WEEKLY MARKET OUTLOOK

FOR THE WEEK OF FEB. 27, 2023

Welcome to the Traderverse Weekly Newsletter! We are thrilled to welcome you to our trading community!

Each week, we provide you with the most up-to-date stock, crypto, & real estate information and charts, so you can stay informed and optimize your trading decisions. Thank you for joining us!

Happy trading!

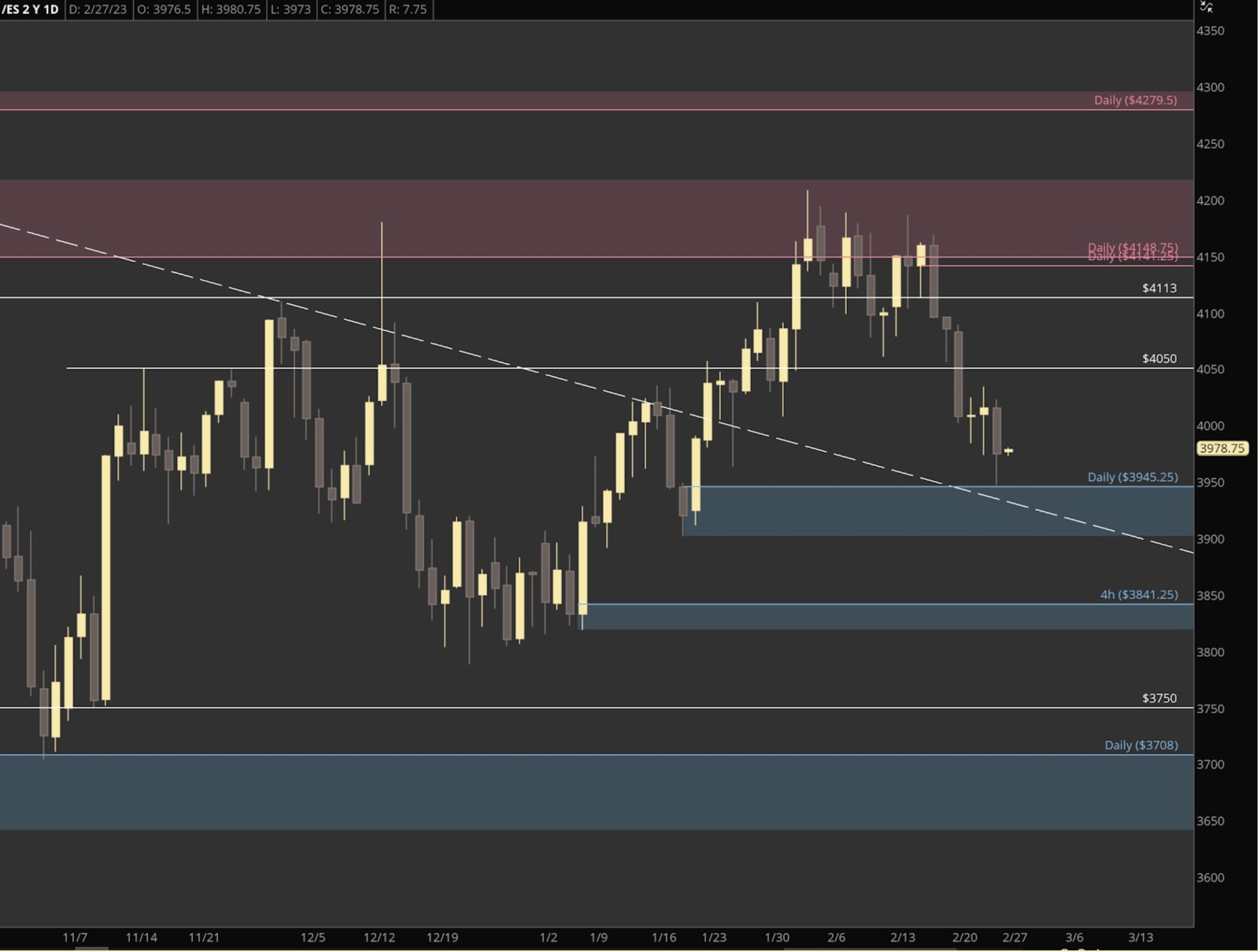

Bull Case: Price finally hit 3945.25 Daily Demand which correlates with major daily trend line that bulls would need to hold above. Resistance above at the 4000 psychological level and 4050 which has acted as both resistance and support.

Bear Case: 3901.75 is the level to invalidate the current daily demand. Breaking demand would also bring price back underneath the major daily trendline with the next possible demand at 3841.25. There are a few possible areas for strong rejection at 4050, 4113, and 4141.25 (Daily Supply).

SUPPORT AND RESISTANCE

Apple Inc. (AAPL) 30m

Tesla Motor Co. (TSLA) 30m

Invesco Trust (QQQ) 30m

Alphabet Inc. (GOOG) 30m

Amazon.com Inc. (AMZN) 30m

BITCOIN (BTC) 30m

S&P 500 ETF (SPY) 30M

Nvidia (NVDA) 30M

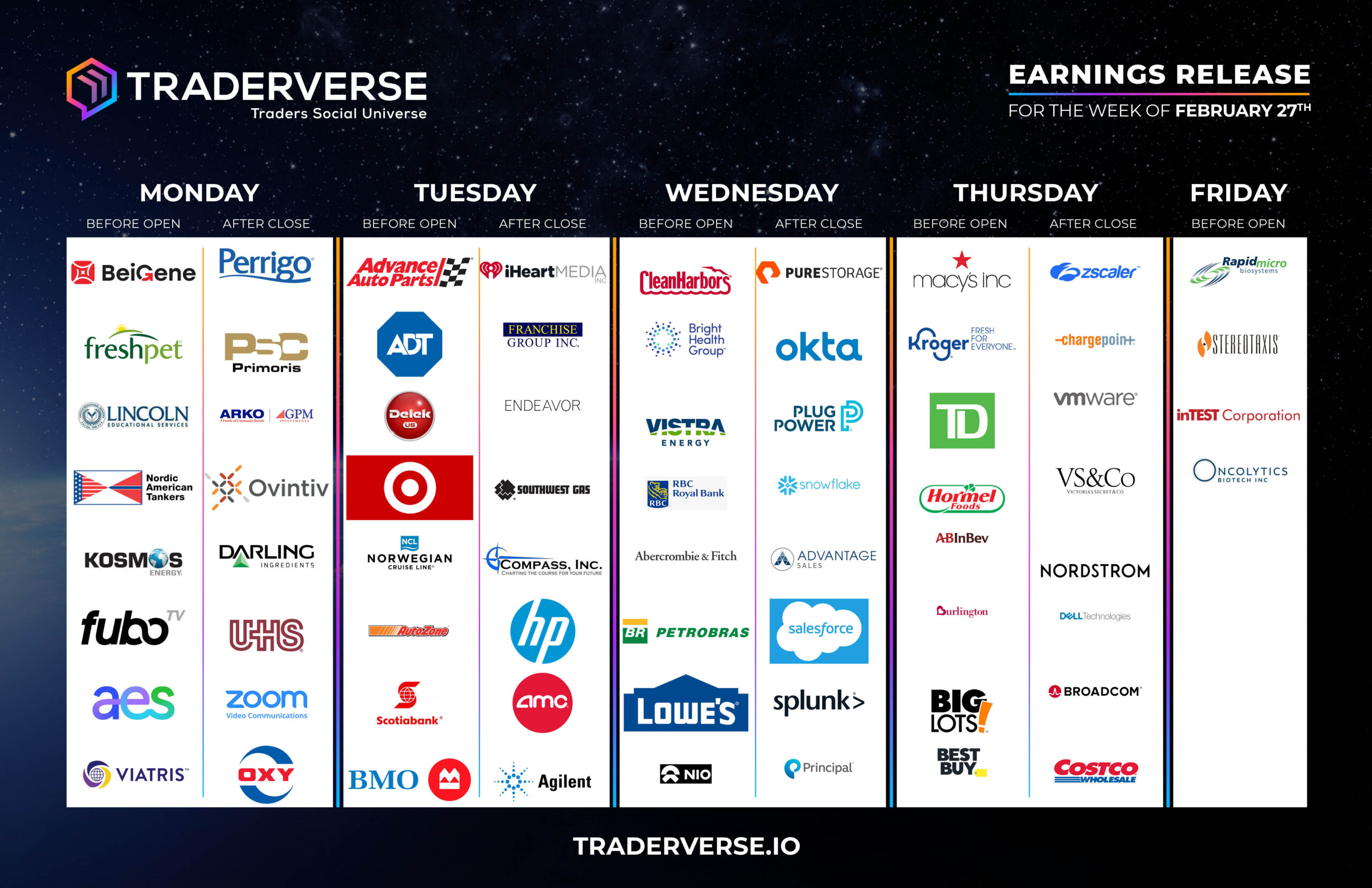

EARNINGS RELEASE CALENDAR

FOR WEEK OF FEB 27

NEWS RECAP

Feb 20 - Feb 26

The Great AI Race

More than a million people in 169 countries have been granted access to the new version of Microsoft’s Bing search engine, powered by AI chatbot technology, since its release two weeks ago. Microsoft has invested billions of dollars into OpenAI, the company providing them with its AI technology, and announced this past week that it is rolling out this system to its Skype communications tool, and the mobile versions of its Edge web browser and Bing search engine. Being first to market with a chat-based AI gives Microsoft a huge initial lead over companies that have been slower to release their own chat-based AIs, such as Google.

Nvidia’s New Revenue Stream

Hype over the popularity of the ChatGPT artificial intelligence chat tool and the AI war brewing among Google and Microsoft overwhelmed any worries about Nvidia’s business in the near term. Microsoft and Google both made major announcements earlier this month regarding the adoption of AI chatbot tools in their respective search engines, which requires far more intense computing power than standard search activity. This could result in even more capital spending being directed Nvidia’s way. Nvidia is already a major supplier to Microsoft, Google, and other tech giants offering cloud computing services. The new software business gives Nvidia yet another outlet to generate more business from the substantial library of AI software tools it has built up over the years.

EU Emissions Milestone

The price of permits on the European Union’s carbon market hit 100 euros ($106.57) per tonne for the first time last Tuesday. This milestone reflects the increased costs that factories and power plants must pay when they pollute. The more emitters have to pay for EU carbon permits to cover each tonne of C02 they produce, the greater the incentive to invest in low carbon technologies and switch to less polluting fuels. The 100-euro level has long been cited as a price that could incentivise some of the expensive technologies seen as necessary to limit global warming such as hydrogen produced from renewable energy.

Shaky News For Stablecoins

Paxos Trust Company, which mints Binance’s stablecoin, said it would cease issuing new BUSD tokens after U.S. regulators labeled the asset an unregistered security. This move made by the U.S. left investors questioning the future shape of the $137 billion market for stablecoins, tokens that are usually backed by traditional assets like dollars and U.S. Treasuries. While some uncertainty remains on the impact of the SEC ruling on other stablecoins, this is unlikely to represent a critical large structural change to the market for now. The immediate impact has actually been positive for the stablecoin market as a whole seeing its total value grow by $2 billion since the Paxos announcement on February 13.

Mortgage Applications Hit A 28-Year Low

Last week, mortgage applications experienced a shocking decline of 18%, reaching the lowest level seen since 1995. This comes as a result of high mortgage rates, surging inflation, and steep home prices weakening consumer demand. The average rate on a 30-year fixed mortgage also climbed from 6.32% to 6.50%, significantly higher than rates just one year ago. Although rates have fallen from their peak of 7.08% in November, they have recently reversed that trend and started to march higher amidst fears of further rate-hikes on the horizon.

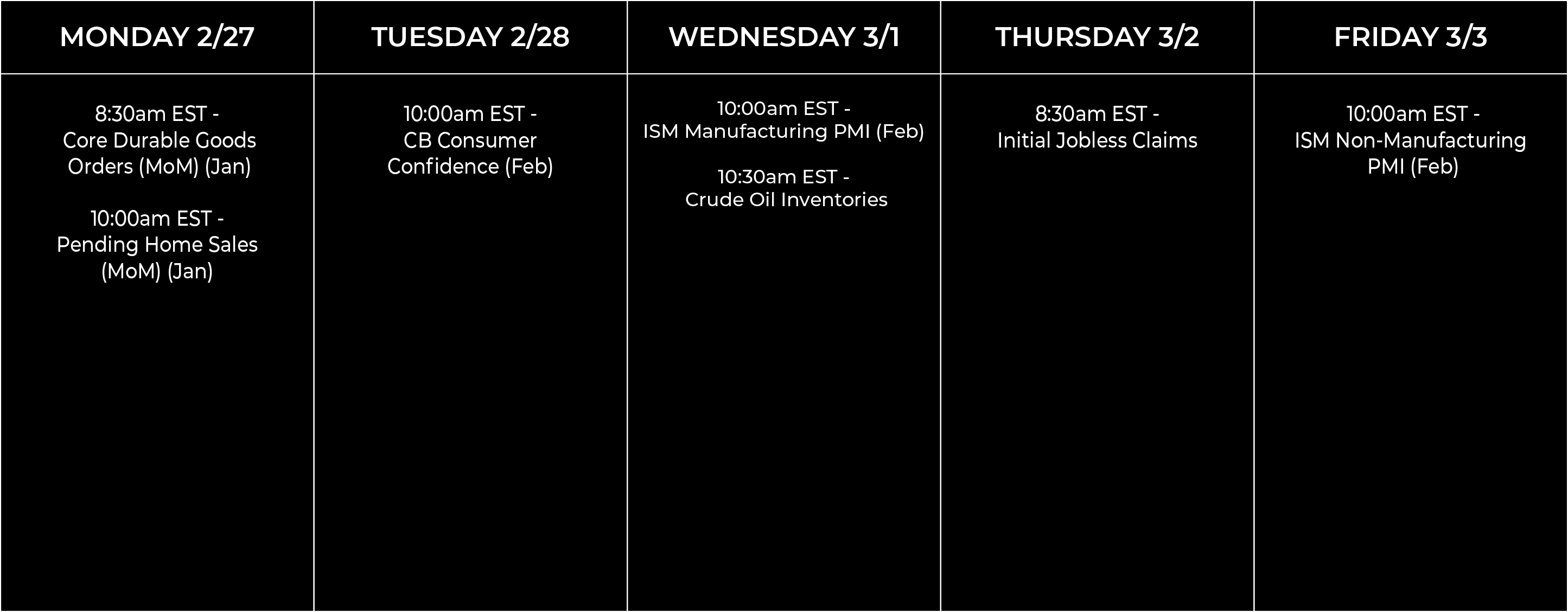

Economic Data Calendar