WEEK OF DECEMBER 4, 2023

Welcome to the Traderverse Weekly Newsletter!

TRADERVERSE Updates

Showcase your focus and preferences, and create opportunities to find and collaborate.

If you haven't reserved your spot, Sign Up to test Traderverse Alpha!

Important Prices

What’s Moving The Markets?

Tesla’s Cybertruck

Last week, Tesla began delivering its long-awaited Cybertruck, priced at $60,990—over 50% more than Elon Musk’s 2019 estimate—featuring a distinctive stainless steel design inspired by James Bond.

OPEC+ Oil Cut

OPEC+ oil producers, responsible for over 40% of global oil production, agreed to voluntary output cuts of approximately 2.2 million barrels per day for early next year, with Saudi Arabia leading by maintaining its current voluntary cut.

Argentina Rejects BRICS Invitation

Under President Javier Milei, Argentina will decline the invitation to join the BRICS bloc, as indicated by his incoming Foreign Affairs Minister, Diana Mondino, who expressed doubts about the value of the group, citing the country’s presidential election outcome as a determining factor, despite Argentina having Brazil and China as two of its key commercial partners.

Bitcoin ETF Incoming

The SEC is expected to make a decision on Spot Bitcoin ETF approval between January 5th and 10th, with Bloomberg’s James Seyffart predicting approval orders to likely occur during the latter stages of that window, specifically between January 8th to the 10th.

Binance To Delist BUSD

Binance, the cryptocurrency exchange, has declared the discontinuation of support for the BUSD stablecoin by December 15th due to increasing regulatory scrutiny on its issuer Paxos, advising users to withdraw or convert BUSD holdings into alternative cryptocurrencies and promoting the conversion to its FDUSD stablecoin as an option at a 1:1 ratio with no trading fees.

MICROSTRATEGY BUYS MORE BITCOIN

MicroStrategy has acquired an additional 16,130 Bitcoins, valued at $593.3 million, contributing to the firm’s total Bitcoin holdings, which have yielded a profit of $1.29 billion and propelled its stock price to a two-year high this week, affirming founder Michael Saylor’s steadfast belief in the long-term potential of the digital asset.

S&P Outlook

Bear Case: The ES is presently confronting a pivotal daily trend line, approaching a critical weekly supply zone commencing at 4613.25, a level defined by bearish momentum observed from July to August. This could potentially offer bears a strategic advantage. However, should the price breach and consistently remain above 4613.25, the next supply level to watch is at 4658.50.

Bear Case: The ES has successfully rebounded from the established daily demand zone at 4564.00. Should bulls manage to propel the price beyond 4613.25, they may set their sights on above targets of 4658.50 followed by 4705.50. Conversely, should it occur, the demand level initiating at 4613.25 may present a crucial battleground for bulls to uphold. A descend below 4540 could precipitate a decline to the next significant demand level at 4425.75

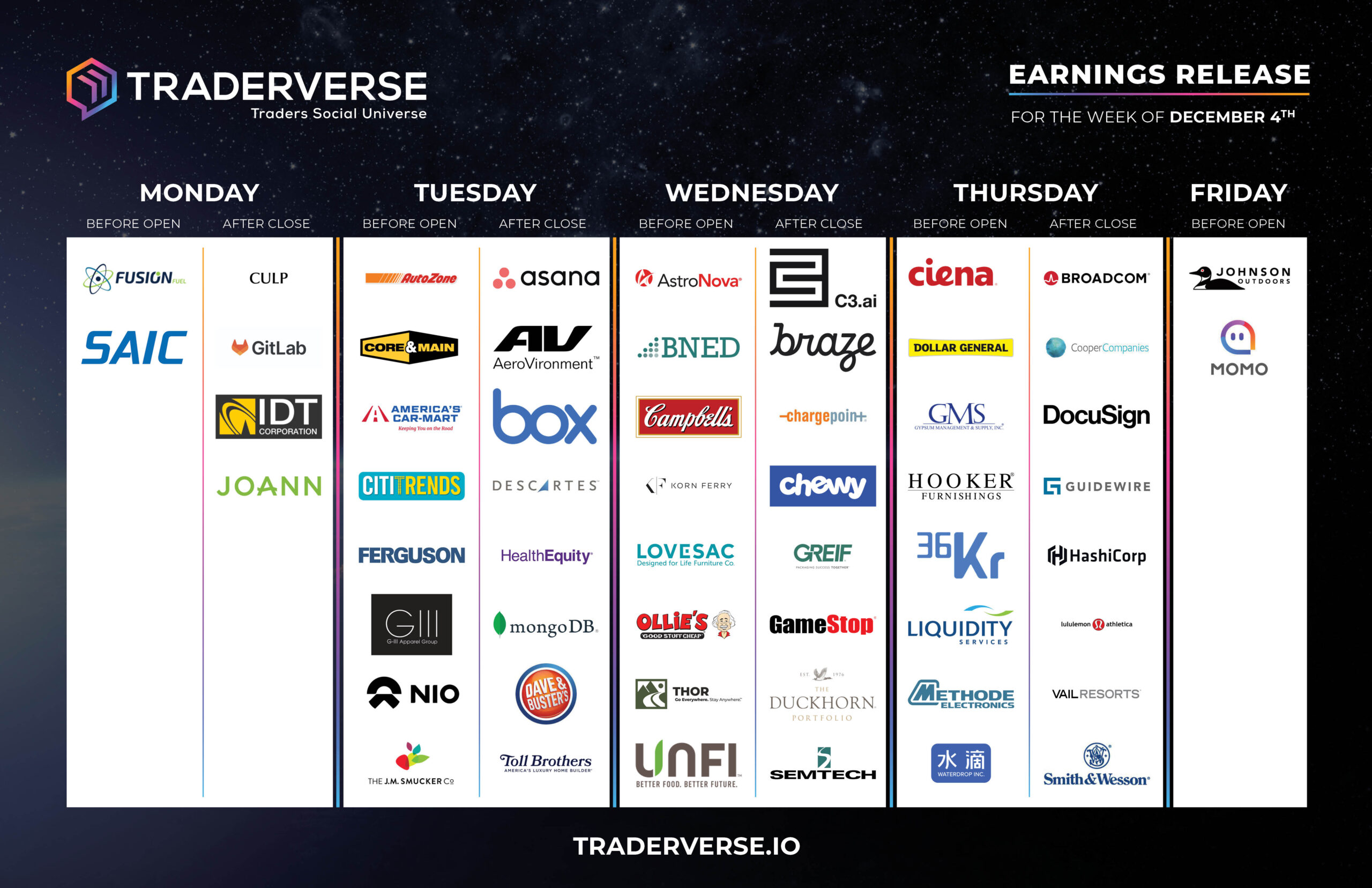

EARNINGS RELEASE CALENDAR

FOR WEEK OF DECEMBER 4TH

Expert Insights & Predictions

Importance of Journaling Your Trades

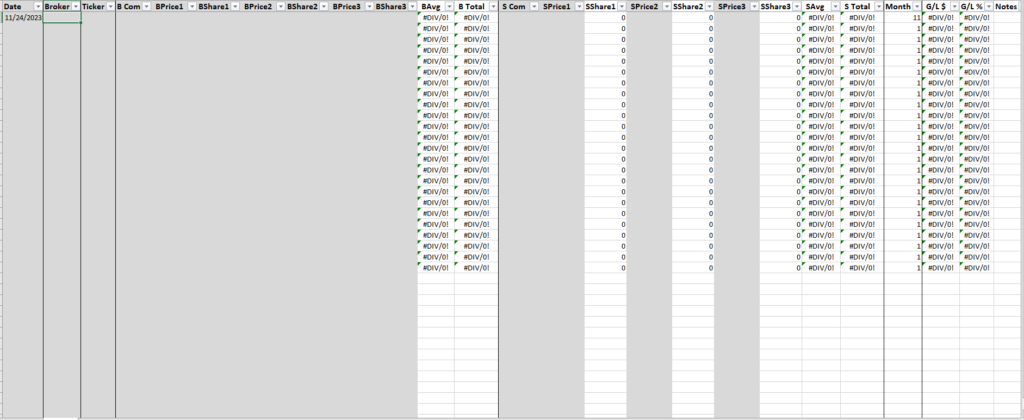

So here’s an example of a Trading Journal (Via Excel) that has worked for me in the past to eliminate mistakes. The more you write in the Notes column the better for later analysis. The more you automate the easier trading is.

Broker – Don’t need it if you only use 1 broker to trade. B Com – Don’t need if you have 0 commission/ fees, just nice to have just in case. B – Buy S – Sell. I have 3 separate possible buy & sell areas. You can add or delete as you need.

BAvg – Literally just the average between the 3 possible buys, same w/ SAvg. Month – When I am analyzing/ Pivot Tables, etc. I use this to see my MTM progress. Notes – Like mentioned earlier, probably the most important column. Below for more on this.

Notes – MOST IMPORTANT! use it as a diary/write down how you feel when you buy, when you sell, what the weather is like, if you’re at work & having a bad day mention that. Anything you post here will help you in the longer run I PROMISE YOU THAT! — @Mitch___Picks

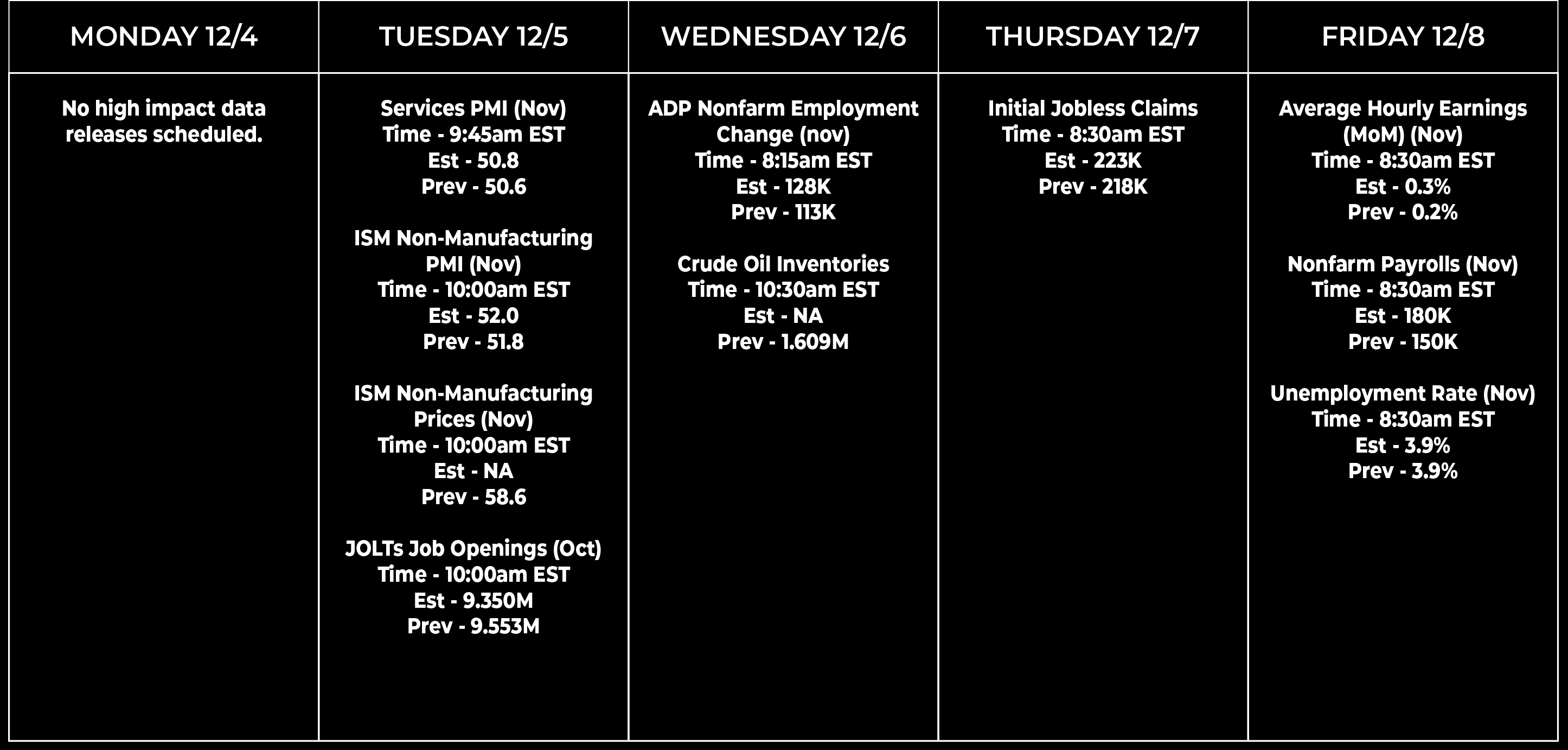

Economic Data Calendar