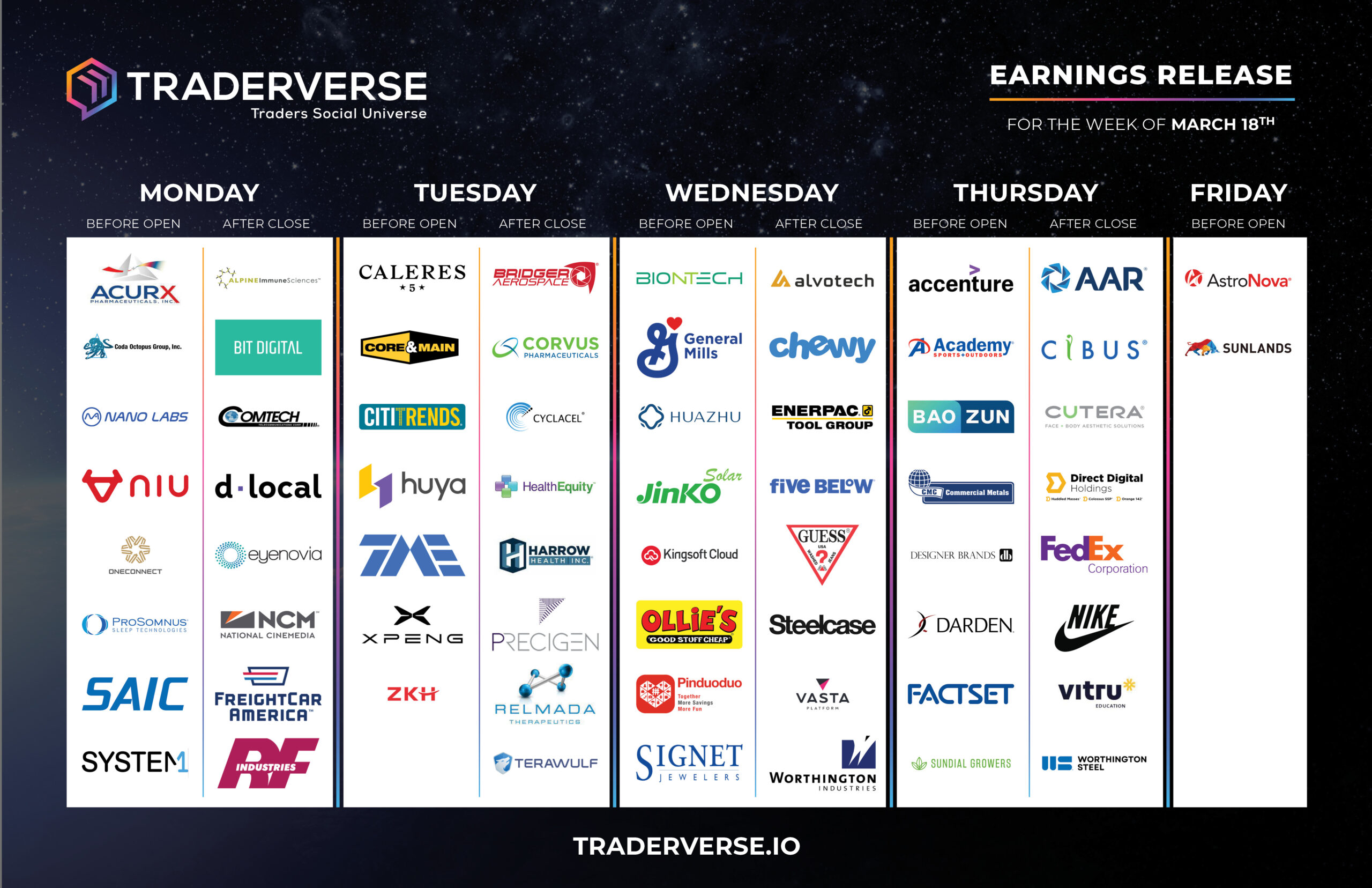

EARNINGS RELEASE CALENDAR

FOR WEEK OF MARCH 18th

Economic Data Calendar