WEEK OF NOVEMBER 20, 2023

Welcome to the Traderverse Weekly Newsletter!

TRADERVERSE Updates

Driving Collaboration:

TRADERVERSE promotes collaboration by creating a robust ‘universe’ for traders. It offers extensive chat functionality, shared note-taking tools, and real-time inputs from peers, enabling traders to work together to achieve common objectives and make informed decisions.

If you haven't reserved your spot, Sign Up to test Traderverse Alpha!

Important Prices

What’s Moving The Markets?

OpenAI Fires CEO

The board of OpenAI, the company behind ChatGPT, has ousted CEO Sam Altman due to concerns about inconsistent communication, appointing Chief Technology Officer Mira Murati as interim CEO and initiating a formal search for a permanent replacement, causing shock waves in the tech industry.

US Inflation Falls

US inflation has decreased to 3.2%, marking the first decline in annual rates in three months, a positive development for policymakers and the Federal Reserve, indicating a potential ongoing downtrend in inflation over the last several months, with prices showing a modest 0.1% increase compared to the previous month.

Companies Halt Advertising on X

Elon Musk has threatened legal action against media watchdog Media Matters and individuals criticizing his social media platform X, facing scrutiny after major US companies suspended advertising due to the promotion of antisemitic content on the site since Musk’s acquisition in 2022.

Spot Ethereum ETFs

BlackRock and Fidelity, two major asset managers with a combined $13.5 trillion in assets, have separately filed for Spot Ethereum ETFs, potentially paving the way for institutional clients to enter the cryptocurrency market pending approval by the SEC.

Upcoming Crypto Downturn

JPMorgan analysts have expressed skepticism about the cryptocurrency rally, stating that even if a spot Bitcoin ETF is approved, it may not attract new investors, as funds are more likely to shift from existing Bitcoin-related products rather than bringing in fresh capital.

Bitcoin and Ethereum Futures

Cboe, the largest US options exchange, is gearing up to launch margined Bitcoin and Ethereum futures in January, a move expected to boost overall crypto market activity by enabling traders to use a percentage of the position upfront, potentially leading to significant gains or losses.

S&P Outlook

Bear Case: Possible areas above that may act as resistance with first one sitting at 4556.50. Above this, 4565.75 which has rejected price in the past. If defended, bears will need to break below 4300 with first target being 4425.75 which could act as support with demand zone.

Bull Case: Bulls were able to break and hold above 4300 and will need to defend if price retraces. Two Daily demand zones were created with first one sitting at 4425.75 and second at 4393.25. Heavy resistance above between 4556 and 4613 that bulls will need to break through.

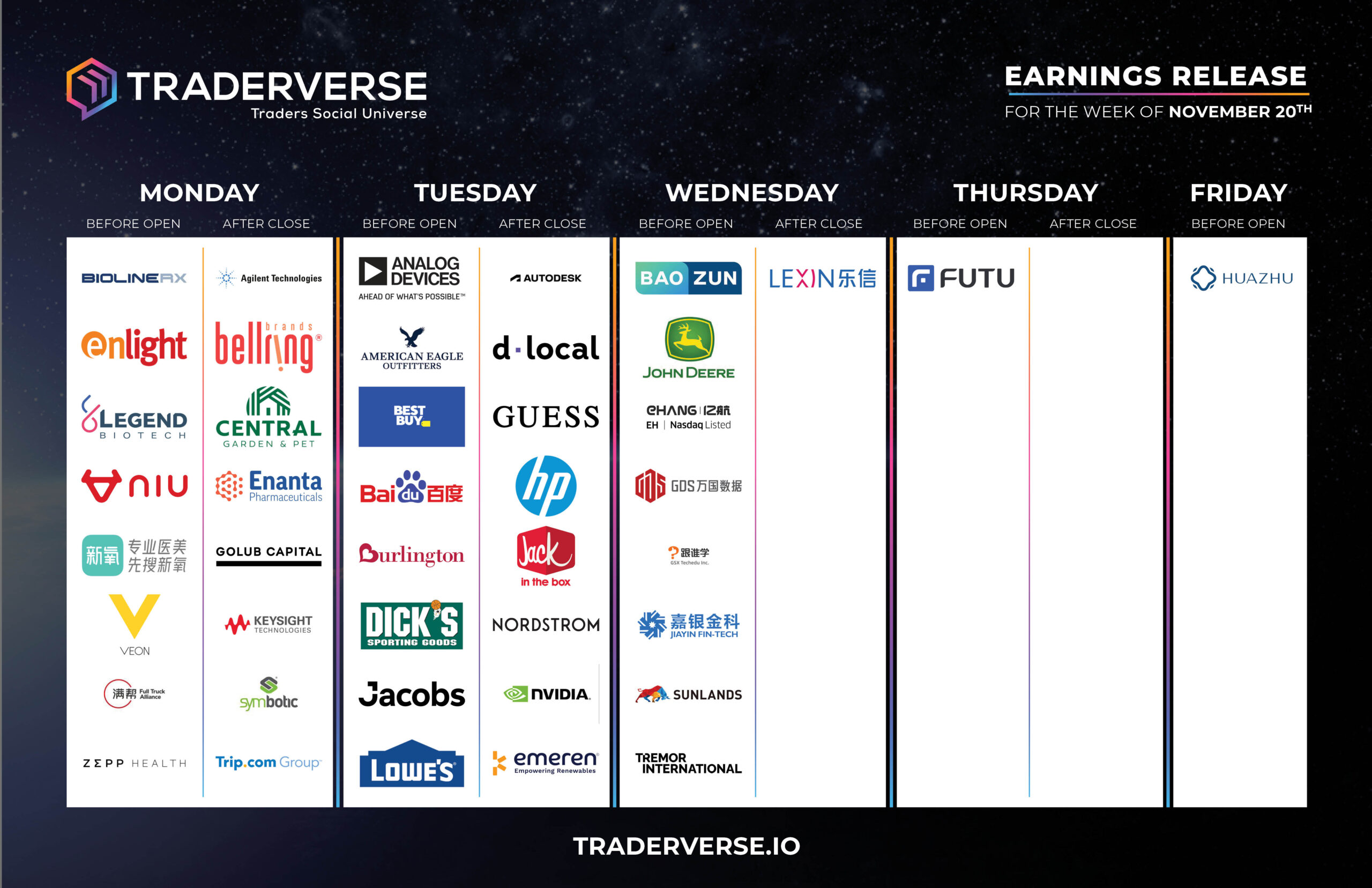

EARNINGS RELEASE CALENDAR

FOR WEEK OF NOVEMBER 20TH

Expert Insights & Predictions

Bitcoin Technical Analysis

Technical analysis is all about using historical price and volume data to predict future market movements. It involves studying charts, patterns, and indicators to make informed trading decisions.

Technical analysis can be a helpful tool for traders to identify trends, support and resistance levels, and potential entry and exit points. It’s a helpful tool for analyzing stocks, crypto,FX commodities, and other financial markets.

Here we see Bitcoin holding strong on its trendline, making its way towards the 44,000 level. — @SDX_Trades

Economic Data Calendar