WEEK OF OCTOBER 9, 2023

Welcome to the Traderverse Weekly Newsletter!

TRADERVERSE Updates

After 18 months of development, we’re excited to share that we have opened a limited number of waitlist spots for the alpha version of our social platform for traders, TRADERVERSE!

Sign Up to test Traderverse Alpha!

Important Prices

What’s Moving The Markets?

Exxon’s Acquisition

Exxon Mobil is on the verge of acquiring Pioneer Natural Resources for around $60 billion, potentially securing the deal within days, thereby granting Exxon a significant foothold in the oil-rich Permian Basin.Grayscale Investments has submitted an official filing with the SEC to transform its Grayscale Ethereum Trust (ETHE) into a Spot Ethereum ETF, following a court victory against the SEC; this move is part of their efforts to convert their cryptocurrency trusts into exchange-traded funds.

Oil Prices Declining

Oil prices plummeted this week due to concerns about rising borrowing costs driven by higher interest rates potentially impacting economic growth, surprising investors who had recently witnessed prices approaching $100 a barrel amidst strong global demand and extended oil production cuts by Saudi Arabia and Russia.

Mortgage Rates Hit 22-Year High

US mortgage rates have surged to their highest levels in over 22 years, reaching an average of 7.5% for a 30-year loan, posing significant challenges for the housing market amid economic fragility and inflation-fighting interest rate hikes.

SEC Denied XRP Appeal

A federal judge has denied the SEC’s motion to appeal the XRP ruling with a trial date for unresolved issues being set for April 2024, potentially allowing the SEC to appeal the overall case after the trial, highlighting a victory for Ripple and a challenge for the SEC’s crypto regulation efforts.

Coinbase’s License In Singapore

Coinbase has obtained a full operating license in Singapore, the Major Payment Institution (MPI) license from the Monetary Authority of Singapore (MAS), enabling the exchange to expand its services for clients and institutional investors in the region.

Grayscale’s Ethereum ETF

Grayscale Investments has submitted an official filing with the SEC to transform its Grayscale Ethereum Trust (ETHE) into a Spot Ethereum ETF, following a court victory against the SEC; this move is part of their efforts to convert their cryptocurrency trusts into exchange-traded funds.

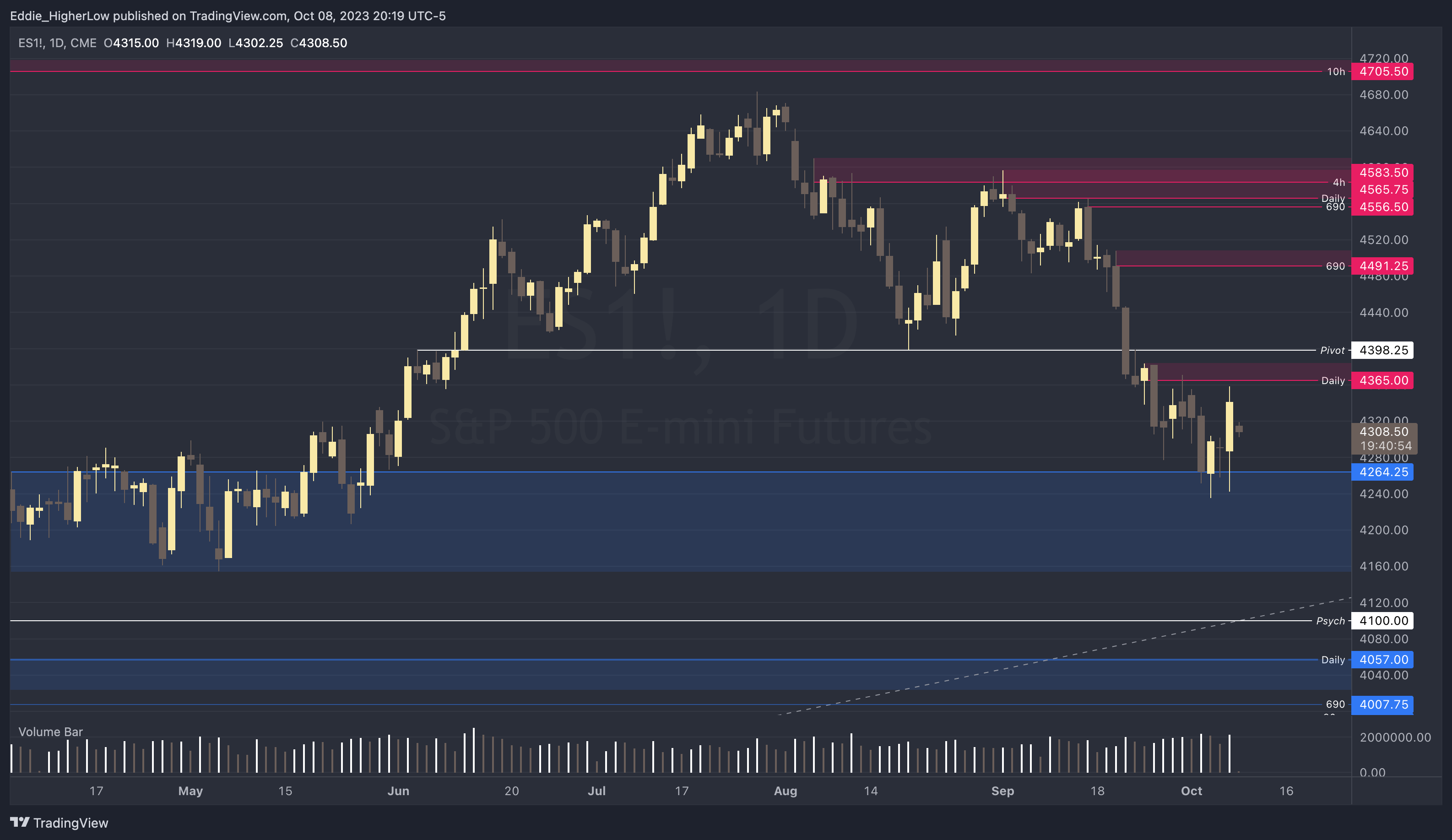

S&P Outlook

Bear Case: Daily supply at 4365 which has been tested and continues to reject price. Bears will need to continue to hold price below 4365 and break below demand that starts at 4264.25.

Bull Case: Bulls will need to break and hold above 4398.25 pivot to gain momentum. Price closed just above an area of heavy consolidation which might act as possible support. If price breaks below 4154, not much support until psychological level at 4100. If price is able to break above 4398.25, next strong supply sits at 4491.25.

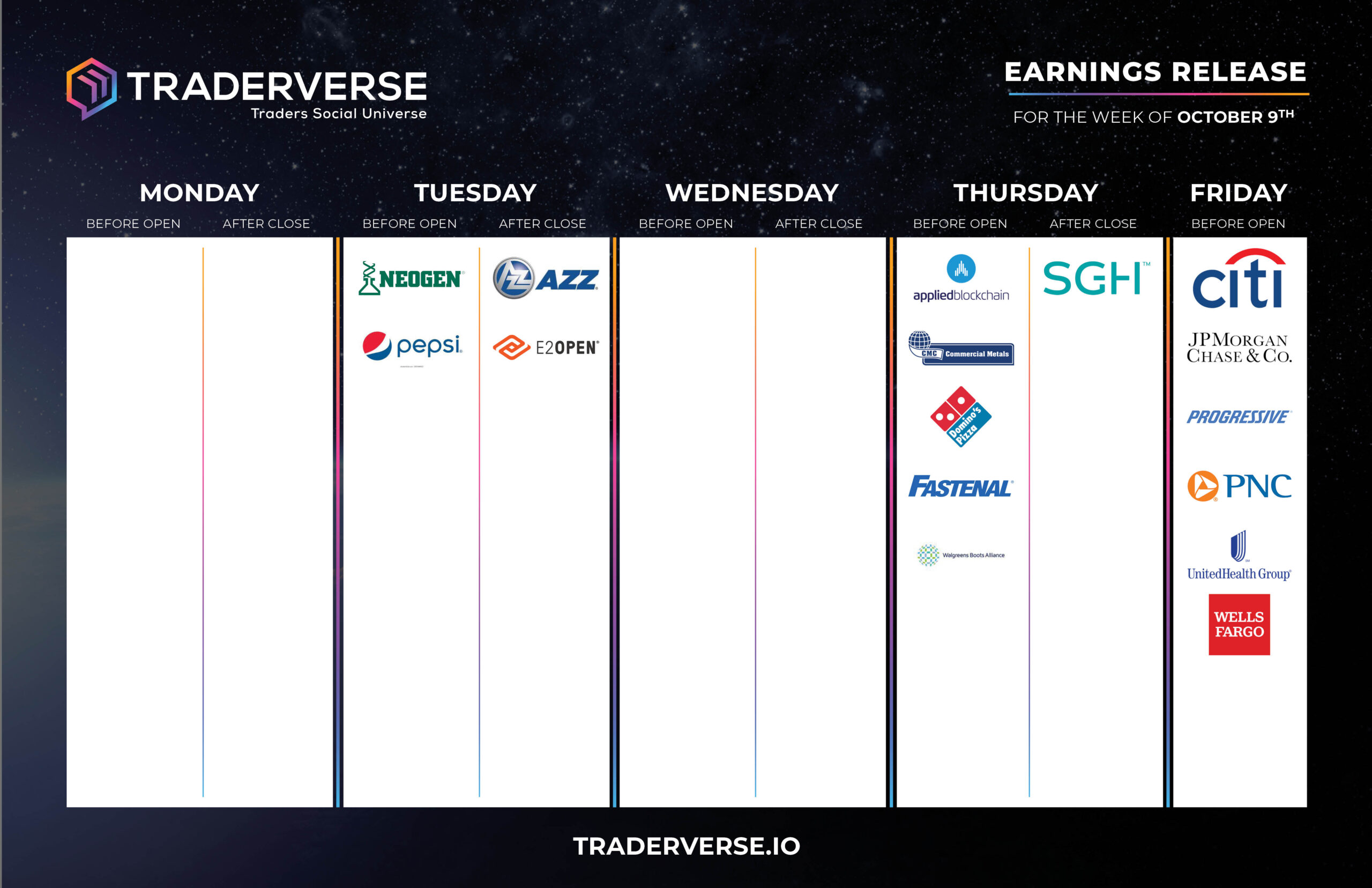

EARNINGS RELEASE CALENDAR

FOR WEEK OF OCTOBER 9th

Expert Insights & Predictions

Price action is getting very interesting for GALA. On the daily we can see a deviation being put in just below prior range low with a RSI breakout. If GALA can reclaim the prior wick range, low $.0154, then this coin will have more confirmation of bullish momentum.

On the 4h chart, we have confirmed a shift in behavior. For a lower risk and safer entry, I am looking to long the pullback zone between $.0136, $.014 assuming it holds.

In short, I am looking for:

a.) a reclaim (and possibly retest) of $.0154, then a target of $.0205 and $.0276

b.) a pullback into $.0136, $.014 and long strong into the same targets.

The Bearish/Failure scenario would be a harsh rejection at $.01548 after getting into the pullback zone

In terms of Bitcoin, I am looking for a power of 3 scenario where price action enters monthly fair value gaps 35,000-37,500. Once there, looking for $BTC to descend to new lows between 11,800-12,500 into 2024. — @cvotrades

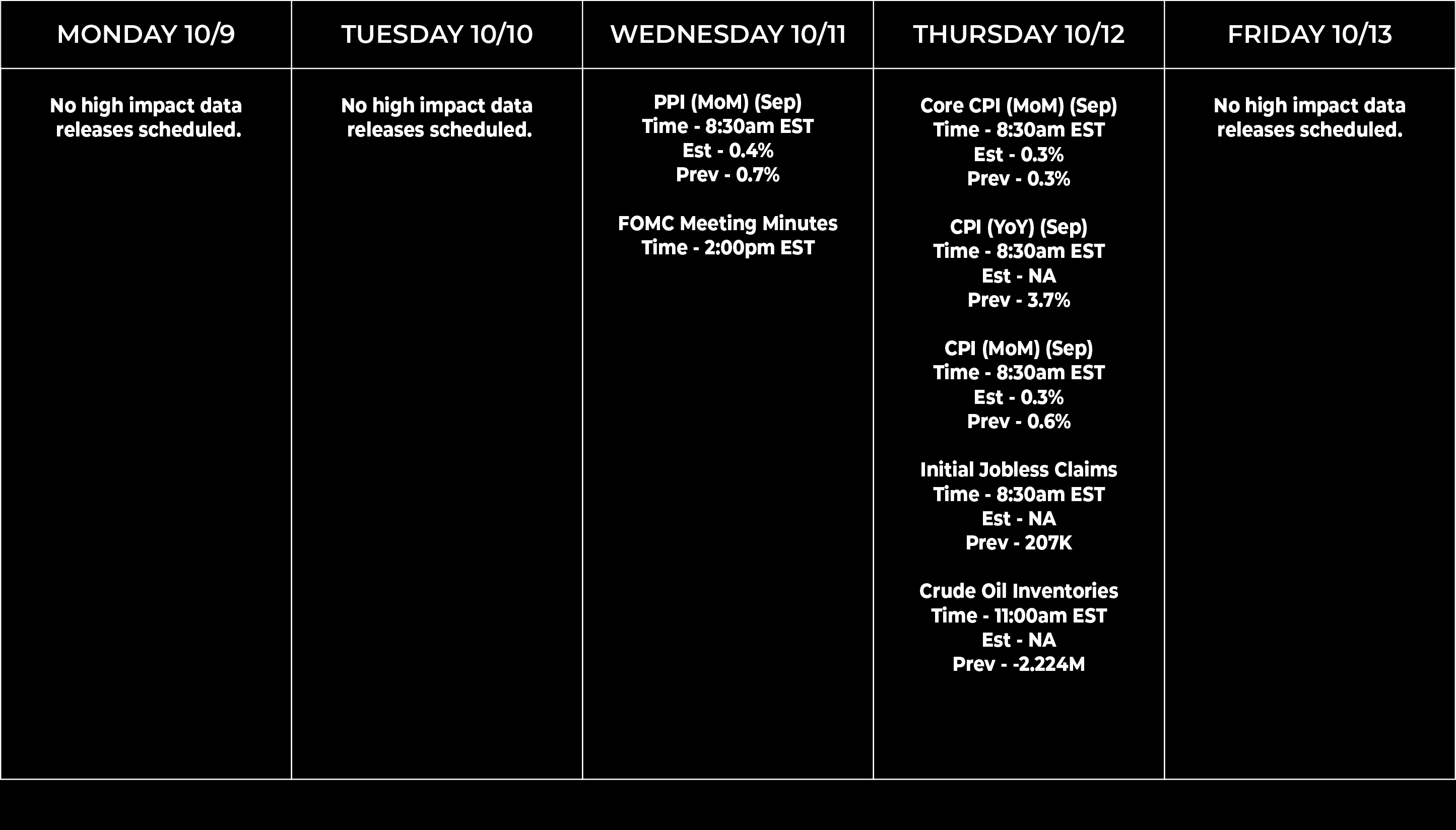

Economic Data Calendar