WEEK OF JANUARY 1, 2024

Welcome to the Traderverse Weekly Newsletter!

TRADERVERSE Updates

Wow! We are absolutely thrilled to announce that we’ve already received a whopping 18,900+ signups for our alpha release! 🚀 A huge shoutout and heartfelt thanks to each and every one of you who has not only signed up but also helped us spread the word about our exciting project. Your enthusiasm and support mean the world to us, and we can’t wait to embark on this incredible journey together! 🙌🌟

If you haven't reserved your spot, Sign Up to test Traderverse Alpha!

Important Prices

What’s Moving The Markets?

Oil Heading Into 2024 Strong

In 2023, the oil and gas industry engaged in a $250 billion buying spree, driven by high stock prices, increased oil demand post-pandemic, and the anticipation of industry consolidation, with major players like Exxon Mobil, Chevron Corp, Occidental Petroleum, and ConocoPhillips leading acquisitions totaling $135 billion.

Pelosi’s New Nvidia Position

Nancy Pelosi has acquired $5 million in Nvidia call options, drawing attention due to her history of stock trading; this move follows her husband’s previous involvement with the chip maker and their sale of Nvidia shares last July amid a surge in the company’s stock.

Iran & Russia Ditching US Dollar

In a significant move for the BRICS alliance, Iran and Russia have reached an agreement to conduct trade in local currencies, opting to abandon the US dollar in bilateral trade agreements, with the deal finalized by the central bank governors of both nations, and Iran is poised to join the BRICS as one of the five new members in 2024.

MicroStrategy’s $8.1B BTC Position

MicroStrategy, led by CEO Michael Saylor, has acquired a total of 189,150 Bitcoin valued at $8.1 billion, with the most recent addition of 14,620 BTC on December 26th, as the software firm consistently adopts Bitcoin acquisition as a central strategy, accumulating the cryptocurrency since 2020.

JP Morgan Back Bitcoin ETF

BlackRock has designated JPMorgan as an authorized participant for its forthcoming Spot Bitcoin ETF, with JPMorgan Securities and Jane Street Capital positioned to be among the initial financial entities to engage with Bitcoin shares for investments pending SEC approval.

India’s Crypto Exchange Ban

India’s Financial Intelligence Unit has reportedly called for the Ministry of Electronics and Information Technology to block nine cryptocurrency exchange URLs, including Binance, Kraken, Huobi, Kucoin, Bittrex, Gate.io, Bitstamp, Bitfinex, and MEXC Global, citing non-compliance with the Prevention of Money Laundering Act.

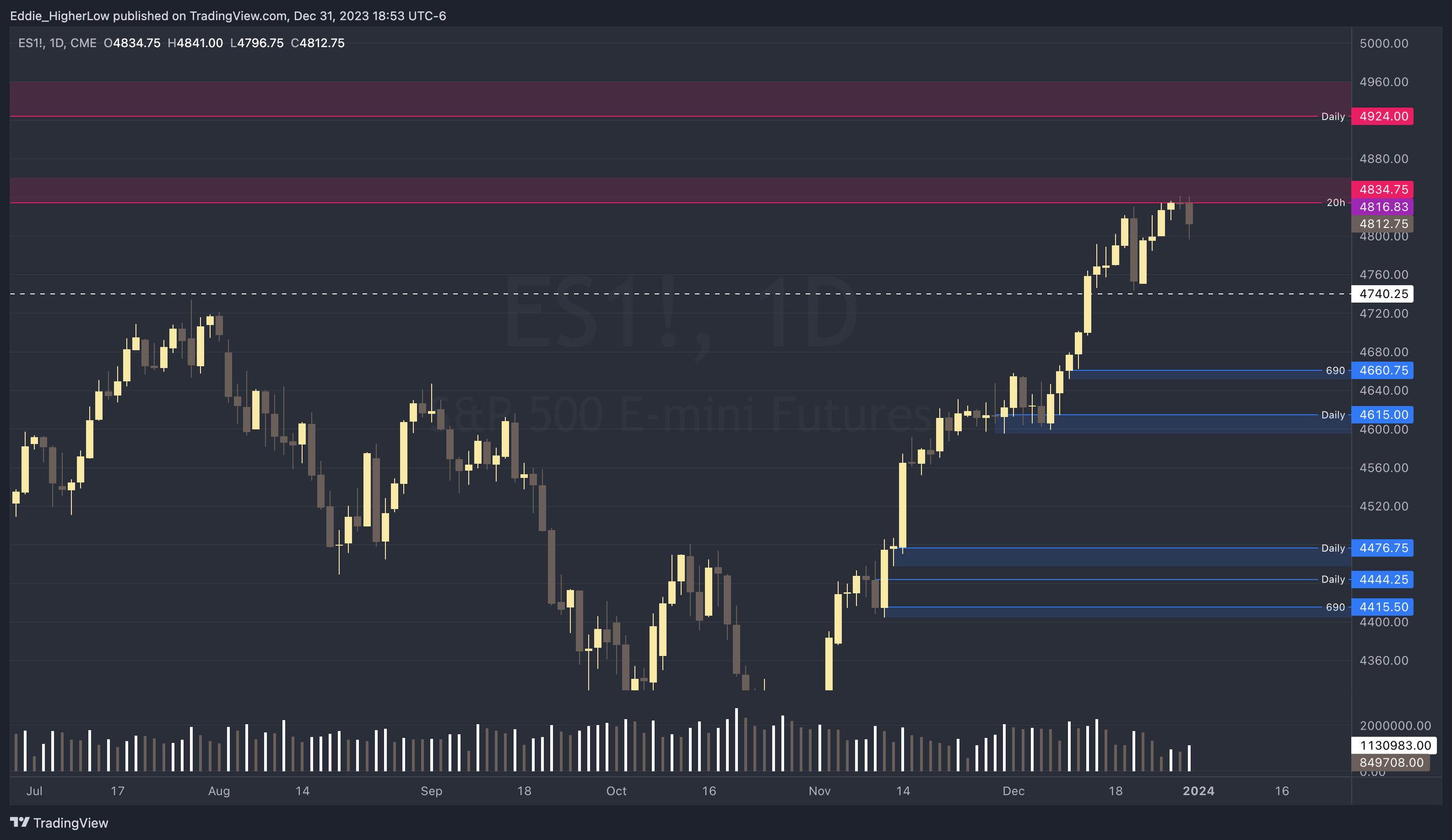

S&P Outlook

Bear Case: The market is currently testing a critical resistance area, starting at 4834.75. This is where we anticipate significant bearish activity, as traders might attempt to cap the price rise. If bears successfully defend this zone, the focus shifts to the pivotal support level of 4740.25. This level has previously held strong, but a decisive break below could signal further downward momentum, potentially driving prices towards the next key target at 4660.75.

Bull Case: On the flip side, the bulls have shown resilience by holding the line at the 4740.25 support pivot. Maintaining control at this level is crucial for a bullish trajectory. If bulls can push the price above and sustain it beyond the 4834.75, price will likely see an upward movement towards 4924, which aligns with a Daily Supply Zone.

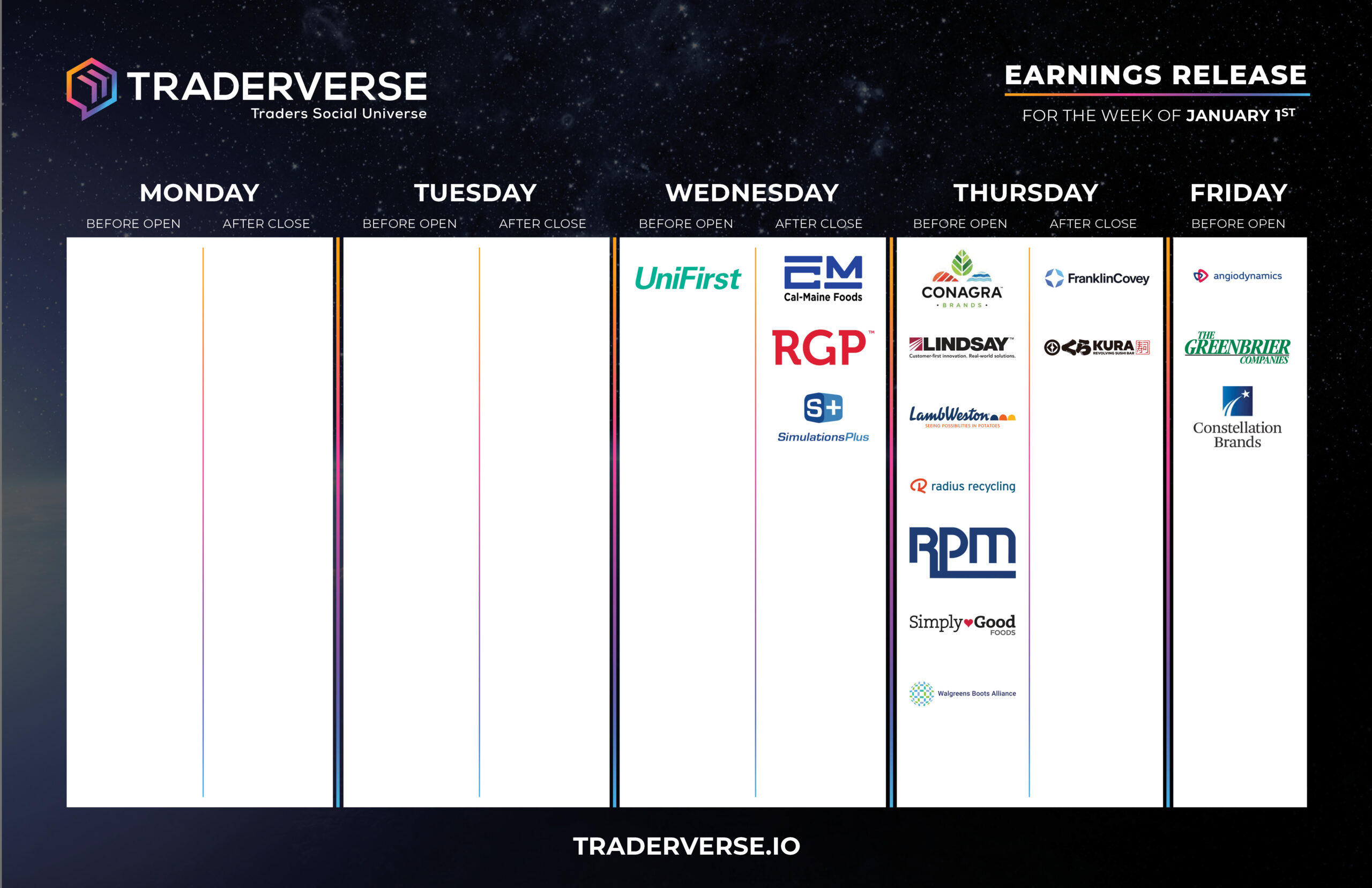

EARNINGS RELEASE CALENDAR

FOR WEEK OF JANUARY 1ST

Economic Data Calendar