WEEK OF FEBRUARY 12, 2024

Welcome to the Traderverse Weekly Newsletter!

Traderverse Update

The need for Traderverse stems from the myriad of issues plaguing the current online trading and investing landscape. Despite its popularity, this system is fundamentally flawed, rife with scammers, fraudsters, and false prophets who inflict substantial costs and harm on traders worldwide. Various schemes like pump and dumps, rug pulls, Ponzi schemes, and meme-coin scams collectively cost retail investors billions of dollars. Social scams have also become increasingly prevalent, exacerbating the problem.

In essence, Traderverse is necessary to address these challenges and create a safer, more transparent, and trustworthy environment for traders.

If you haven't reserved your spot,

Sign Up to test Traderverse Alpha!

Important Prices

What’s Moving The Markets?

S&P 500 Hits New Highs

The stock market surged to record highs on Friday, with the benchmark index surpassing 5000 for the first time, bolstered by resilient economic data despite cooling inflation concerns.

SoftBank’s Big Payday

Shares of chip designer Arm surged 48% on Thursday following better-than-expected earnings and a robust profit forecast for the current quarter, adding approximately $38 billion to its market capitalization, with the majority benefiting SoftBank, its majority owner.

Meta Announces Dividend

Meta Platforms astounded investors with an exceptional fourth-quarter earnings report, surpassing expectations on both top and bottom lines, coupled with an optimistic first-quarter guidance, leading to a historic single-day market cap gain of over $200 billion following the announcement of its inaugural dividend.

Bitcoin Breaks $48,000

Bitcoin surged past $48,000, marking a new monthly high amid bullish sentiments, potentially primed for a weekend rally, its 110% growth in a year solidifying its position as a formidable force in global financial markets, with factors behind its recent price spike explored in this article.

Yellen Calls For Crypto Legislation

Treasury Secretary Janet Yellen urged Congress to enact legislation safeguarding citizens from digital asset risks, emphasizing the need for Federal oversight over stablecoin issuers during her address to the House Financial Services Committee.

MicroStrategy Buys More Bitcoin

During Bitcoin’s uptrend, MicroStrategy, led by Michael Saylor, continues to bolster their BTC holdings, purchasing 850 more tokens for $37.2 million, now totaling 190,000 BTC valued at $9.18 billion, while Saylor sold 5,000 shares of the company’s stock, totaling 120,000 shares sold over the past year without any purchases.

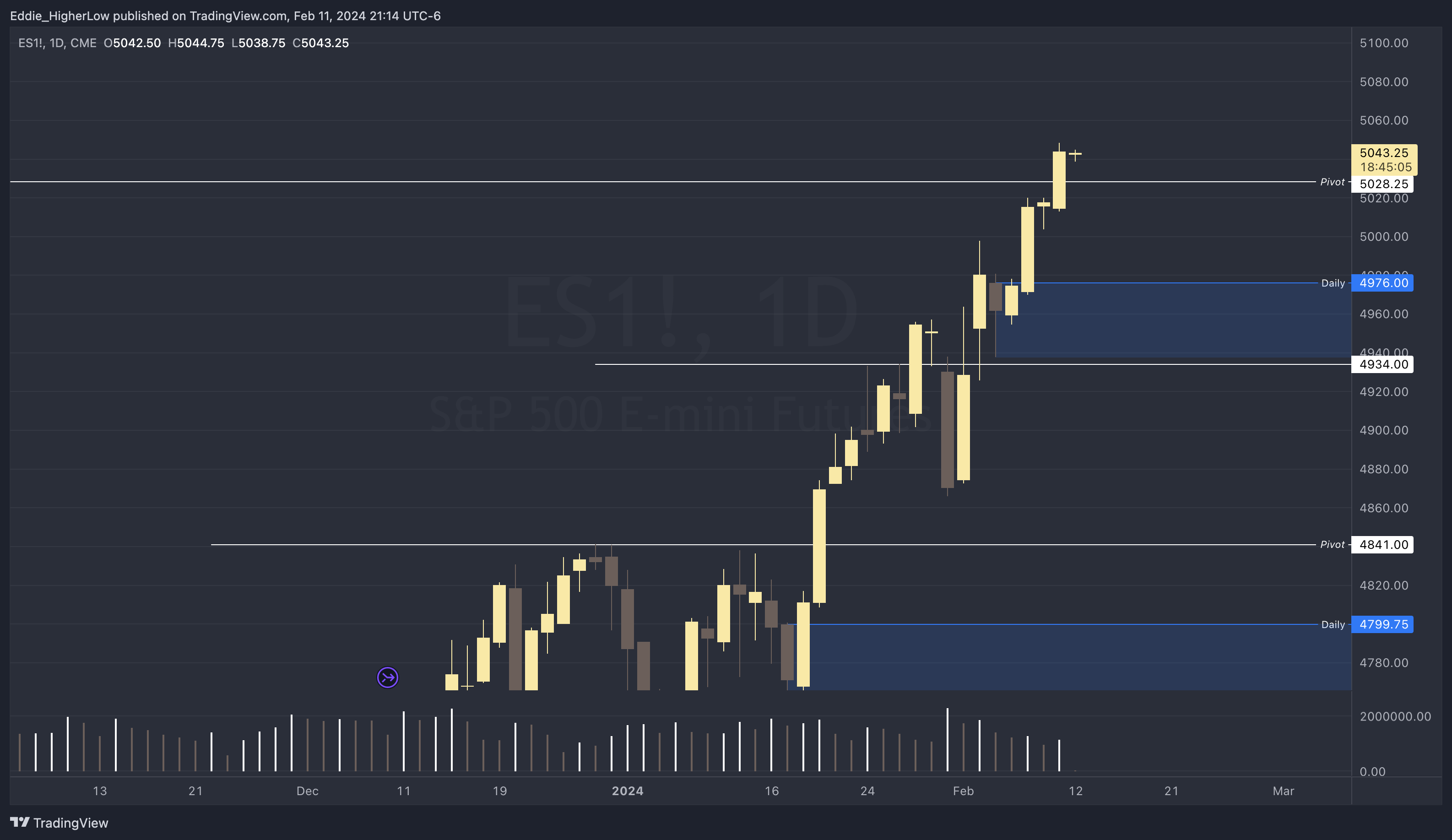

S&P Outlook

Bear Case: Bears face the challenge of pushing the price below the 4934 level to ignite real momentum in their favor. With no significant supply zones above to capitalize on, bears must actively drive the price lower, potentially establishing a new supply area in the process. This aggressive move is crucial for setting the tone for a bearish market.

Bull Case: Bulls have demonstrated their strength by propelling the price beyond the 5028 all-time high (ATH) pivot, marking a significant bullish achievement. To maintain this momentum, it’s critical to secure the 5028 level. However, should a retracement occur, the 4976 level stands as a key daily demand zone, ready to offer possible support.

EARNINGS RELEASE CALENDAR

FOR WEEK OF FEBRUARY 12th

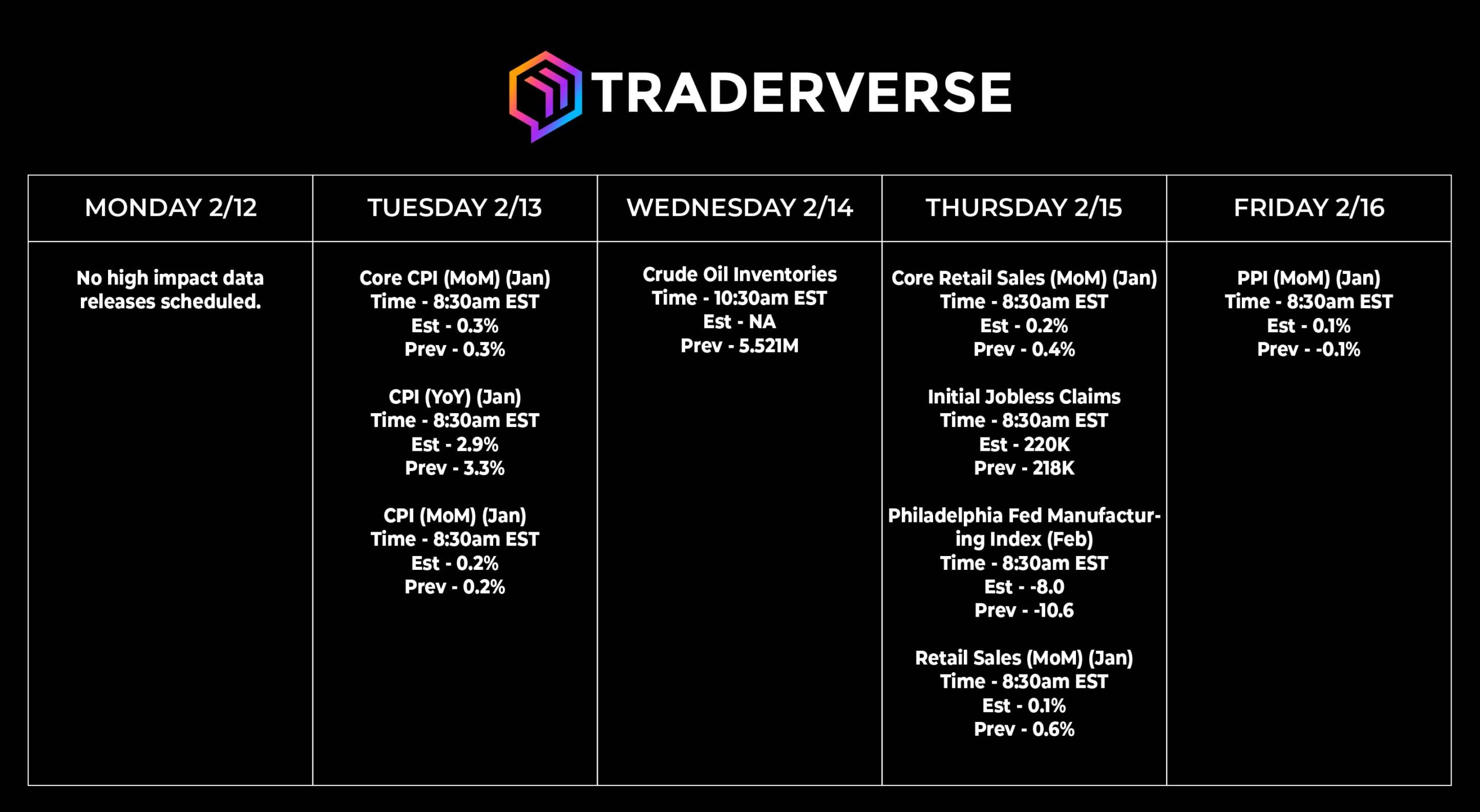

Economic Data Calendar