WEEK OF FEBRUARY 5, 2024

Welcome to the Traderverse Weekly Newsletter!

TRADERVERSE Updates

Strategic Integrations:

Traderverse has strategically entered into open API integrations with a wide array of prominent companies in the financial industry. This includes Fidelity Investments, CommSec, Stake UK, Wealthsimple Trade, Questrade, Coinbase, Unicoin, Webull, Degiro, Zerodha, Charles Schwab, E*TRADE, Tradier, Robinhood, Alpaca, Stake AUS, Vanguard, Binance, Bitbuy, Kraken, TradeStation, and TD Ameritrade,

If you haven't reserved your spot, Sign Up to test Traderverse Alpha!

Important Prices

What’s Moving The Markets?

Fed Keeps Current Interest Rates

The Federal Reserve has maintained its current interest rates at 5.25%-5.50% during the first decision of 2024, consistent with the last three meetings, sparking speculation about potential future rate cuts despite positive inflation data.

Russia Adamant About Ditching The US Dollar

Russia has declared that prioritizing the abandonment of the US Dollar is its top agenda for 2024 as it prepares to assume the chairmanship of the BRICS alliance, focusing on the discussion of the current financial state of the global economic order.

Donald Trump Wants New Fed Chair

Donald Trump has announced in a Fox Business interview that if elected president in 2024, he plans to dismiss Federal Reserve Chair Jerome Powell, accusing him of being “political,” and mentioned having undisclosed alternative candidates for the position.

FTX Anticipates Full Repayment

In a recent court hearing, FTX, the now-defunct crypto exchange involved in one of the largest financial crimes in US history, anticipates repaying its customers in full during bankruptcy liquidation, dispelling rumors of a relaunch as no buyers for the platform have emerged.

Bitcoin ETFs Hold 3.3% Of Current Bitcoin Supply

Spot Bitcoin ETFs in the US, having garnered 3.3% of the current Bitcoin supply within a month of approval, indicate a significant shift in Bitcoin dynamics and a growing interest in institutional Bitcoin investment, accumulating $197 million in net inflows by the end of January.

Google Now Allowing Crypto Ads

In a significant policy shift, Google now allows the advertising of Bitcoin and other crypto trust products, leading to companies like BlackRock and VanEck promoting their Spot Bitcoin ETFs on the platform, with all 11 approved ETFs expected to follow suit under the updated policy.

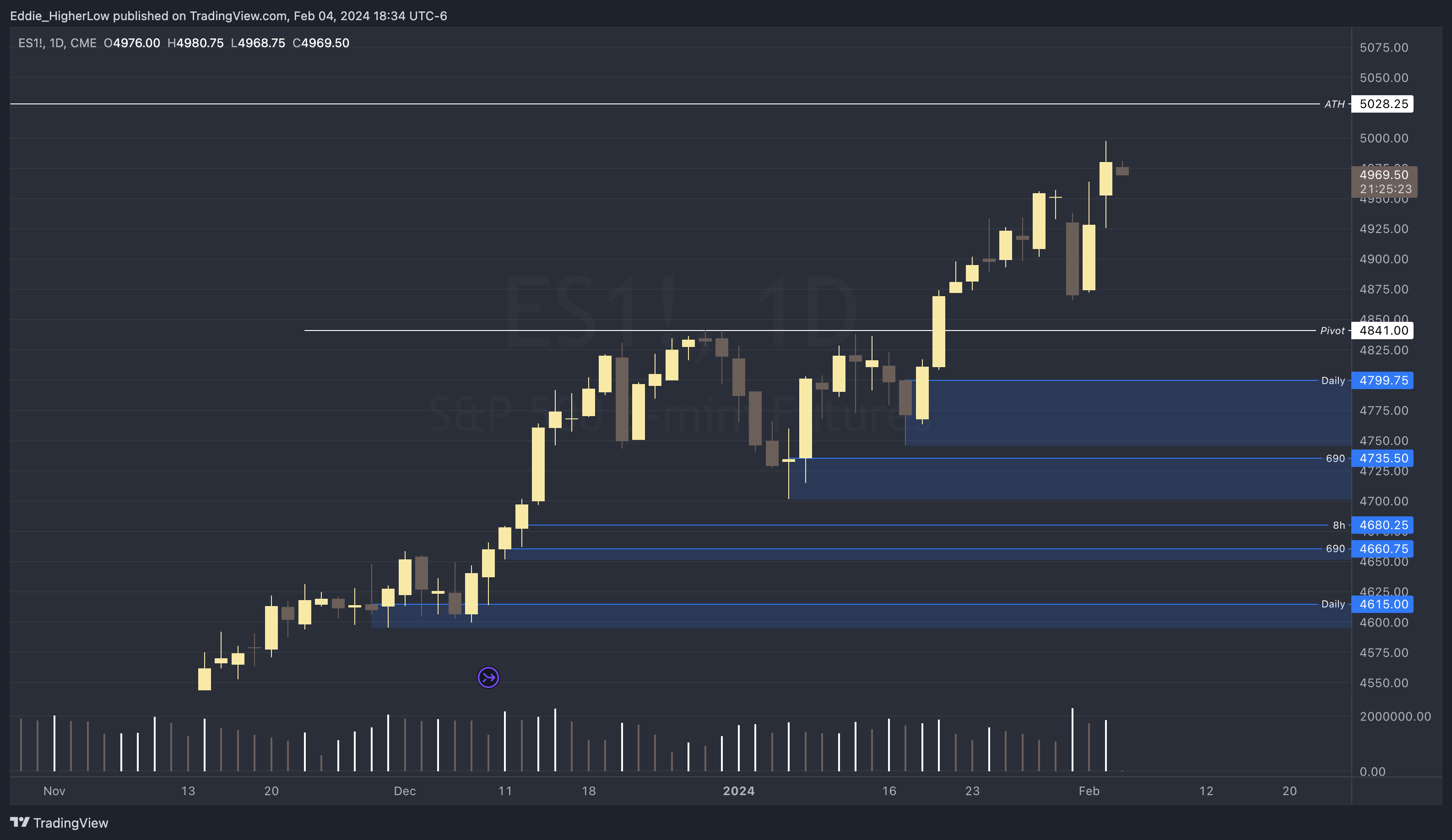

S&P Outlook

Bear Case: A pivotal move involves driving the price below the 4841 mark. The primary resistance to watch above this level is at 5028.25, which represents the high of December contracts. This level is crucial for bears, as overcoming it would be essential to validate any bearish trend in the market.

Bull Case: Bulls have successfully maintained the pivotal 4841 level, setting the stage for an assault on the next significant target at 5028.25. Should there be any retracement, the bulls aim to sustain the price above 4841, with an ideal support zone around 4880, to ensure the continuation of the upward trajectory.

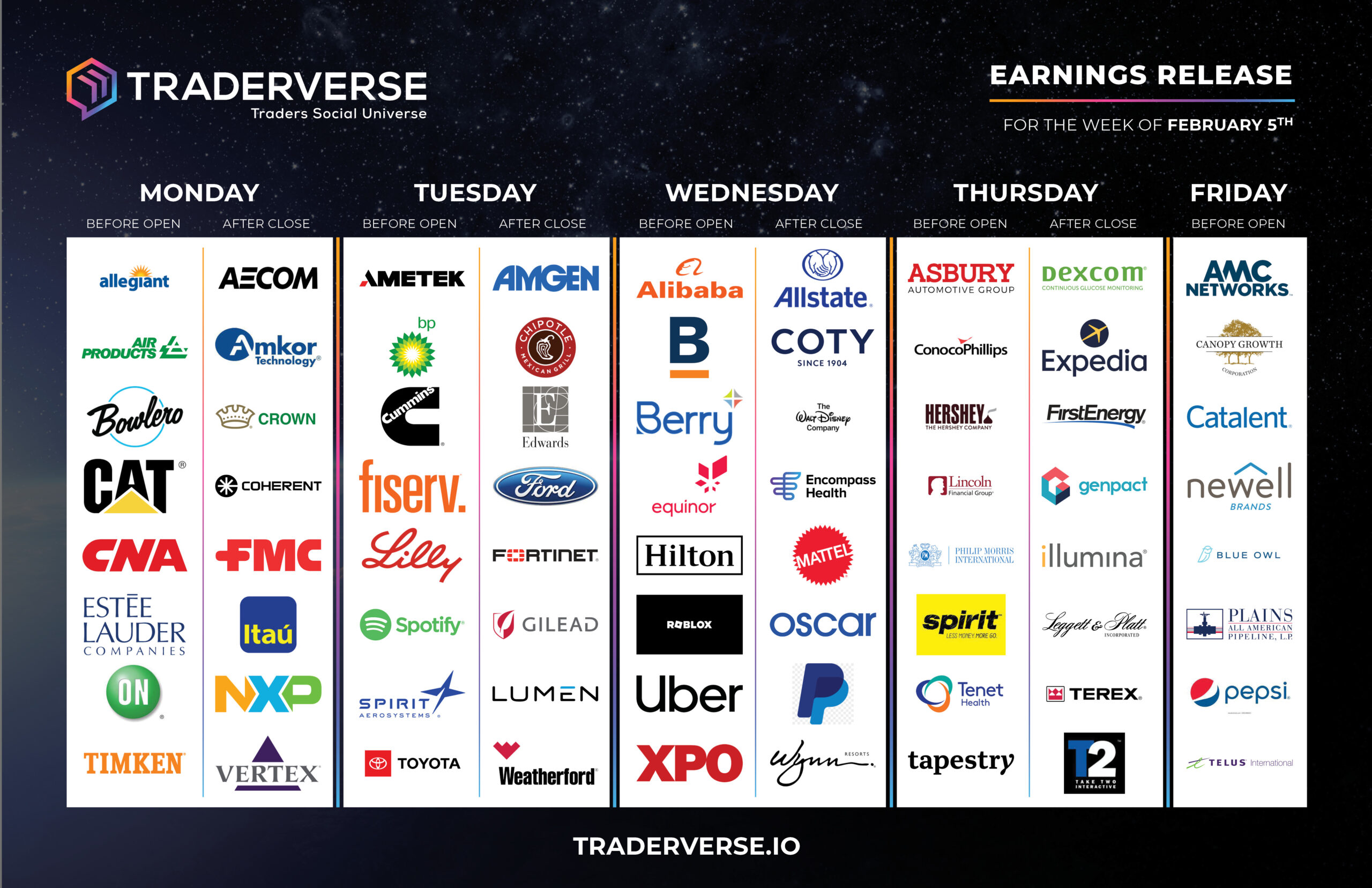

EARNINGS RELEASE CALENDAR

FOR WEEK OF FEBRUARY 5TH

Expert Insights & Predictions

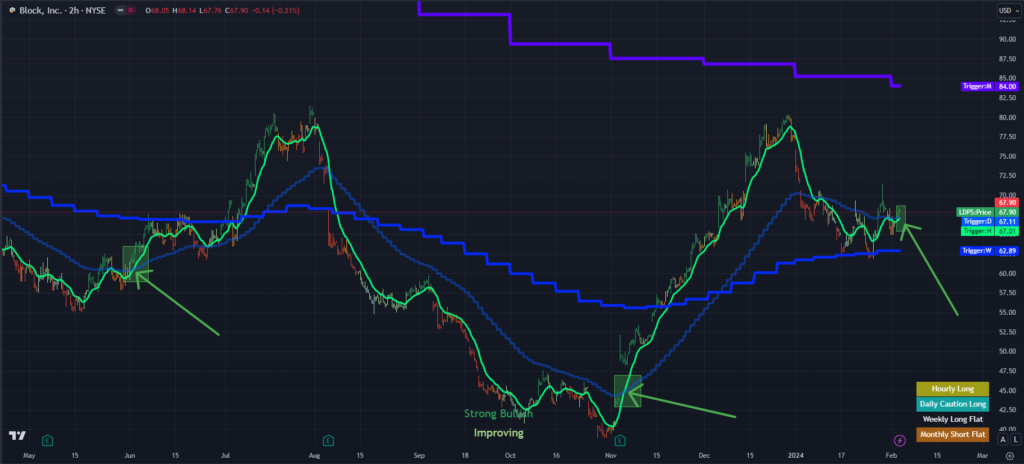

SQ is setting up a really nice upside trade this week if price can get an Hourly close (9:00am, 10:00am, 1:00pm, etc) above $68.33.

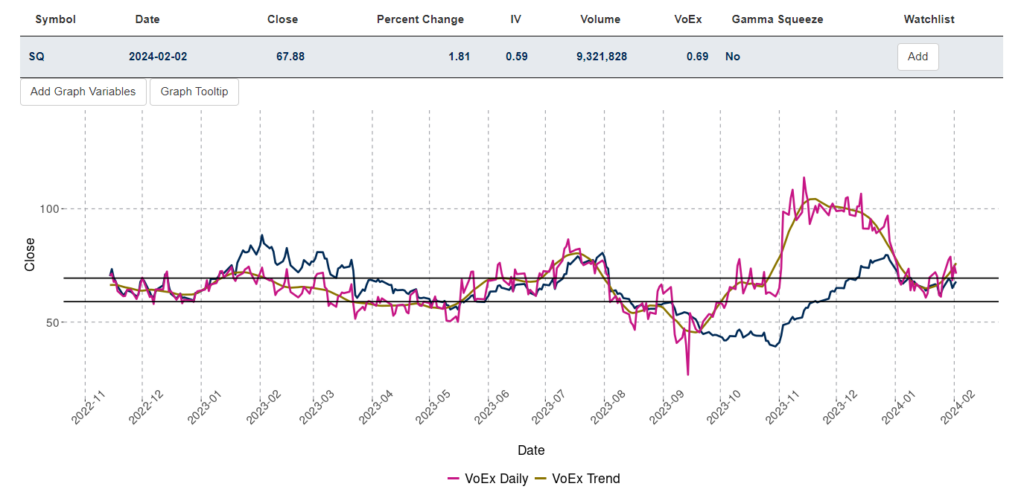

As you can see in the first chart, SQ tends to move well to the upside on Bullish Hourly Trigger/Daily Trigger crossovers. As long as there’s no gap down on Monday, SQ is set to incur a Bullish Hourly Trigger/Daily Trigger crossover in the first or second hour of the trading week, and should that happen, upside will be expected over the coming weeks/months.

-VoEx is in the Inhibition Zone (a bullish finding)

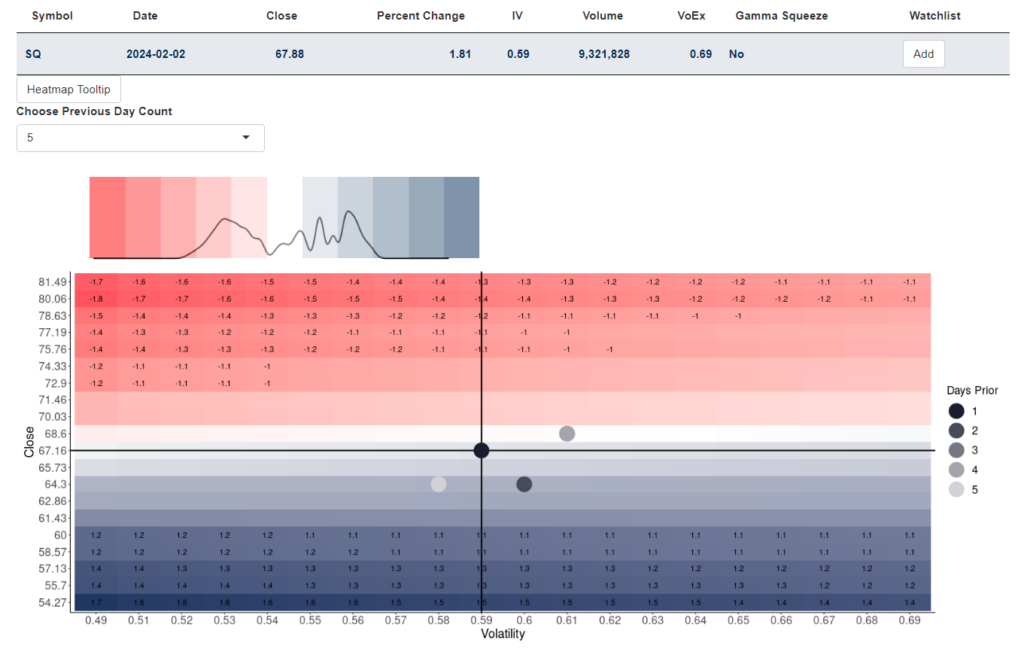

-The Hedging Heatmap shows robust purchasing support below price, which tells us that dips will more than likely be bought right back up as Dealers are forced to purchase shares to hedge their positions.

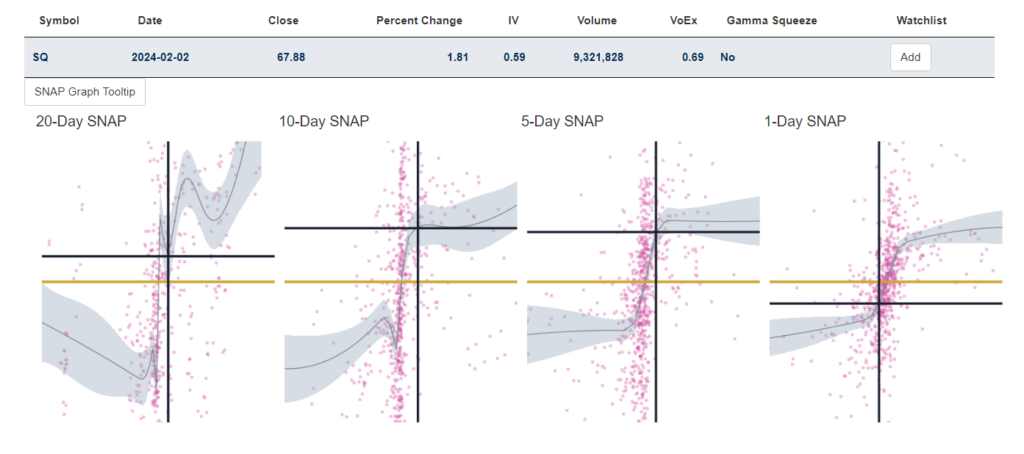

-The snap graphs offer a bearish prediction for Monday, but are bullish on the next 5,10 and 20 trading days.

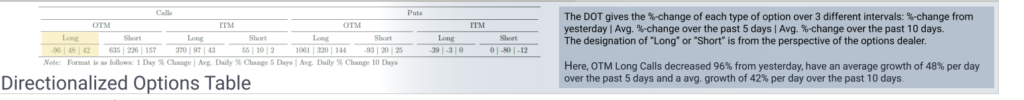

-The options table shows a 1425% increase in call buying on Friday, along with a 592% increase in put buying. Obviously, big money seems to think a big upside move is coming as well.

Day Trade: Wait for price to get an Hourly close above the $68.33 level. Once that happens, odds are quite high that price will gravitate higher to the $71.77 level, which is the target for this trade. The stop loss for this trade will be if after price gets an Hourly close above the $68.33 level, it then gets an Hourly close back below the level.

Swing Trade: As long as price remains above the Daily Trigger at $67.11, we expect price to move higher over the coming weeks/months to the Monthly Trigger at $84.00. As long as price remains above the Daily Trigger, this Bullish Hourly Trigger/Daily Trigger crossover can bring price all the way up to the Monthly Trigger at $84.00.

— @jrol17

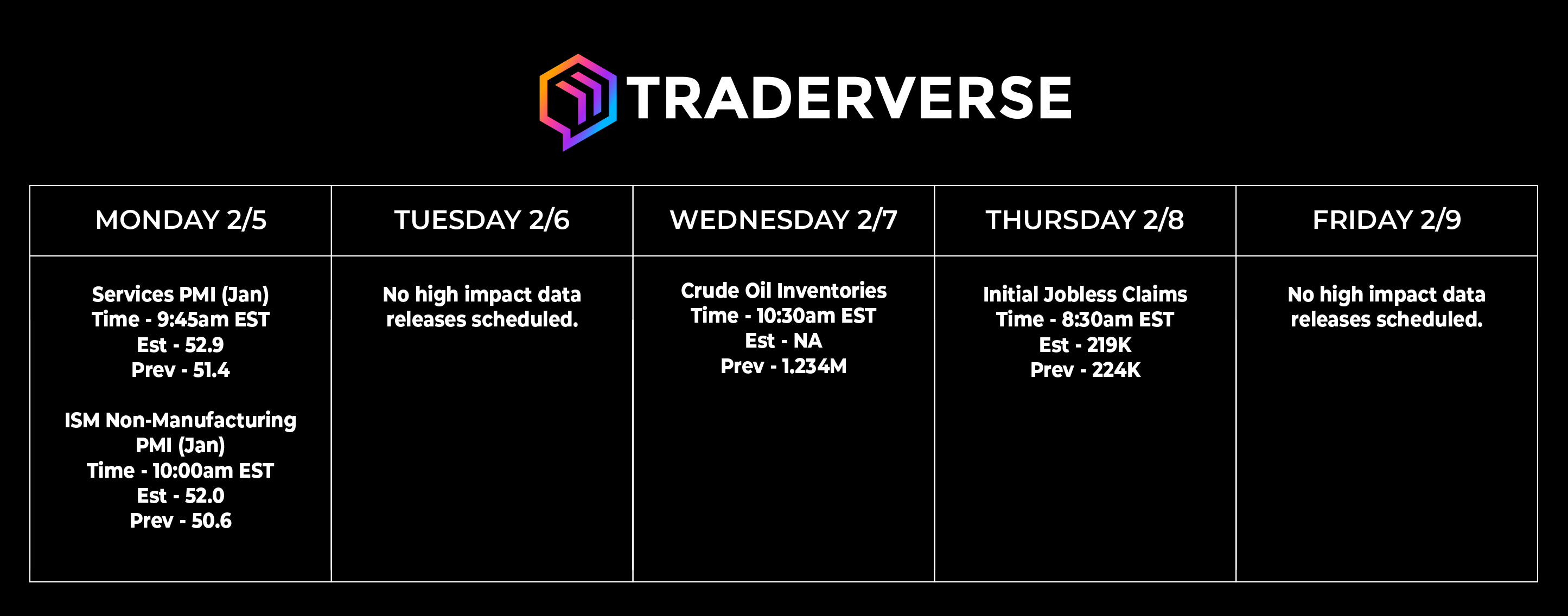

Economic Data Calendar