WEEK OF DECEMBER 11, 2023

Welcome to the Traderverse Weekly Newsletter!

TRADERVERSE Updates

TRADERVERSE “PROFILES”:

Traderverse “Profiles” are traders gateway to discoverability and collaboration. Unlock the power of networking through investment interest. Build your own network that will empower and unite retail traders across the globe.

If you haven't reserved your spot, Sign Up to test Traderverse Alpha!

Important Prices

What’s Moving The Markets?

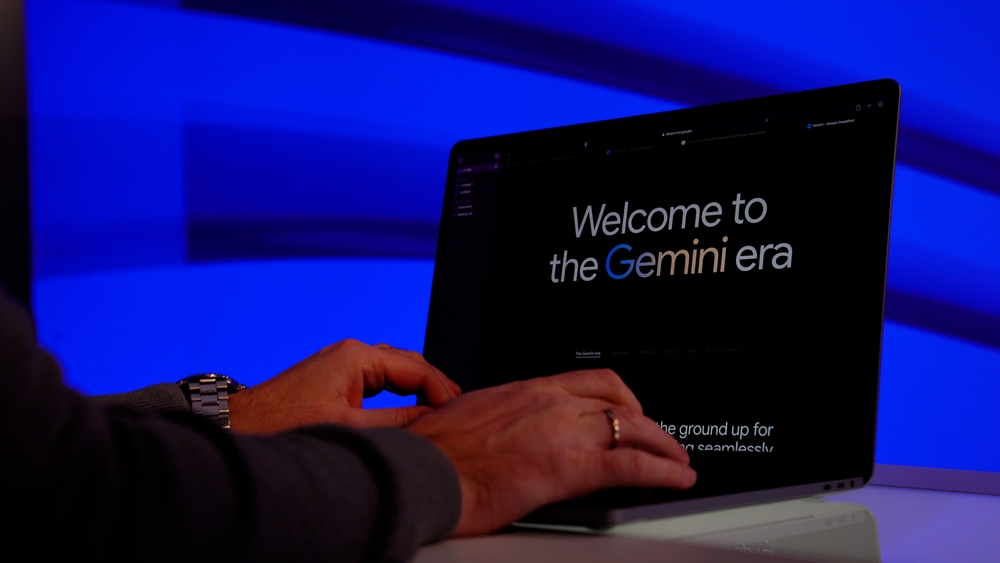

Google's Move In The AI Game

Google has unveiled Gemini, a significant upgrade to its Bard chatbot developed by the Google DeepMind division, aiming to compete with OpenAI’s ChatGPT in the field of generative artificial intelligence.

Musk Raising Funds For xAI

Elon Musk’s xAI, aims to raise $1 billion in an equity offering, having already sold over $134 million, according to a Securities and Exchange Commission filing, with a binding agreement in place for the remaining $865 million.

Growing EV Demand From China

The emergence of affordable Chinese electric vehicles has intensified competition, prompting traditional automakers to collaborate with suppliers, including battery materials makers and chipmakers, to accelerate the development of cost-effective electric vehicles ahead of original timelines.

All Eyes on The SEC

The US Securities and Exchange Commission’s discussions with Spot Bitcoin ETF issuers have progressed to key technical details, signaling a potential shift towards approval, with 13 firms, including BlackRock, Fidelity, Grayscale Investments, and ARK Investments, having pending applications.

Fidelity’s Bitcoin ETF

The SEC has engaged in discussions with Fidelity Investments regarding its Spot Bitcoin ETF application, during which Fidelity provided details about the pending application and presented information on ETF workflows.

MicroStrategy's Bitcoin Gains Grow

MicroStrategy’s Bitcoin investment, overseen by Michael Saylor, has reached an unrealized profit of $2.3 billion, with significant growth in his Bitcoin holdings in anticipation of potential Bitcoin ETF approvals.

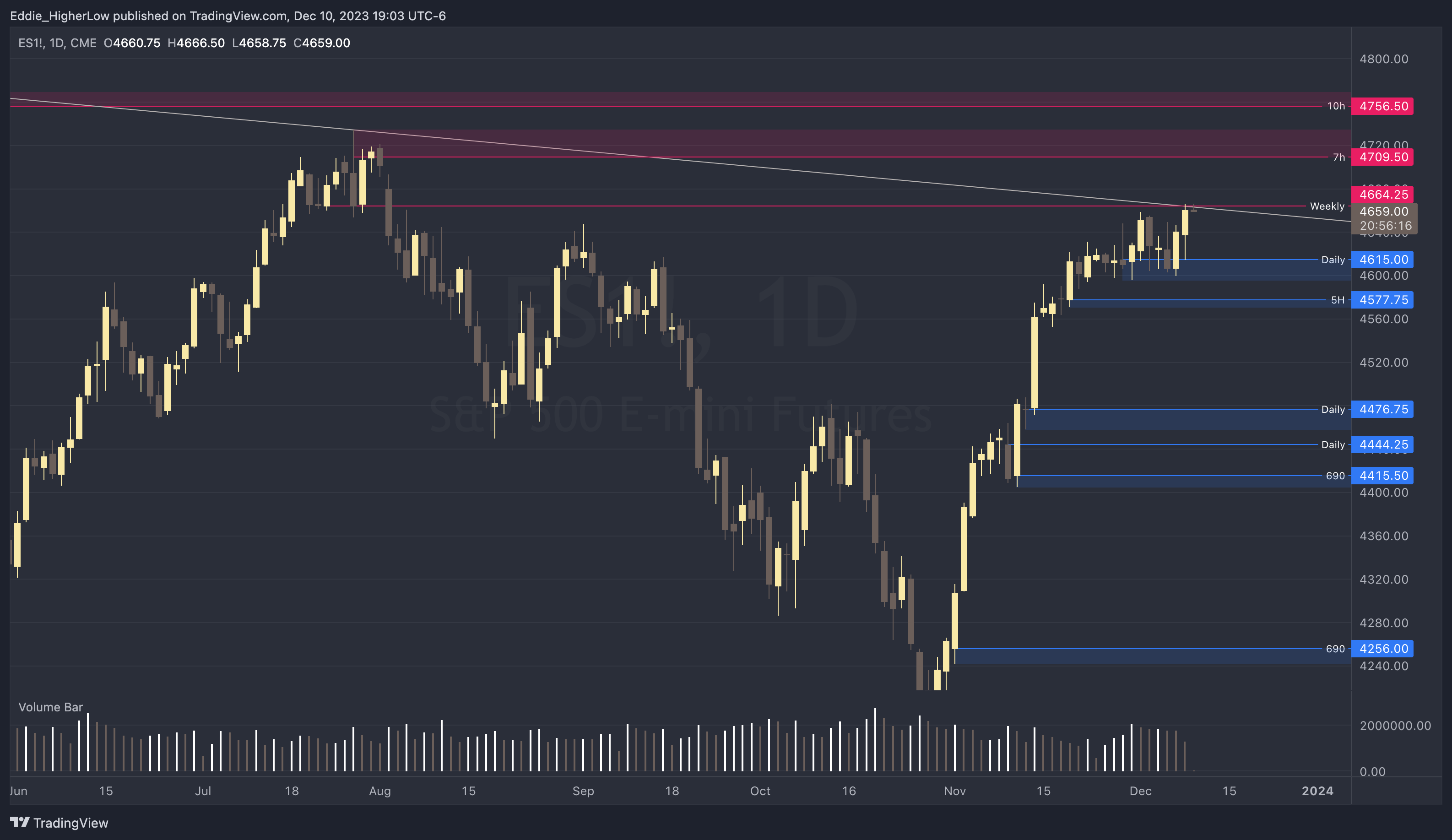

S&P Outlook

Bear Case: As of Friday, the price closed at a significant daily trend line, coinciding with 4613. It’s important to note that this week sees the expiration of futures contracts, leading to new contract levels. The adjusted level to watch is 4664.25 (equivalent to last week’s 4613). Bears will aim to keep the price below this level. If they succeed, the next likely target is the daily demand at 4615.

Bull Case: The price is currently at a critical daily trend line, with 4664.25 being a key level (equivalent to 4613 in the previous futures contract). For a bullish trend to establish, it is essential for bulls to break and sustain above 4664.25. The next supply level to watch above this is 4709.50. Should the price retrace, 4615 may provide potential support.

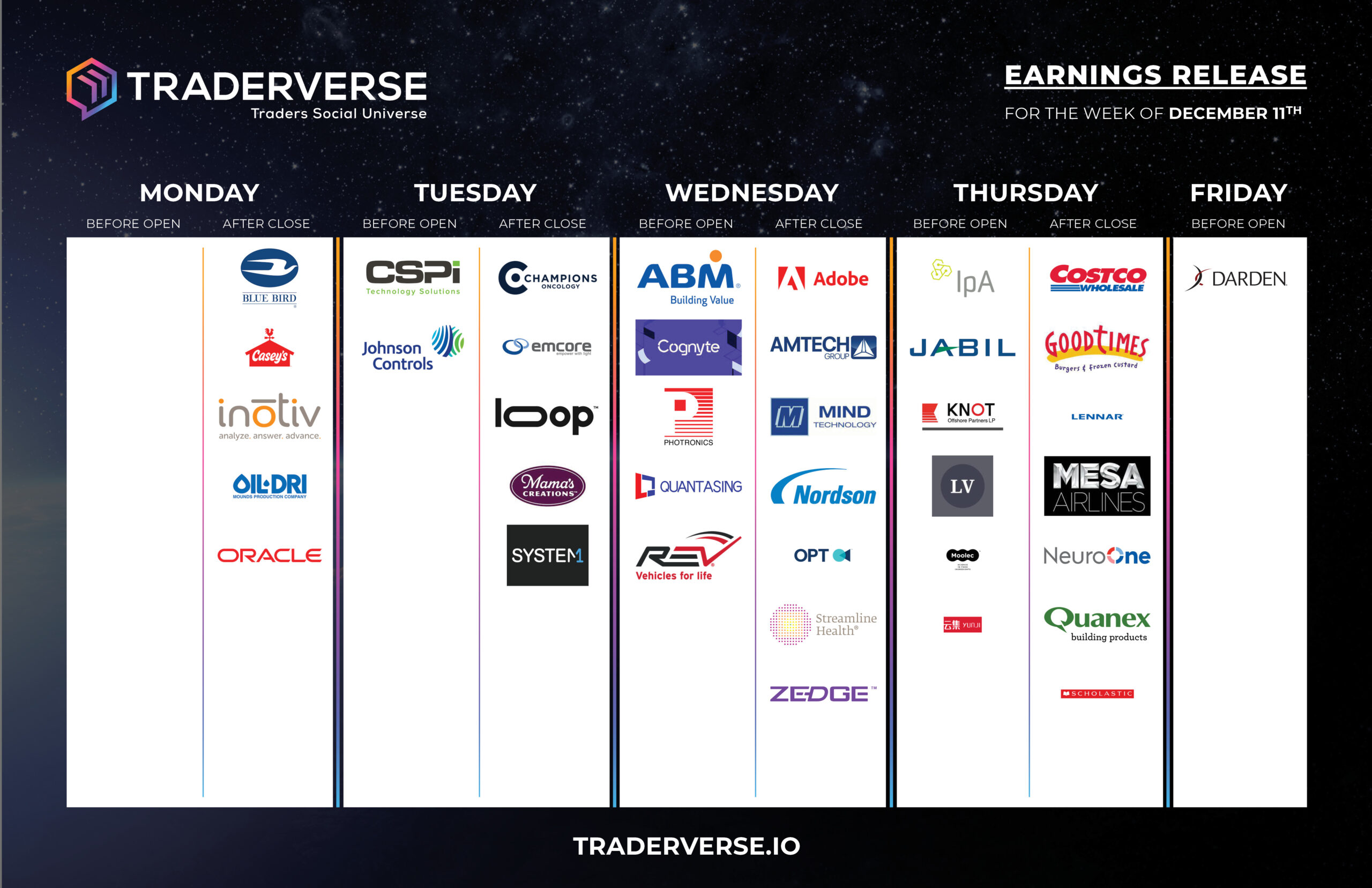

EARNINGS RELEASE CALENDAR

FOR WEEK OF DECEMBER 11TH

Expert Insights & Predictions

Outlook on Upstart Holdings

This week, I will be zoning in on a ticker I haven’t looked at in what seems like years, $UPST.

A massive fall from all time highs BUT with that being said, a chart that to me looks like it has the potential for a massive move. We are currently in the middle of the Mando Model, which is a market structure shift, retracement into a discount imbalance, and rip to previous high, which in this case is 72.58.

Thus far, we’ve made a perfect retracement into the bullish imbalance just below that 79% Retracement and bounced. We have one large imbalance to move through before getting back to that high. Above that high at 72.58, the next level of Buyside liquidity is the high of 94.43 dating back to May of 22.

I am looking at this name from the weekly perspective so it can absolutely take some time to get to my ultimate destination, but a name that has absolutely drawn my attention. — @MandoTrading

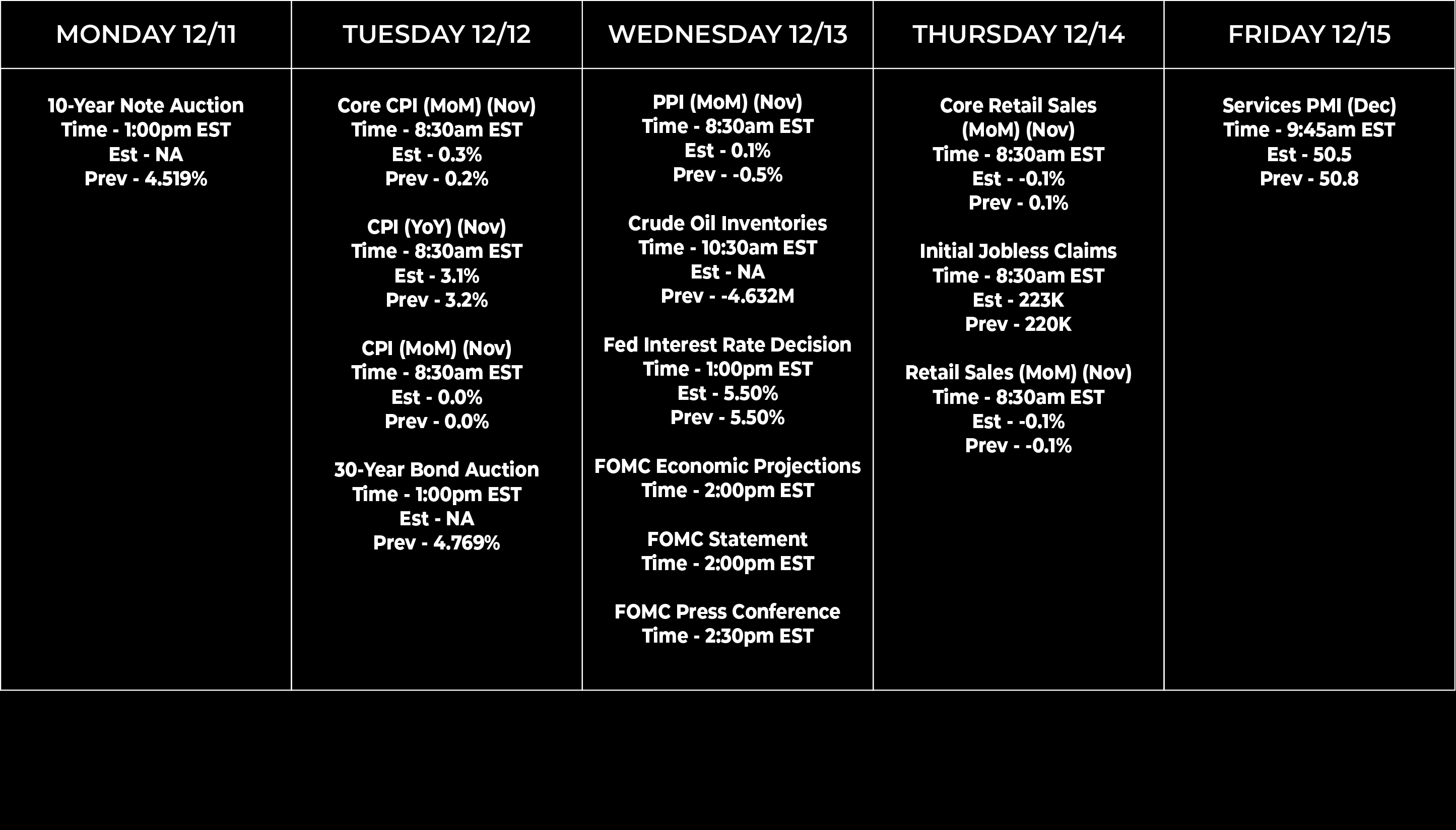

Economic Data Calendar