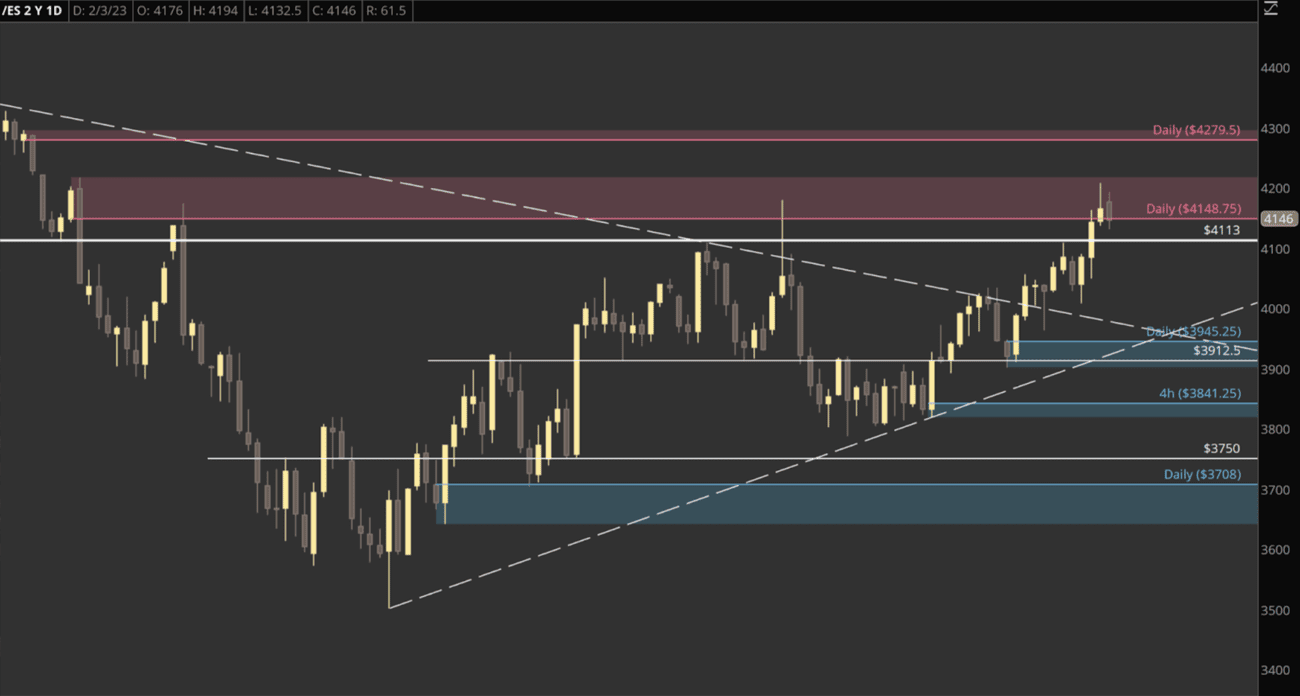

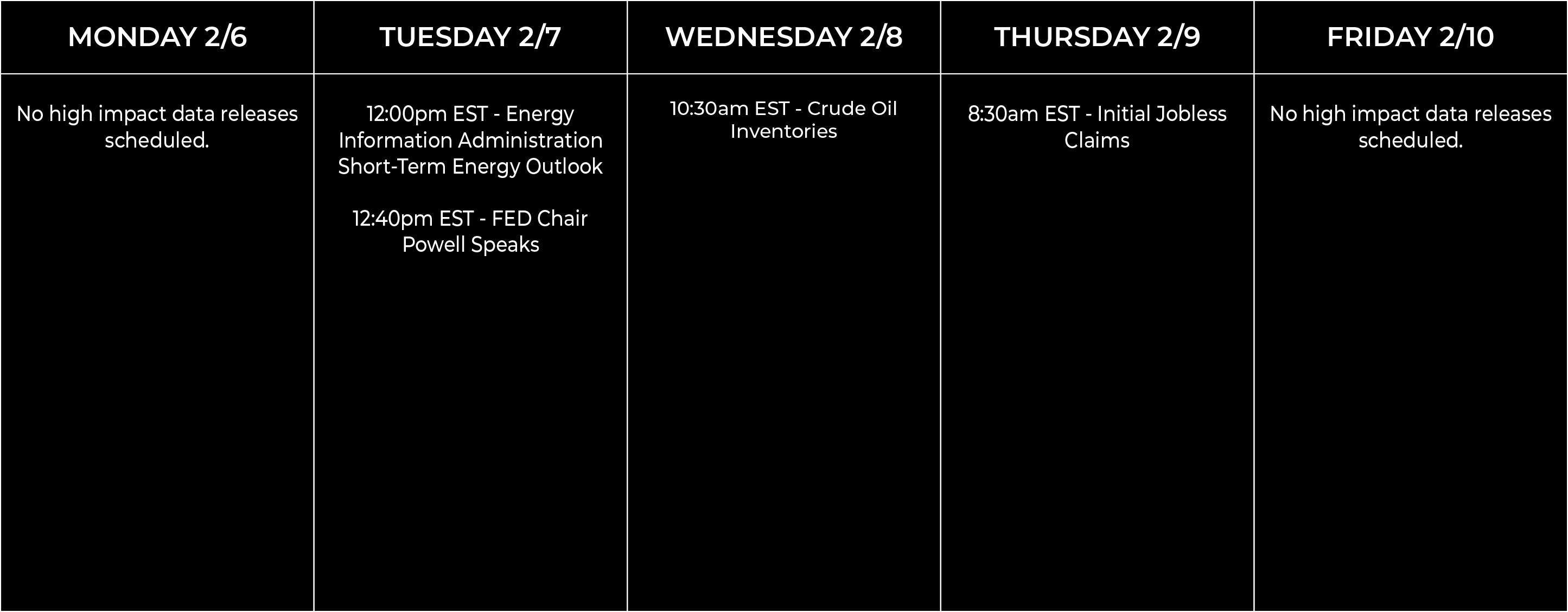

On Wednesday, Fed policy makers raised their target range on rates by just a quarter point, a step down from the half-point increase they implemented in December. Despite this, they maintained that more rate increases are still in the works and that once they stop raising rates, there won’t be any rate cuts in the immediate future. The consensus is that inflation is still too high and in order to bring it back to the 2% target, higher interest rates and a weaker labor market are necessary. Investors are betting that the Fed will cut rates deeply next year, while the projections policy makers put forth in December showed their rate-range ending 2024 just a half point below the current level.