WEEK OF NOVEMBER 13, 2023

Welcome to the Traderverse Weekly Newsletter!

TRADERVERSE Updates

Curating Financial Education:

TRADERVERSE offers an exclusive social network where traders can learn from each other, share ideas, and gain insights. It also provides intuitive research tools and an Intelligent Assistant to enhance educational opportunities for traders at all levels.

If you haven't reserved your spot, Sign Up to test Traderverse Alpha!

Important Prices

What’s Moving The Markets?

Musk To Integrate AI To X Platform

Elon Musk’s AI startup xAI will be integrated into his social media platform X and offered as a standalone app, with the release of its first AI model, Grok, designed to answer questions with humor and available to X Premium+ subscribers.

Oil Prices Slipping

Oil prices dropped to their lowest in more than three months, driven by worries about declining demand in the US and China, as market focus shifted from potential Middle Eastern supply disruptions to a perceived easing in the supply-demand balance.

Moody’s Negative US Credit Rating

Moody’s downgraded the US credit outlook from “stable” to “negative” on Friday, citing America’s deteriorating fiscal condition and the repercussions of political dysfunction.

UK Stablecoin Regulation Plan

The Bank of England has unveiled a plan, in collaboration with the Financial Conduct Authority, to regulate the stablecoin cryptocurrency market in accordance with rules set by the UK government to oversee the broader digital asset industry.

Bitcoin ETF By January

BlackRock expresses confidence in the Securities and Exchange Commission approving its Spot Bitcoin ETF by January, following the $9 trillion asset management firm’s registration for an Ethereum Trust in Delaware.

Blackrock Files Ethereum ETF

BlackRock officially submitted its Spot Ethereum ETF filing with Nasdaq, registering its iShares Ethereum Trust in Delaware, with plans mirroring its pending Spot Bitcoin ETF, though regulatory approval from the SEC is required amid the agency’s cautious stance on broadening access to crypto through spot ETFs.

S&P Outlook

Bear Case: Price closed at 4430 level which also lines up with a trend line. Bears will want to continue defending 4430 with next possible target at Daily demand that begins at 4393.25. If price is able to trade above 4430, next possible supply sits at 4491.25.

Bull Case: 4430 continues to be major pivotal level that bulls will need to break above and hold and target next supply at 4491.25. If price trades below 4400, 4393.25 could act as possible support. if price breaks below 4352, not much demand has been formed until 4205.

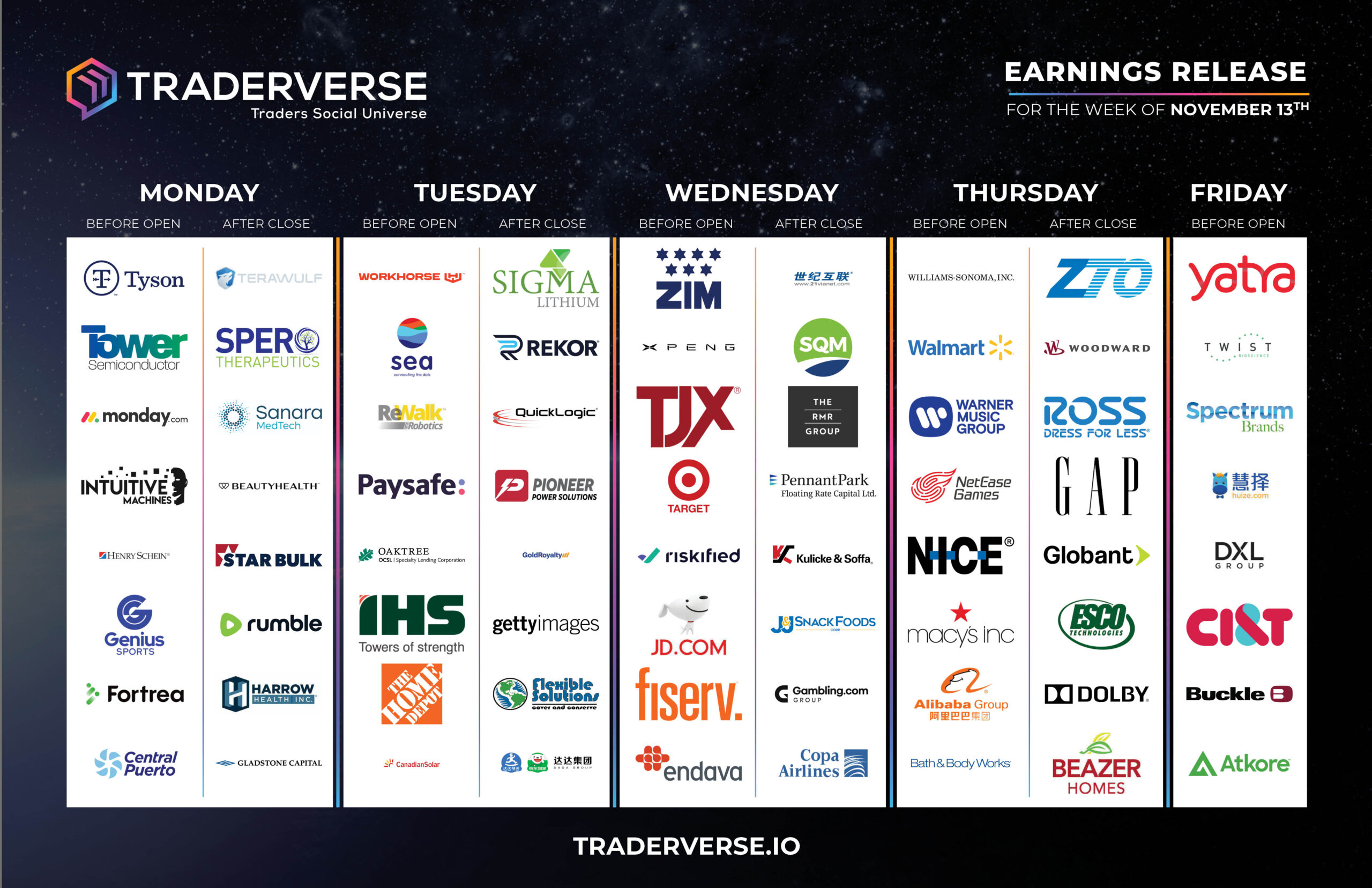

EARNINGS RELEASE CALENDAR

FOR WEEK OF NOVEMBER 13TH

Expert Insights & Predictions

SPY & QQQ Outlook

Friday’s opening bell saw SPY dip, double top, then fall into a falling wedge. Price action never fell below Thursday’s sell-off lows. It was up from there.

For this week, QQQ has shown relative strength, breaking out of a daily wedge. SPY remains under.

Which one catches up? Does QQQ fall back into the wedge or does SPY follow suit and break through?

No matter what happens, we will likely get what we got on that falling wedge pop on Friday: a retest.

Safest trading would wait for that. — @KeanuTrades

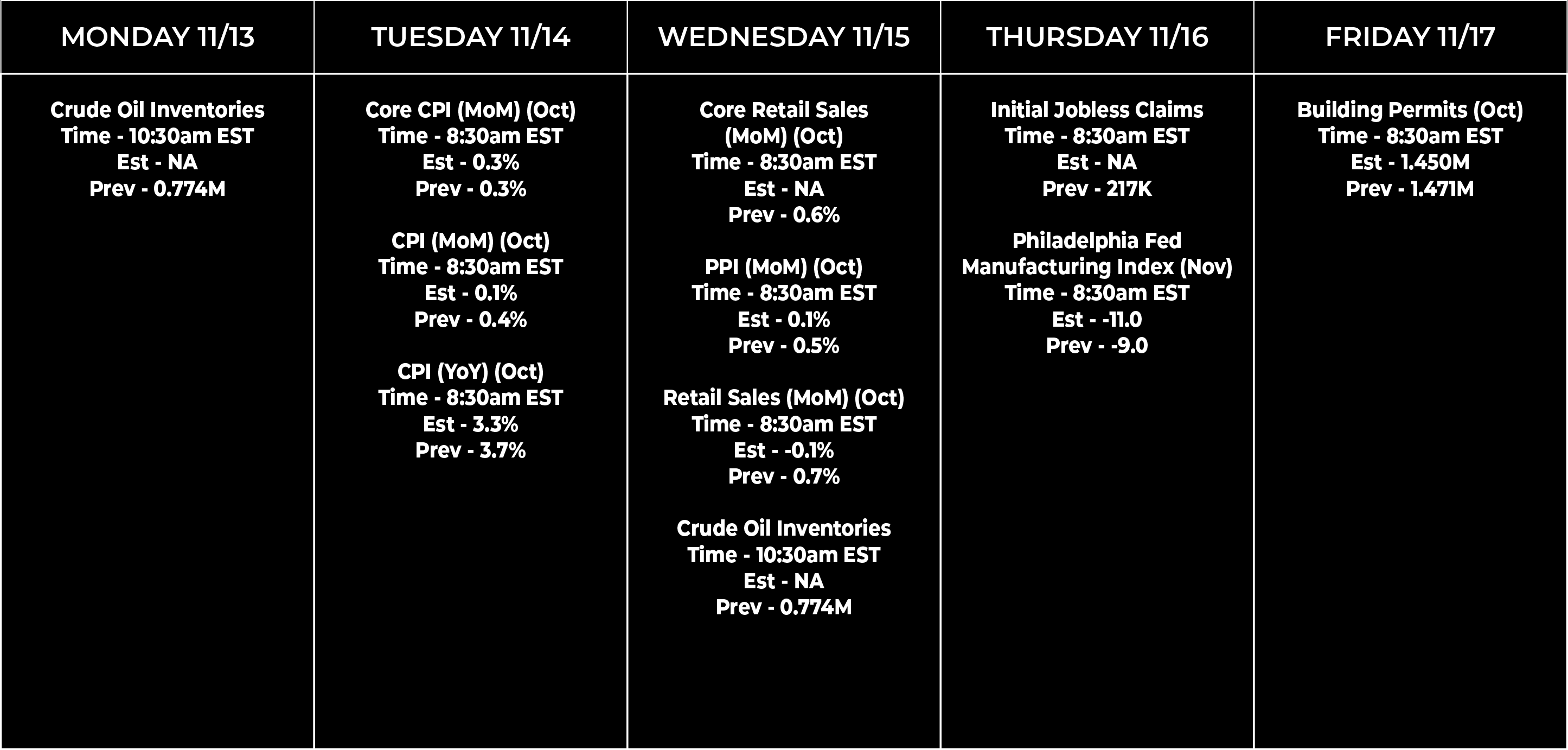

Economic Data Calendar