WEEK OF OCTOBER 30, 2023

Welcome to the Traderverse Weekly Newsletter!

TRADERVERSE Updates

Creating Discoverability:

TRADERVERSE offers powerful proprietary trading tools and collaborative features that enable traders to find, display, and interpret data efficiently. It provides real-time inputs from peers to help traders take advantage of market movements.

If you haven't reserved your spot, Sign Up to test Traderverse Alpha!

Important Prices

What’s Moving The Markets?

AI Chip Battle

Nvidia is expanding its reach into the personal computer market by designing CPUs for Windows operating systems in collaboration with Microsoft, challenging Intel’s traditional dominance, and targeting Apple’s Arm-based processors for Mac computers.

Honda & General Motors Ditch EVs

Honda and General Motors have decided to abandon their joint effort to develop affordable electric vehicles, shifting GM’s strategy towards profitability amid rising costs and United Auto Workers strikes, despite initially aiming to compete with Tesla in sales.

UAW Agreement With Ford

The United Auto Workers (UAW) union has tentatively agreed on a labor deal with Ford Motor, potentially ending a series of strikes and offering workers a 25% wage increase over a 4.5-year contract, setting a template for negotiations with other car manufacturers.

Bitcoin Surge

Bitcoin surged over 15% this week to reach over $34,500, its highest level in 18 months, amid growing anticipation of an imminent exchange-traded bitcoin fund approval by the U.S. Securities and Exchange Commission, which is expected to drive increased demand for the cryptocurrency.

SEC Reviewing Bitcoin ETFs

The US SEC Chairman, Gary Gensler, has disclosed that the commission is reviewing 8–10 spot Bitcoin ETF filings and could potentially issue the first approval of its kind in the United States, despite his previous critical remarks about the crypto industry.

FTX’s SBF Testifies

FTX founder Sam Bankman-Fried, in his fraud trial, testified that lawyers at his now-bankrupt cryptocurrency exchange played a role in crucial decisions central to the case, as he aimed to distance himself from wrongdoing and presented a defense argument of acting in good faith.

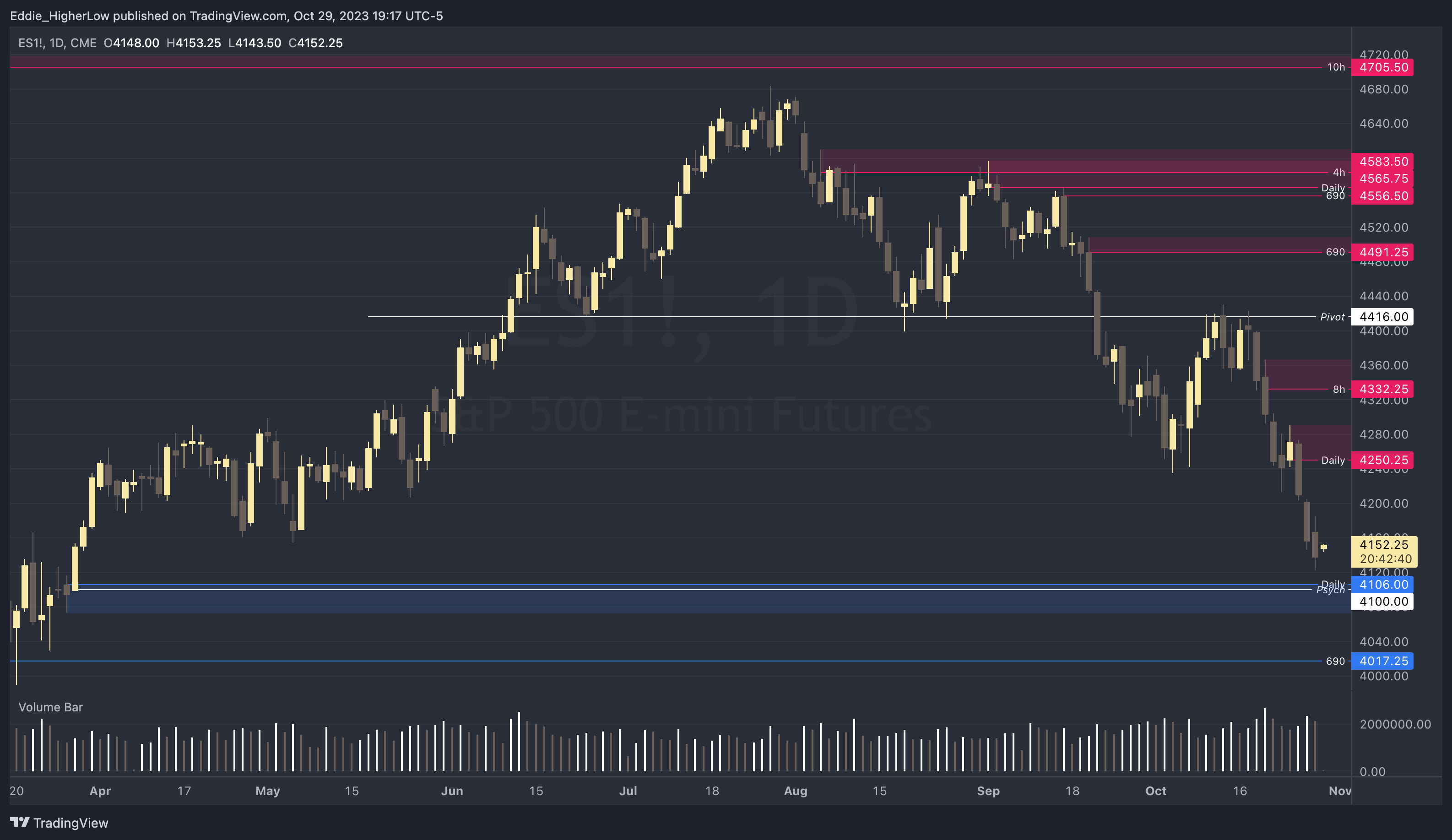

S&P Outlook

Bear Case: Bears continue to break through several support levels and created heavy Daily supply at 4250.25 where bears may look to defend. Currently trading right above a daily demand zone that starts at 4106. If price breaks below 4073.25, not much demand until 4017.25.

Bull Case: Price currently above a possible Daily demand at 4106. If this area is defended, next heavy supply sits at 4250.25. If price is able to trade above 4290.50, next supply sits at 4332.25.

EARNINGS RELEASE CALENDAR

FOR WEEK OF OCTOBER 30th

Expert Insights & Predictions

Amazon Closes the Week Green After Strong Earnings

While the S&P 500 and the Nasdaq closed the week with a -2.11% and -2.25% loss respectively. Amazon (AMZN) shares had a 6.83% day on Friday 10/28 after reporting strong earnings on the previous day, recovering all its losses and gaining +2.6% on the week.

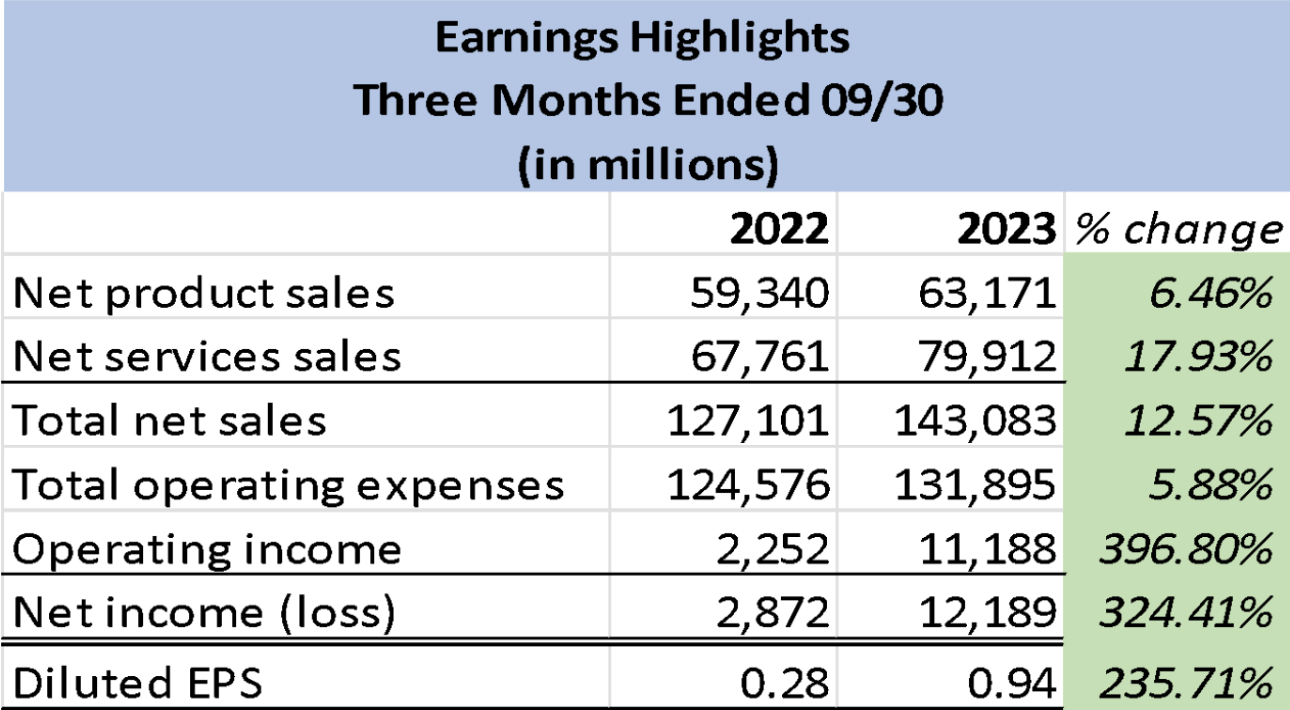

Earnings and Guidance

The company released its earnings for the Third Quarter of 2023. Reporting an increase of 13% in Net sales, $11.2 billion in Operating income, $9.9 billion in Net income, and 81% in Operating cash flow compared with the Third Quarter of 2022. Free cash flows also improved with an inflow of $21.4 billion for the trailing 12 months, compared to an outflow of $19.2 billion for the trailing 12 months that ended on September 30, 2022.

Additionally, the company reported a strong outlook for the Fourth Quarter of 2023 and it is expecting Net sales to grow between 7% and 12% compared with the Fourth Quarter of 2022. Amazon will be operating for its 29th holiday season which it described as “a particularly action-packed time of the year”.

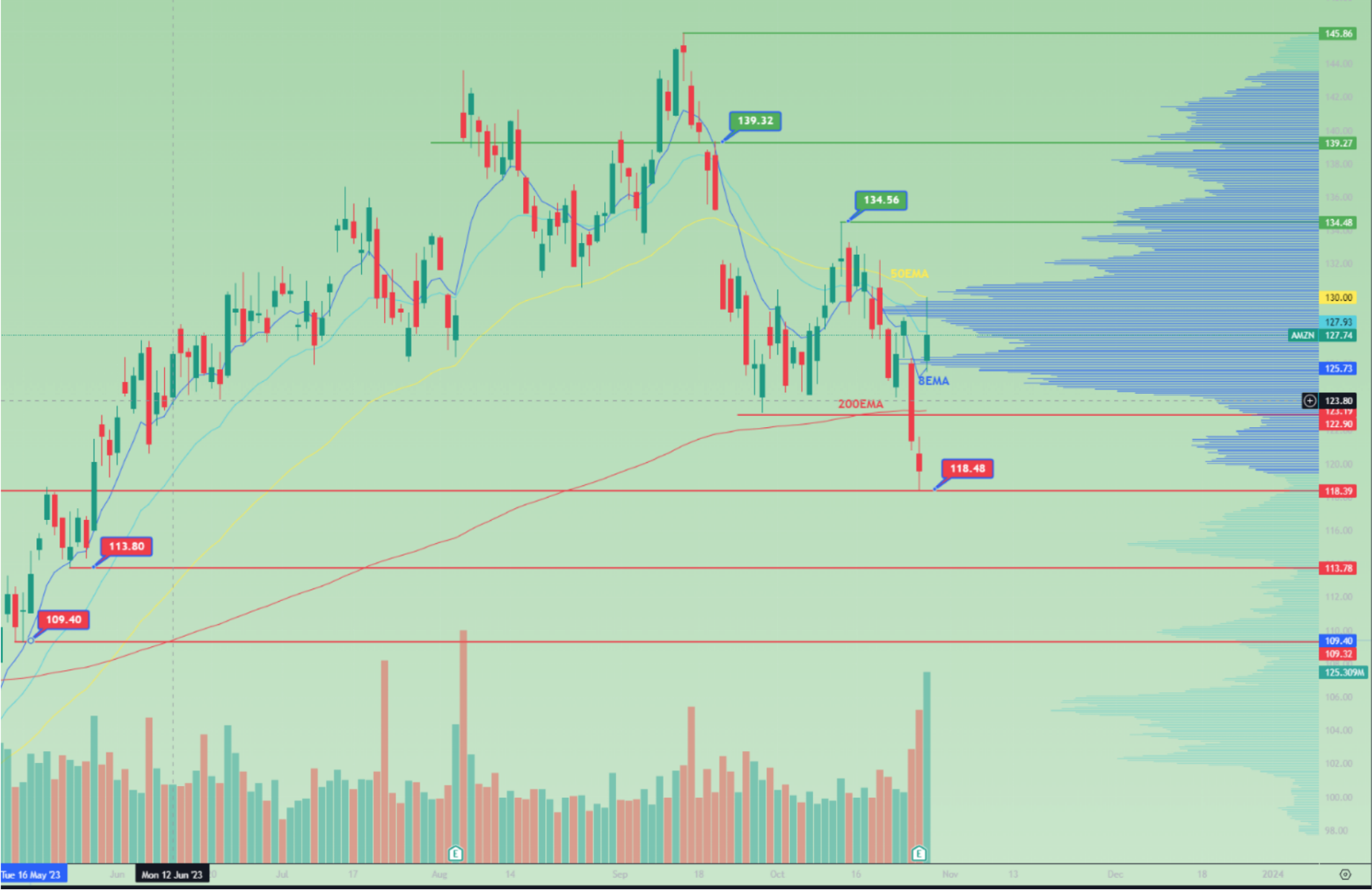

The Daily Chart

The stock lost the $120 psychological level on Wednesday and dropped below the 200 Exponential Moving Average (EMA) on Thursday. However, after the report, the stock reclaimed the 200EMA seeing a high of 130.08 on Friday but closing at $127.74 (+6.83%) after following the QQQ and SPY midday selloff.

Bull case

The stock found support on Friday at $125.6 and the 8EMA. Holding this price will give the bulls confidence to restest $130 and the 50EMA. At those levels, resistance can be expected and bulls will have to come stronger if they want to push the price back to $134.5 which was 10/12 highs. Eventually, if the uptrend continues a support/resistance flip can be considered at the $139.3 area which was support in August and Resistance in September.

Bear case

The bear case is simple, if the stock gives up all its gains from Friday by breaking under the 200EMA the next support will be $118.4 from Thursday 10/27, the same level that worked as resistance in mid-May of this current year. Under this level, there is a gap down to 113.8 (support from 05/23) and 109.4 (support from 05/12).

Economic Data Calendar