WEEK OF MARCH 4, 2024

Welcome to the Traderverse Weekly Newsletter!

Traderverse Update

Join us in shaping the future of social trading by investing in Traderverse!

Our crowdfunding campaign on Wefunder gives retail traders the chance to be part owner of the biggest revolution in social trading, get equity and unlock exclusive perks, while fueling our mission to innovate the trading landscape.

Don’t miss out – click here to check out our Wefunder page and be part of the journey!

If you haven't reserved your spot,

Sign Up to test Traderverse Alpha!

Important Prices

What’s Moving The Markets?

IPhone Sales Decline in China

Counterpoint Research reported a 24% decline in iPhone sales in China due to fierce competition from local smartphone brands, with Apple facing particular pressure from Huawei’s resurgence following the launch of its Mate 60 smartphone.

OpenAI Responds To Elon Musk

OpenAI rebutted Elon Musk’s allegations of straying from their original altruistic mission, stating their commitment to dismiss his claims, highlighting a conflict that poses challenges for both parties.

TikTok Crackdown Bill

The US House Committee on Energy and Commerce is poised to vote on legislation mandating ByteDance to divest from TikTok within six months or risk a US ban, marking a crucial step towards a potential crackdown on the platform and setting an important precedent for other big tech companies operating in the United States.

Bitcoin All-Time Highs

Bitcoin has surged to over $70,000 per bitcoin, marking a 350% increase since its late 2022 low of $15,000, with traders eyeing even higher price targets.

MicroStrategy’s Private Offering For More Bitcoin

MicroStrategy plans to offer $600 million in convertible senior notes due 2030 to qualified institutional buyers, with an option for an additional $90 million, aiming to utilize the proceeds for purchasing Bitcoin and general corporate purposes, subject to market conditions and completion uncertainties.

BlackRock Wants More Bitcoin

BlackRock aims to acquire additional Bitcoin ETFs for its Global Allocation Fund, leveraging the success of its Spot Bitcoin ETF, amidst a record-breaking performance for all Bitcoin ETFs with Bitcoin maintaining stability around $68,000.

S&P Outlook

Bear Case:Bears aim to maintain control by keeping the price below the newly established supply zone starting at 5159.25, identified last Friday. Achieving this would set the stage for the next objective: breaking and securing the price below the 5060 level, which has proven to be a strong support. A successful breach below this point would signal the start of a genuine downward momentum, as bears look to capitalize on this shift.

Bull Case: For bulls, the immediate challenge lies in surpassing and sustaining above the 5159.25 mark, which would pave the way for tackling the upper supply zone limit at 5193 and setting new highs. In case of a price pullback, maintaining the 5060 level becomes crucial. Should the price dip beneath this, the 5018 level is eyed as a potential support. However, for a recovery and continuation of the upward trajectory, bulls would then need to reclaim and stay above 5060, especially if 5018 proves to be strong.

EARNINGS RELEASE CALENDAR

FOR WEEK OF MARCH 11th

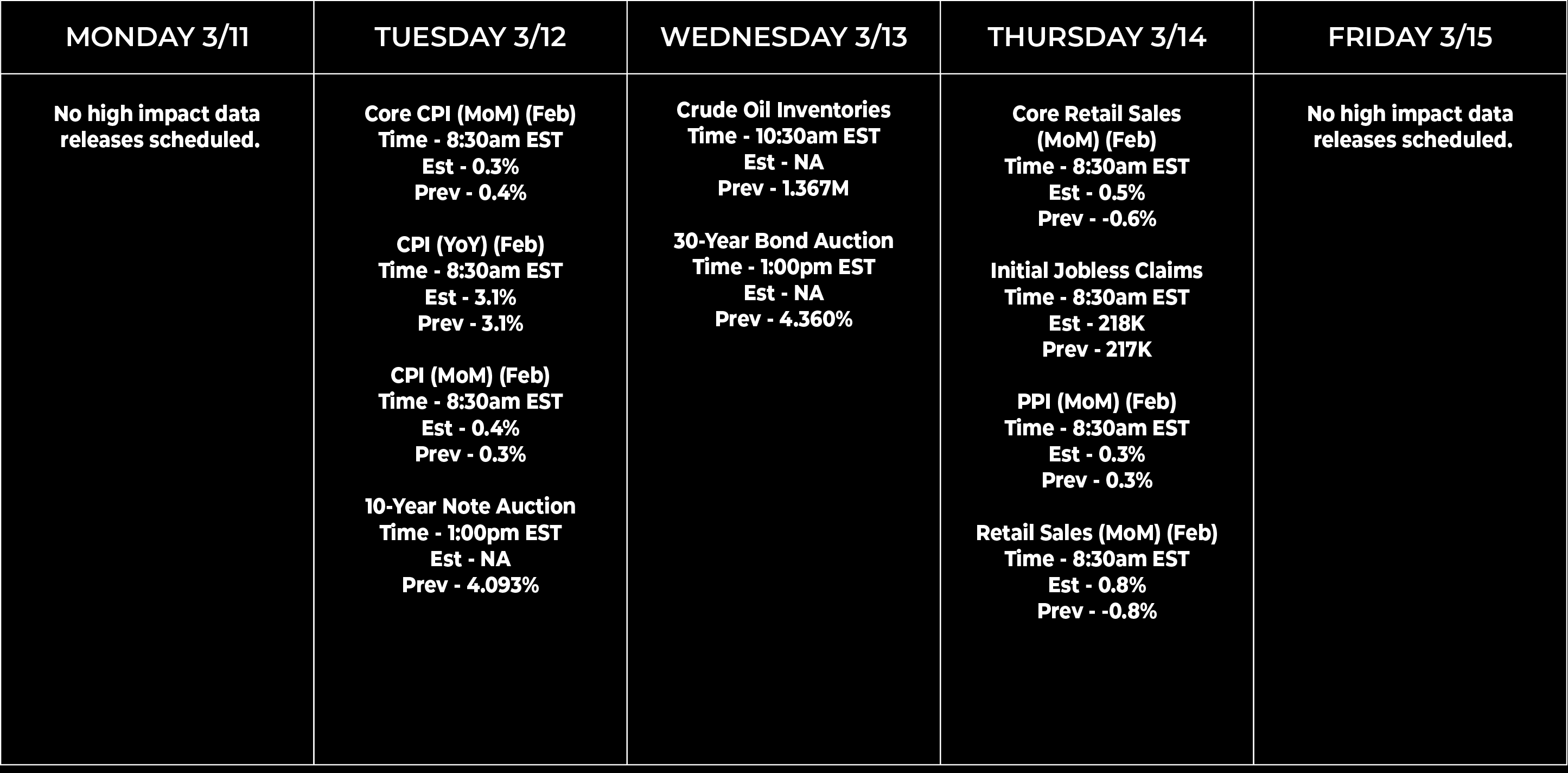

Economic Data Calendar