WEEK OF OCTOBER 16, 2023

Welcome to the Traderverse Weekly Newsletter!

TRADERVERSE Updates

After 18 months of development, we’re excited to share that we have opened a limited number of waitlist spots for the alpha version of our social platform for traders, TRADERVERSE!

Sign Up to test Traderverse Alpha!

Important Prices

What’s Moving The Markets?

Asia’s AI Regulation

Southeast Asian countries are pursuing a business-friendly approach to AI regulation, diverging from the EU’s strict standards, as they draft an “AI ethics and governance” guide that prioritizes feedback from tech giants like Meta, IBM, and Google, potentially creating a divergence from the EU’s push for global AI rules.

Record EV Sales

In Q3, US electric vehicle sales exceeded 300,000 for the first time, but Tesla’s market share dropped to a historic low, now holding just 50% of the market, down from 62% at the beginning of the year, despite aggressive pricing strategies.

Airlines Halt Flights To Israel

International airlines suspended or reduced flights to and from Tel Aviv, and Russia imposed a ban on night flights to Israel, in response to increased safety concerns following a surprise attack by Hamas militants and the threat of an escalating conflict, resulting in significant flight disruptions.

Bitcoin ETF Incoming

Bloomberg analysts Eric Balchunas and James Seyffart forecast a 90% likelihood of a spot Bitcoin ETF being approved by January 2024, citing ongoing positive dialogues between the SEC, Ark, and 21Shares.

MetaMask Removed From App Store

The widely used crypto wallet MetaMask has been unexpectedly removed from the Apple App Store, mirroring a previous incident with Trust Wallet, where it was later reinstated, with no explanation provided for MetaMask’s removal as of October 14th.

Fidelity Praises Bitcoin

Fidelity, a prominent asset manager overseeing $4.5 trillion, asserted in a recent statement that Bitcoin remains the most secure and decentralized cryptocurrency, outperforming its competitors in these aspects.

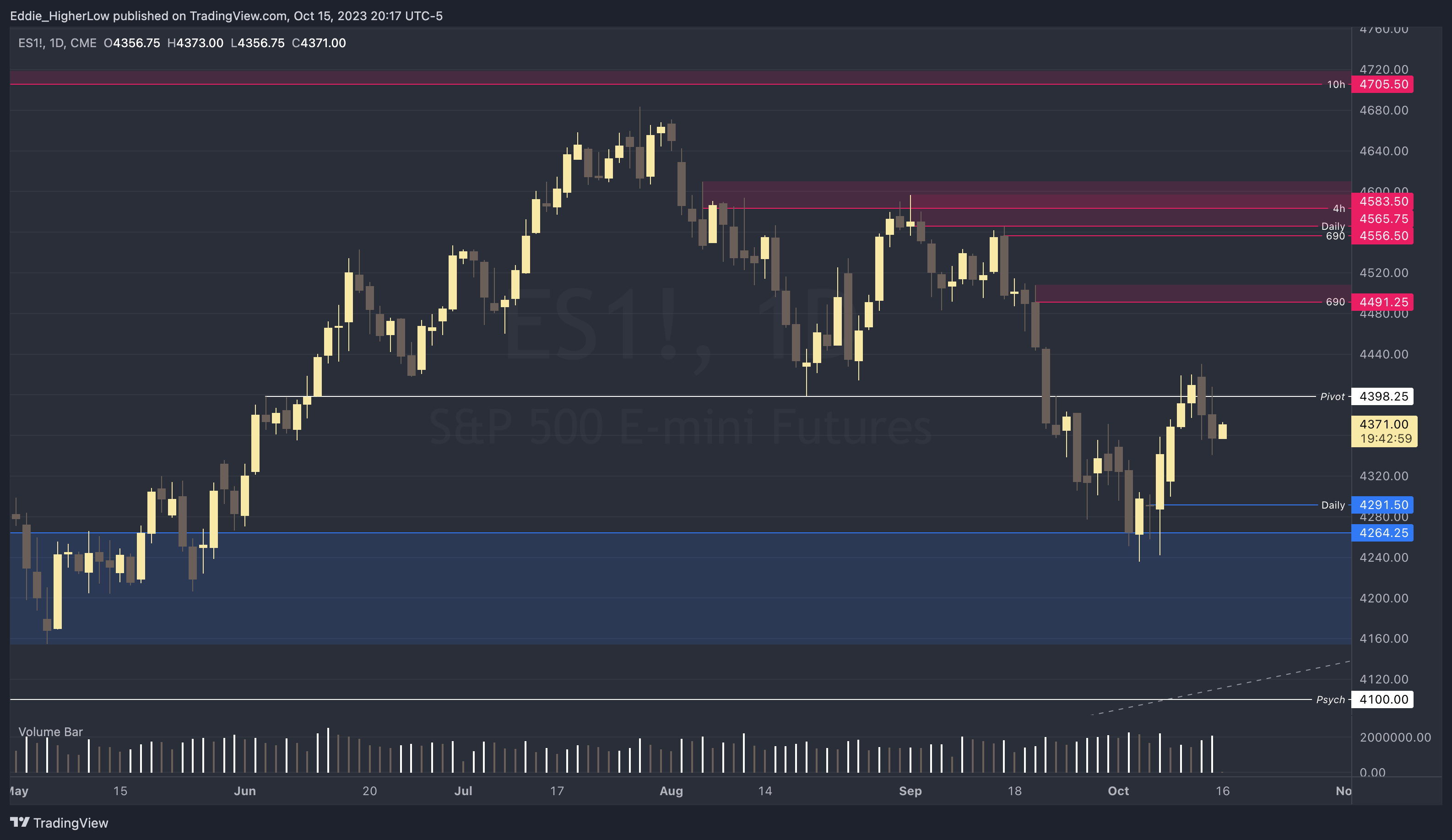

S&P Outlook

Bear Case: Bears will want to continue defending 4398.25-4400 with next possible target at lower Daily Demand at 4291.50. If price is able to break above 4400, next heavy supply sits at 4491.25

Bull Case: Bears will need to break above and hold 4398.25 with next target at 4491.25 followed by 4556.50. Not the cleanest Daily demand but a Possible zone sits at 4291.50.

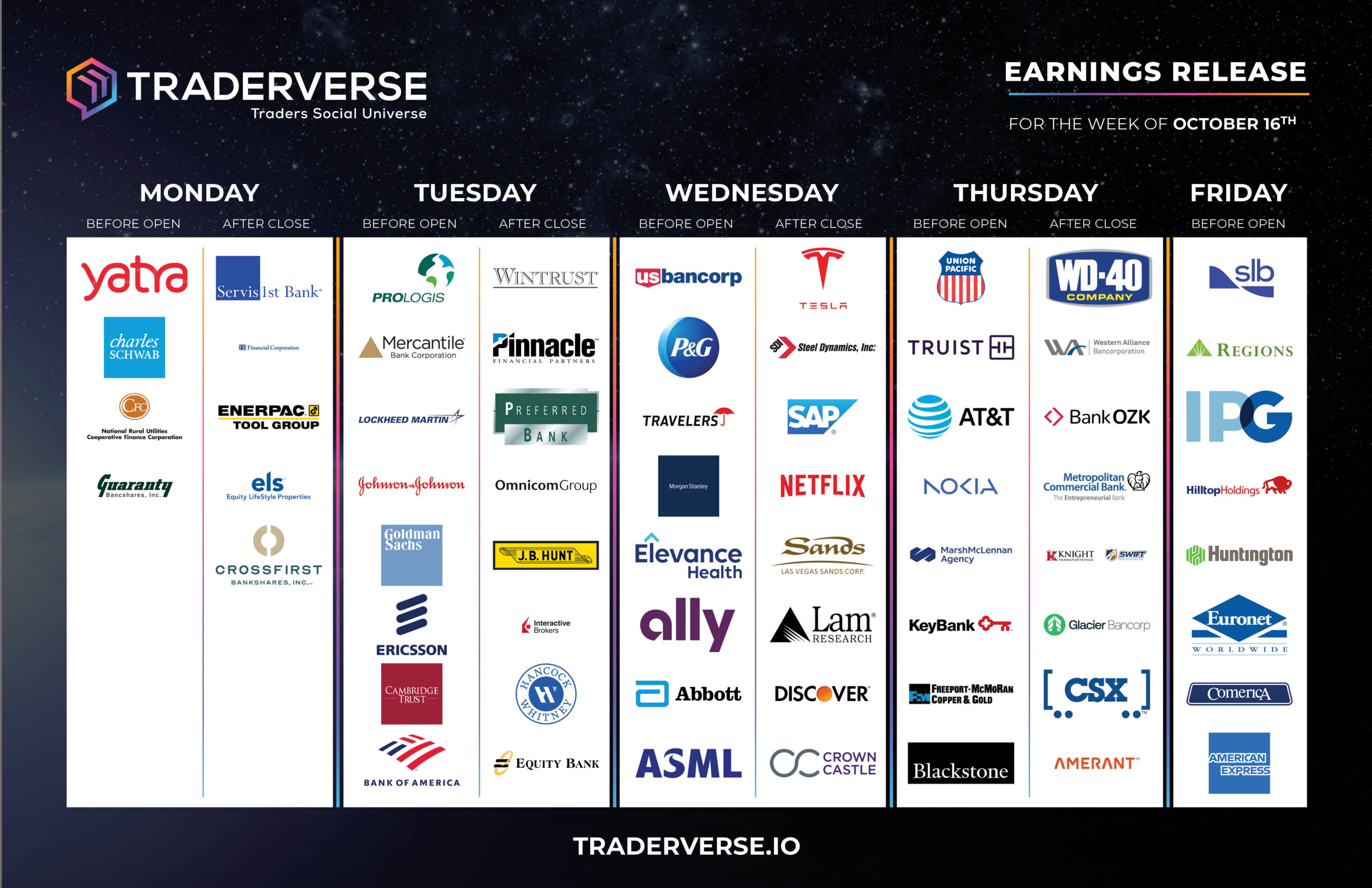

EARNINGS RELEASE CALENDAR

FOR WEEK OF OCTOBER 16th

Expert Insights & Predictions

QQQ Analysis – Week of 10/16

This week, the Invesco QQQ Trust, which mirrors the NASDAQ-100 Index, shows some interesting patterns. Here’s a quick breakdown:

Triangle Pattern: QQQ displays a symmetrical triangle. This usually means the current trend might continue. Since QQQ was rising before this, we might see a further rise, but it’s not guaranteed.

Below the Cloud: The ETF moved below a key moving average indicator, which might suggest a slowing down.

Volume Insights: The trading volume indicates that QQQ’s current price is at a key level. This could lead to a significant price move soon.

Price Check: QQQ is priced at $365.28, closing down 1.26% for the day on Friday. It’s close to a crucial price level that investors should watch at 362.95.

Wrap-Up: QQQ is at an interesting point. The coming week should provide more clarity on its direction. Always consider other market news and factors when deciding. — @EnhancedMarket

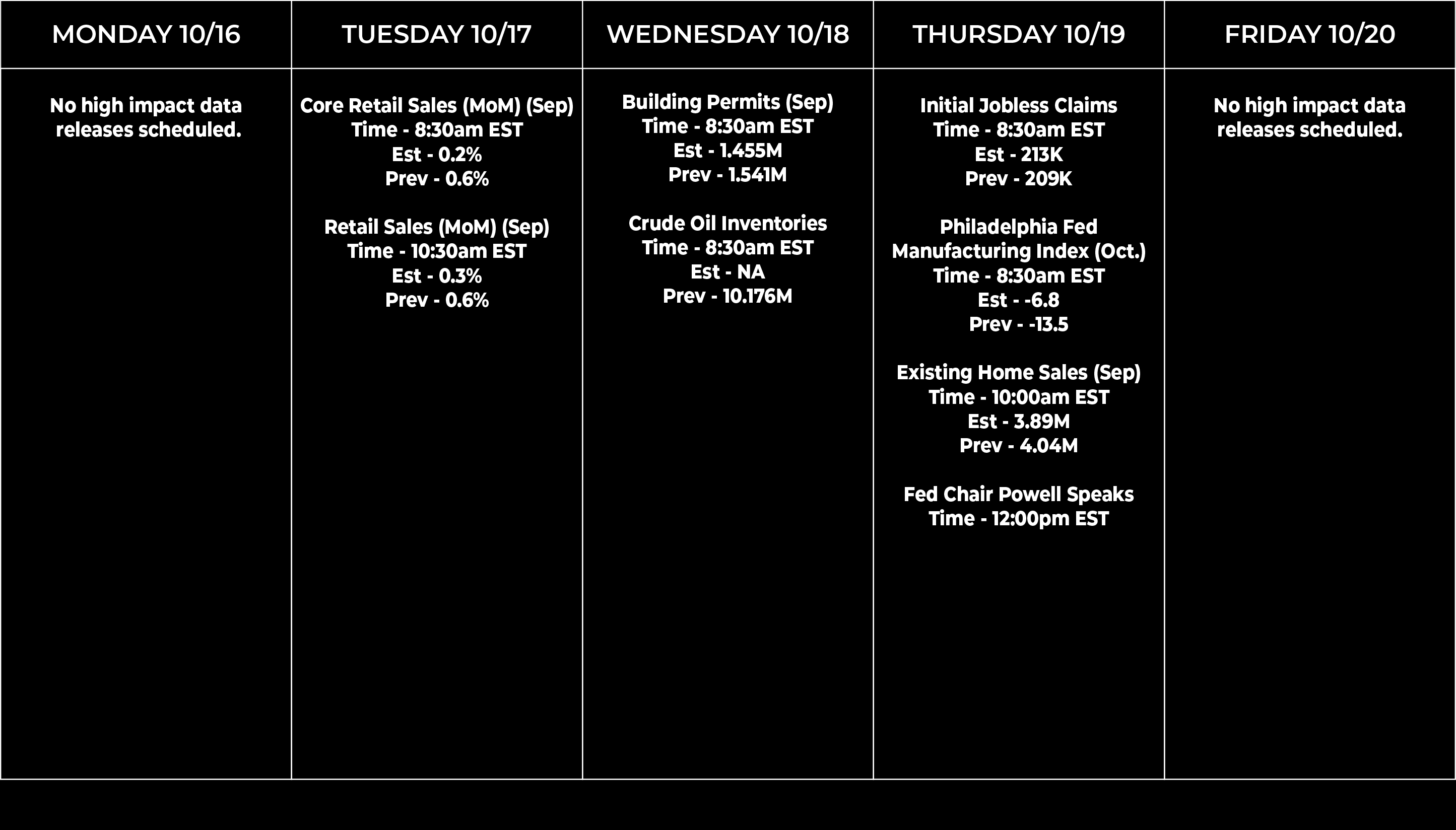

Economic Data Calendar