WEEK OF JANUARY 8, 2024

Welcome to the Traderverse Weekly Newsletter!

TRADERVERSE Updates

Meet John Forster, the Chief Operating Officer (COO) of TRADERWARE, a seasoned entrepreneur with 25 years of experience and multiple successful exits under his belt. Beyond his entrepreneurial journey, John brings a unique blend of expertise to the table. He boasts a rich background as a retired PGA Golf Professional, coupled with three decades of experience in the realm of business operations. With this wealth of experience, John Forster plays a pivotal role in shaping TRADERWARE’s strategic direction and ensuring operational excellence.

In his latest article, John Forster discusses the rising trend of niche social networks in the digital age, providing a haven for individuals with specific interests, passions, or industries. Unlike all-encompassing platforms like Facebook and Twitter, these networks foster tighter-knit communities based on shared interests, promoting authenticity and genuine interactions.

To view the full article: CLICK HERE

If you haven't reserved your spot, Sign Up to test Traderverse Alpha!

Important Prices

What’s Moving The Markets?

Tech’s Potential Continued Growth Into 2024

In 2023, global mega-cap companies, led by the technology sector, saw substantial gains fueled by optimism around artificial intelligence, peaking inflation, and anticipated central bank stimulus, with Meta Platforms and Nvidia Corp surging 188% and 240% respectively, setting the stage for potential continued growth into 2024.

US National Debt Surpasses $34 Trillion

The United States’ national debt reached a historic high of $34 trillion, marking the first time it has surpassed this milestone, as reported by the Treasury Department.

Tesla Overtaken In China

Despite delivering a record 484,507 electric vehicles in the fourth quarter and meeting its 2023 target, Tesla lost its position as the leading electric vehicle maker by sales to China’s BYD, which handed over 526,409 vehicles in the same period, possibly indicating a consumer preference for more affordable models in a high-interest-rate economy.

Bitcoin ETF Approval On The Horizon

A senior ETF analyst at Bloomberg suggests that official approval for Spot Bitcoin ETFs in the US is imminent, with the SEC providing final comments to issuers and various applicants, including major investment/asset managers like Fidelity, BlackRock, and Grayscale, preparing to submit their final documents, indicating a potential approval of the first ETFs.

ARK Invest’s Crypto Positions

Cathie Wood’s ARK Invest purchased 4.3 million shares of the ProShares Bitcoin Strategy ETF (BITO), valued at approximately $92 million based on the fund’s closing price on Wednesday

SBF Will Not Face Another Trial

US prosecutors have announced their decision not to pursue a second trial against Sam Bankman-Fried, the founder of the now-bankrupt FTX cryptocurrency exchange, who was convicted last month of stealing from customers, citing the “strong public interest” in promptly resolving the case over the potential benefits of a retrial.

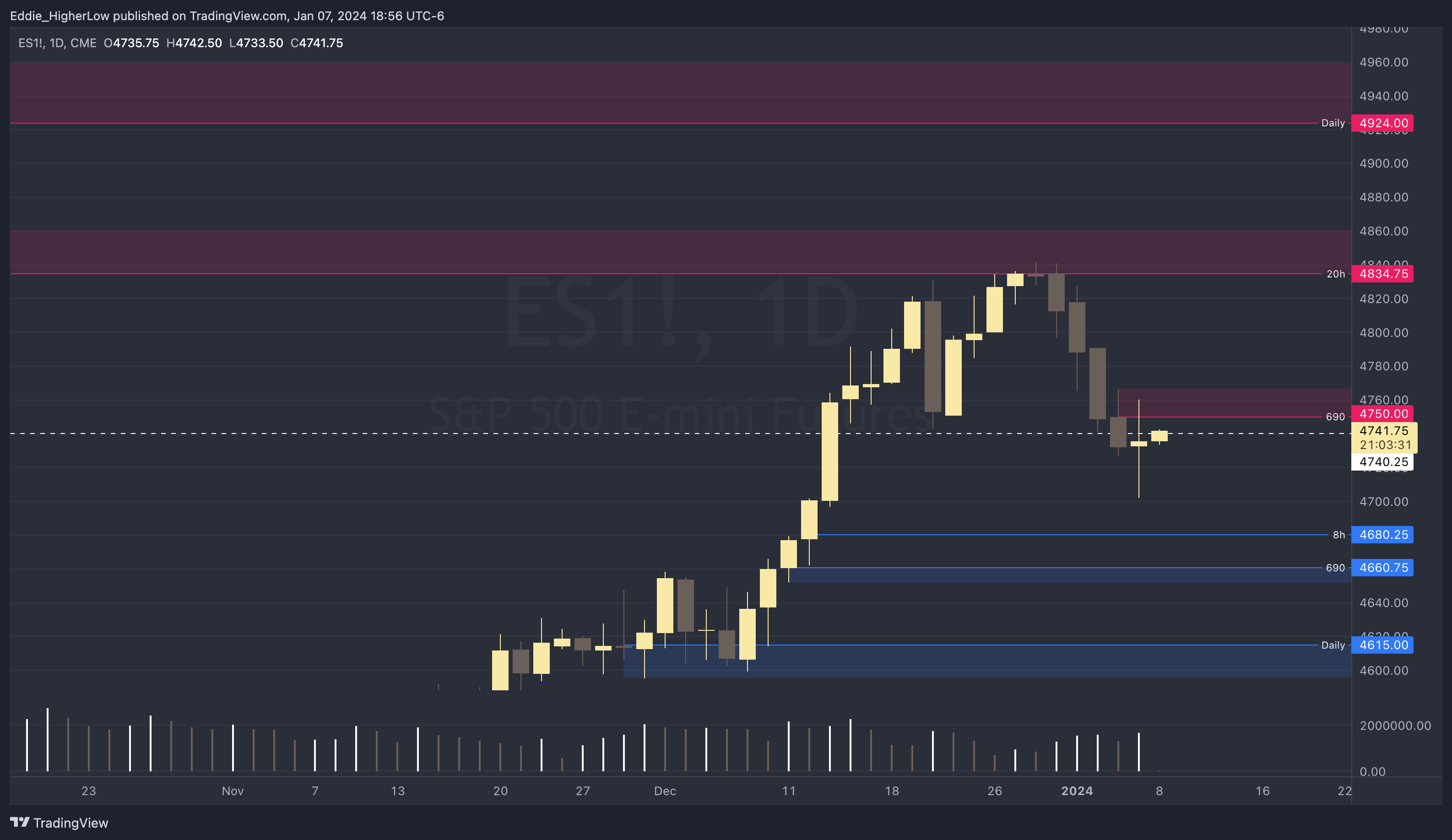

S&P Outlook

Bear Case: Attention is drawn to 4740, a crucial level that previously acted as a strong support and is now in the bears’ territory to defend. Additionally, a new supply zone has been created, ranging from 4750 to 4766.50. Should the bears manage to keep the price under the upper limit of this zone at 4766.50, we might anticipate a downward push towards the next targets, located at 4680.25 and subsequently at 4660.75.

Bull Case: For the bulls, maintaining control over the 4740 level is essential. The primary objective for bulls will be to breach the 4766.50 mark, effectively disrupting the overhead supply zone. Achieving this could pave the way towards the next significant target at 4834, a level that has consistently demonstrated strong supply presence.

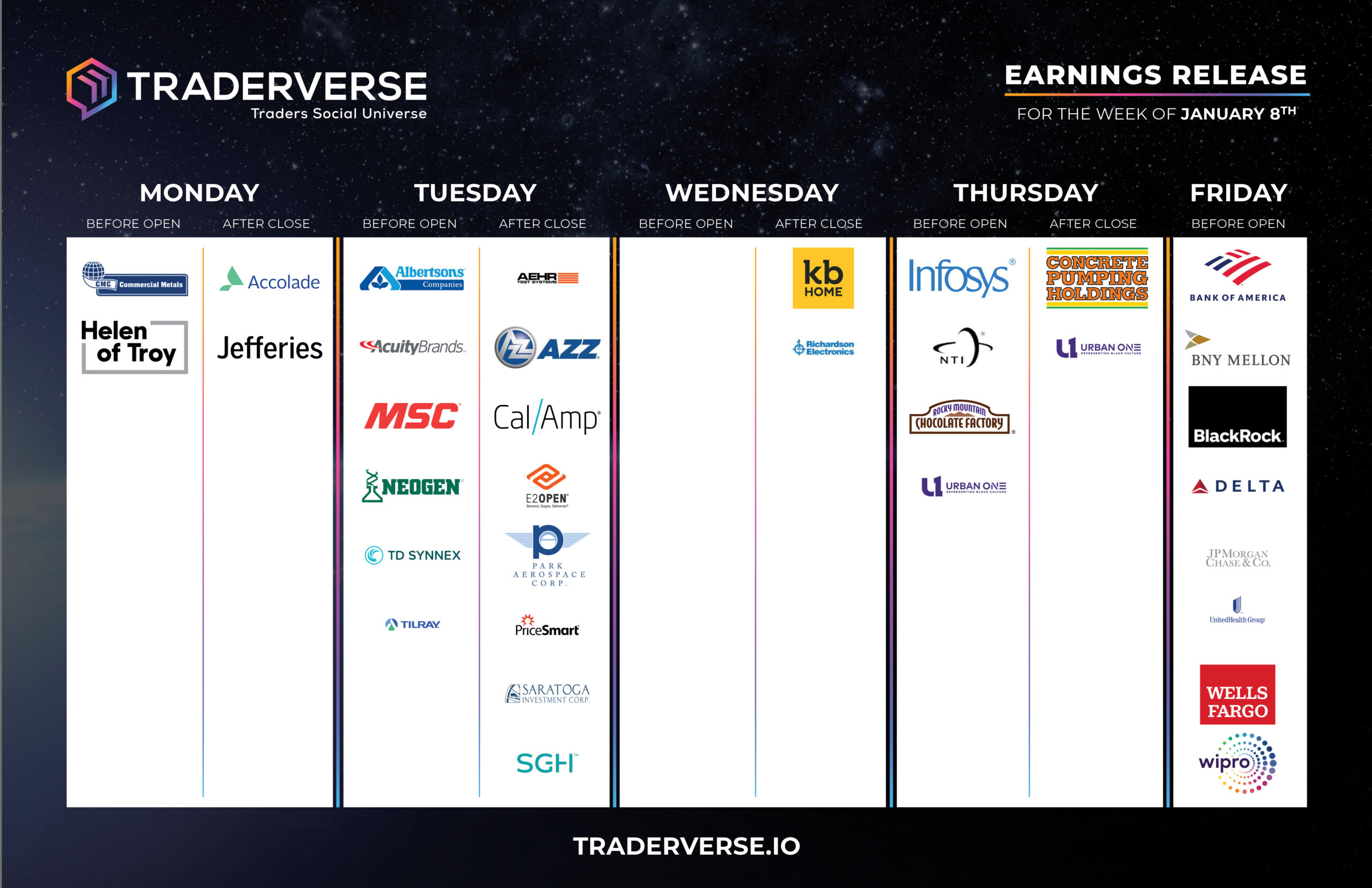

EARNINGS RELEASE CALENDAR

FOR WEEK OF JANUARY 8th

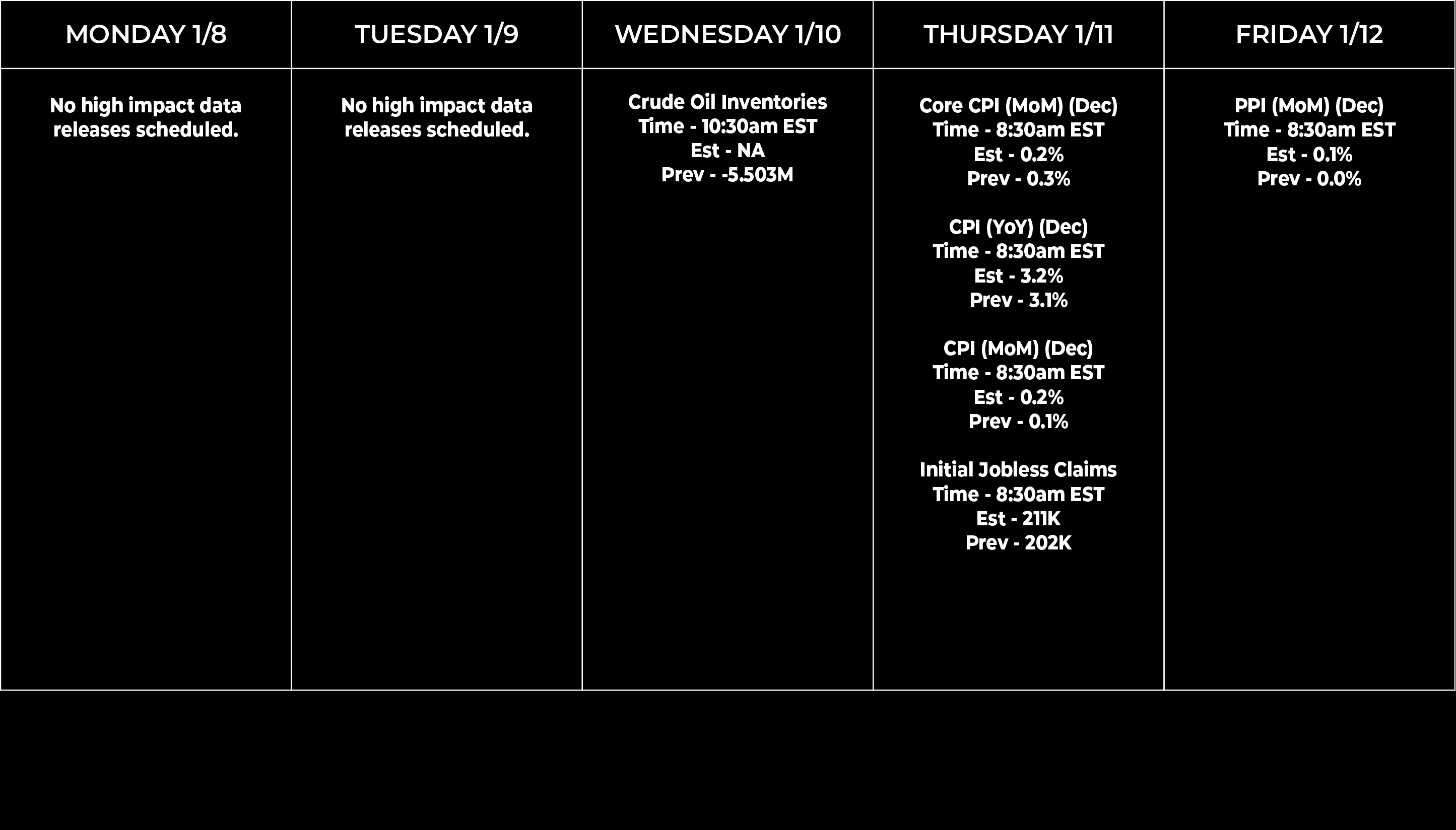

Economic Data Calendar